Maintaining a QuickBooks fixed asset item list does a lot to keep your asset accounts organized. A list, a good accurate list, of fixed asset items documents the “nitty gritty details” of which assets you own, for example.

Maintaining a QuickBooks fixed asset item list does a lot to keep your asset accounts organized. A list, a good accurate list, of fixed asset items documents the “nitty gritty details” of which assets you own, for example.

What’s more, if you get nicely organized in the way you track these items, you can group fixed asset items under broad account names so your balance sheet is clean and easy to read. For example, if you’ve purchased (say) twenty pieces of furniture, you don’t want twenty different line items on your balance sheet—you want one line item labeled “furniture.”

One more point about fixed asset item lists: Good, accurate rich details on your fixed asset items also track a lot of useful information you’ll need to calculate tax depreciation properly. Note that your tax accountant will actually do a lot of this work for you—and that’s the way you probably want to roll. But you don’t lose by having good details inside your QuickBooks file. You win in all sorts of little ways—such as by not losing track of items you’ve purchased and such as by seeing items you’ve discarded and so need to write off.

How to Track a Fixed Asset Item in QuickBooks

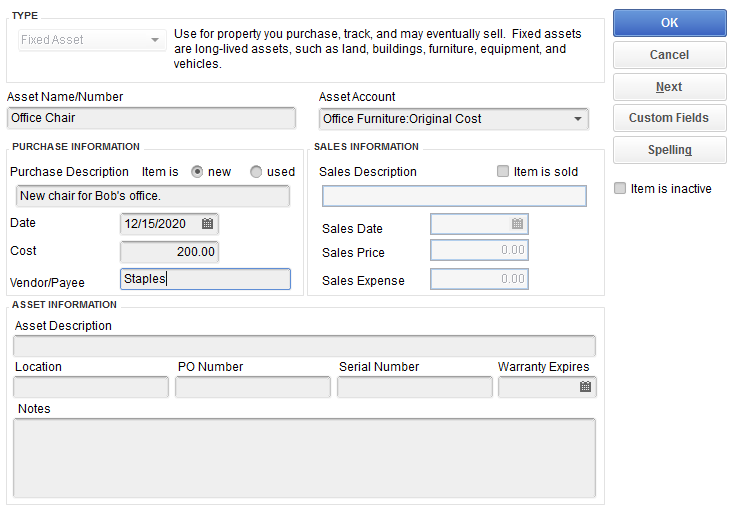

Your first step when recording a fixed asset should be to record the fixed asset item in QuickBooks. To do this, go to Lists → Fixed Asset Item List. QuickBooks displays the Fixed Asset Item List window (see Figure 1).

Next, in the bottom left corner, click the “Item” button, then click “New.” This will open the New Fixed Asset Item dialog box which you can use to enter information about the asset you’ve acquired. Be sure to provide the name of the asset, which account the asset belongs to, and all of the information requested in the “Purchase Information” section.

Note that most of the information requested in the “Asset Information” section might be helpful to track, but isn’t necessary to enter (at least as far as your tax accountant is concerned). The one exception might be location if your business operates in multiple states.

Once you’re done entering information about your fixed asset item, click the blue “OK” button in the upper-right corner.

Creating a Fixed Asset Account

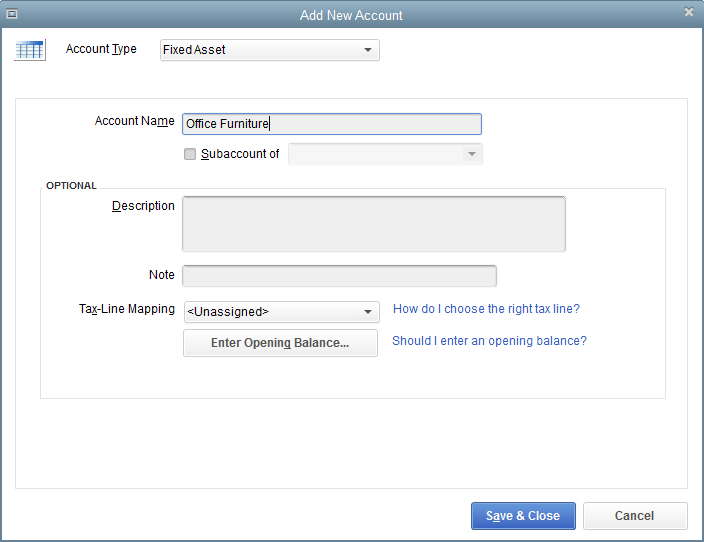

You might have to create a new asset account for the fixed asset item.

You can add accounts to QuickBooks in a variety of ways, but to do this while you’re describing the fixed asset item, first select the field labelled “Asset Account.” Next, scroll to the top of the list of accounts and click “<Add New>.” QuickBooks displays the Add New Account dialog box (see Figure 2). Enter a name for the account (for example, if you’re creating an account to track all of your office furniture, you might call this account “Office Furniture”). Then click the blue “Save & Close” button.

Dealing with Depreciation

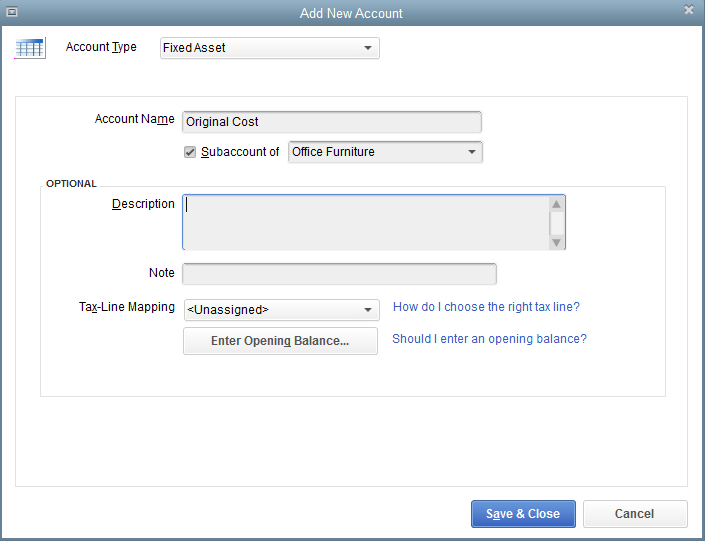

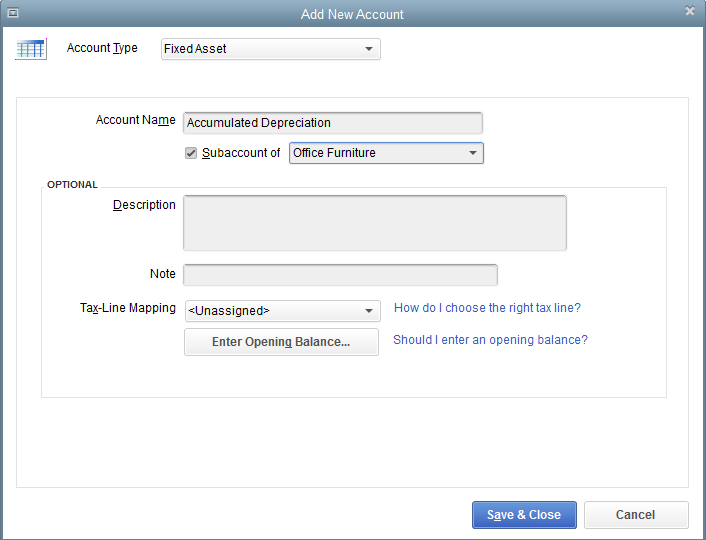

One other thing to note: If you’re creating an asset account for a depreciable asset, you’ll actually want to create two subaccounts for your fixed asset accounts: one to track the original cost of your purchases, and one to track accumulated depreciation. (I might name these subaccounts “Original Cost” and “Accumulated Depreciation”.)

Creating subaccounts works the same way as any other account, except once you reach the Add New Account dialog box, you’ll want to check the box “Subaccount of” and select the appropriate account from the drop-down menu (see Figure 3 and Figure 4)

How to Record a Fixed Asset Purchase in QuickBooks

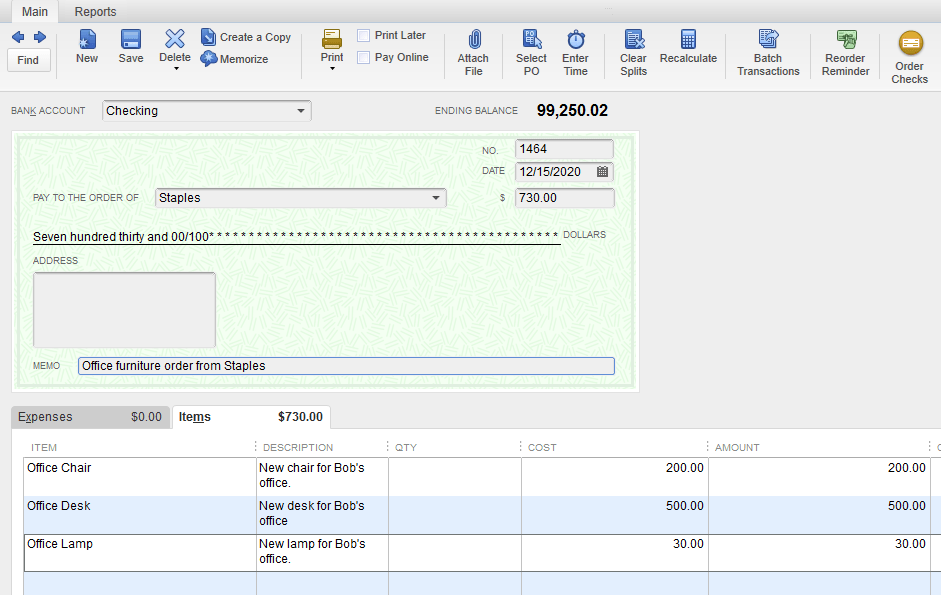

After you’ve created fixed asset items for your assets in QuickBooks, you’ll want to make sure you actually record the purchase in your books. Probably the easiest way to do this is through the Write Checks window. So start by going to Banking → Write Checks.

Next, select the “Items” tab (about halfway through the screen). Select an empty field under the column labelled “Item” and click the drop-down arrow. Now scroll through your item list to find the fixed asset items we created during step one, above. Once you select the fixed asset item(s) you created for this purchase, QuickBooks will automatically enter the purchase amount into the check. Note that you can select more than one fixed asset item for the same purchase. See Figure 5 for an example.

All you have to do next is enter a vendor and a memo like you would for any other check you write, and then click “Save & Close” (or “Save & New” if you have multiple checks to write, of course).

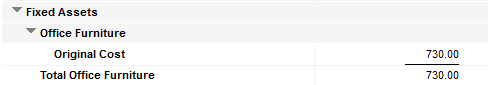

After you’ve recorded the purchase, the fixed assets will show up on your balance sheet as of the purchase date (see Figure 6). (In the example below, the Accumulated Depreciation account doesn’t appear because we haven’t recorded any transactions to that account yet.)

Are You a Small-Business Owner Paying Too Much Tax?

Small-business owners often don’t do a good job maximizing their legitimate tax deductions. They don’t, for example, structure their operations to protect legitimate deductions. They frequently don’t do enough to create new deductions. And rarely do they understand how to recycle, or double-deduct, amounts that can be used more than once.

Small-business owners often don’t do a good job maximizing their legitimate tax deductions. They don’t, for example, structure their operations to protect legitimate deductions. They frequently don’t do enough to create new deductions. And rarely do they understand how to recycle, or double-deduct, amounts that can be used more than once.

Which is all a financial tragedy. Getting smarter about tax deductions can save business owners a bundle.

If you’re thinking after reading this that maybe you can do a better job with your tax deductions, consider our $40 monograph Small Businesses Tax Deduction Secrets.

This 70-page monograph provides detailed instructions about how you can annually save thousands of dollars in income and related taxes simply by more effectively using legitimate small-business tax deductions. Interested in more detailed information? Click here.

Tip: If you are a client of our CPA firm, don’t purchase this monograph—or any of our other monographs. Just email us and ask for your complimentary copy.

Immediately Downloadable & Money-Back Guarantee

The book is instantly downloadable. You get the monograph when you purchase it.

Also, we provide a money-back guarantee. If you don’t find the information you need or want, no problem. Just email us and request your refund.

P.S. Interested in more article like this? You can subscribe to the email newsletter version of the blog post by clicking the green follow button that appears below.

How is this handled with the purchase of a property? I use my books personally (and for my business but this questions I about personal use) so I think the property is a current asset, mortgage is a long term liability (principal going to mortgage and interest going to interest expense account), I’ve read about the accumulated depreciation… in this case would it be appreciation? Then there’s the expenses of the purchase; wiring fees, escrow fees, document fees… so many fees LoL.

So I’m not sure exactly what accounts I should have or how to allocate the funds. I know this is a specific question – any chance you would be able to help me out?

Hi Eli,

The asset purchase price includes all the costs of acquiring it… and the account type should be “fixed asset” not “current asset”.

The blog post, once you do this the standard way, should help you through the steps.

Steve

Hello, I am buying multiple of the same machines. I want to put a purchase price then when i go into the “check” to buy it i want to put a quantity of how many I purchased but it does not allow me to enter a quantity. What is the best way i can do this?

Hi Tyler,

Right now there is no quantity column when writing checks, but you can enter the quantity on the ‘memo’ box. – this way you can refer to the check payment later and you’ll see how many machines did you purchase.

Hope this helps.

Hi Tyler,

Sorry, please disregard my previous comment.

When you go to ‘write checks’ from the banking menu, you can see two tabs under ‘memo’ box – one is ‘expenses’ and the other is ‘items’. Click the ‘Items’ tab and now you can enter all the details you want, including the quantity.

Hope your query was answered 🙂

Hello, I am creating a credit for a fixed asset item and receiving the message “Fixed asset item must have a quantity of one”. In the items tab there is already a 1 for Qty. What do I need to do to be able to save the credit?

I set up Fixed Asset accounts, but now I can’t go into those individual accounts and put in all the information on the screen that is shown above. How do I get to that screen? Or do I have to start all over and create a new account for each of the Fixed Assets?

Hi Shelley,

I think you’re referring to the first image in this post; if so, you can reach that screen by first, clicking “Lists” in the top navigation menu (it’s the fourth option, between “View” and “Favorites”). Next, click “Fixed Asset Item List.”

After that, look to the lower left corner of the window. You should see a button that says “Item”, with a downward arrow on it. Click that button, then click “New.” This will bring you to the screen that’s the first image in this post.

Hope this helps!

I have quickbooks for my farm and not sure where I should enter my livestock some where purchased while others were born here.

Rebecca, so I think the first thing to ponder is whether these livestock are fixed assets (like milk cows in a dairy farm or chickens laying eggs you sell) or inventory (steers you sell to a packing plant or chickens you sell to, hmmm, Tyson or whomever).

Inventory you would not set up as a fixed asset. And you might even *not* track inventory by individual item. But in batches.

If you truly have fixed assets though–bulls you use for breeding say–I would think you set them up as fixed assets in the usual way. And if you buy a bull, say, you record the purchase price as its original cost. And if you “make” a bull, you record the purchase cost as zero (since in effect all the costs of making the bull are probably already expensed.)

A closing caveat: I’m not a “farm and ranch” tax accountant and I’m sure there are lots of industry-related issues and regulatory requirements that impact the record-keeping and which may tie into the bookkeeping. I don’t know about these other, probably bigger issues. (Sorry.)

How do I generate a fixed asset REPORT in Quickbooks Pro?

Use the Fixed Asset List, available from the List menu.

Hi Steve – thanks for the great article. I have my fixed Asset report and it looks good,. One question – is there a way to separate leasehold improvements and FFE on the fixed asset report? I have played with filters etc but my report keeps coming out with one big listing. I need to submit this with the different accounts (FFE vs Lease Improvements) separated. Thanks!

I purchased all my fixed assets with a CC and had already entered that info in QB before seeing this post. I have since followed the first step to add the fixed assets list. Is there a way to match up with the CC purchase or do I need to delete those and reenter as a check, even though that is actually a different account and will affect my book keeping balances. Thanks!

Hi Amanda,

Your situation will be a little tricky to clean up. I think you want to confer with your CPA.

Steve