You maybe know this already. But if your retirement plan combines income from IRAs and 401(k) accounts with Social Security benefits, you can probably safely spend more if you delay your Social Security benefits.

You maybe know this already. But if your retirement plan combines income from IRAs and 401(k) accounts with Social Security benefits, you can probably safely spend more if you delay your Social Security benefits.

And just to be clear, I’m not simply saying that starting Social Security later results in you getting bigger benefits. Though that’s true.

Rather, I’m saying this: If you delay starting Social Security, the effect resembles starting retirement with a bigger IRA balance. Or a bigger 401(k) account. Maybe an extra $50,000 or $100,000 in savings for the typical person.

And those extra savings, unsurprisingly, probably allow you to spend more throughout your retirement.

Interested in seeing if your situation allows this improvement?

This blog post explains how to do the math. Specifically, it walks you through the steps for making the calculations in your specific situation using the popular free FireCalc website.

An Example to Provide Context

To start, though, let me give you an example to provide some context for what follows.

Suppose you have $500,000 saved for retirement. (This would put you, by my calculation, at roughly the 90th percentile.)

Further suppose you want to spend $50,000 a year during a 30-year retirement and that your Social Security benefit equals $28,000. In this case, you will need to draw the other $22,000 from your savings. Obviously.

The problem with this plan? Historically, drawing $22,000 from a $500,000 IRA or 401(k) works less than 90 percent of the time.

That’s too risky in most people’s minds. Conventional wisdom says you want to plan in a way that hopefully succeeds 95 percent of the time… or more. Especially if you’re starting retirement when interest rates are low and stock market values are high.

By the way, if you’ve done much reading or research about safe withdrawal rates from retirement savings, you know people talk about 4% as a “historically” safe withdrawal rate. Drawing $22,000 from a $500,000 IRA or 401(k) represents a 4.4% withdrawal rate.

The Procrastinator’s Windfall

But someone in this situation has an option. She or he could delay Social Security for, say, three years. This means for the first three years, the retiree draws all the money she or he needs from their retirement account. So, $50,000 the first year and then inflated amounts for the second and third year.

The retiree’s withdrawal rate, then, equals 10% for the first three years.

But the thing is? When this person starts Social Security in year four, their benefit equals something like $35,000. Why? Because the Social Security formula bumps up the benefit by roughly 8 percent a year for each year you delay (up until age 70).

The $28,000 benefit bumped up for three straight years of 8 percent raises grows to $35,000. Roughly.

And this means that from year 4 onward, the retiree gets $35,000 from Social Security and then draws “only” $15,000 from their retirement nest egg.

Starting in year four, the retiree’s withdrawal rate equals 3% for the reminder of the retirement.

This delay dramatically bumps up the chances of success–at least according to history.

The table below summarizes the “no delay” and the “yes delay” scenarios using information calculated by FireCalc.

You can see below the portfolio success rate jumps dramatically by delaying, for example. The historically worst case scenario also appears later in someone’s retirement. Finally, the range of account balances–worst case, average case and best case–favorably compare too.

| No Delay | 3-year Delay | |

| Success rate | 89.1% | 97.5% |

| Smallest balance (which is negative) | –$403,000 | –$55,000 |

| Median balance | $746,000 | $796,000 |

| Largest balance | 2,690,000 | $2,542,000 |

| First failure year | 22 | 25 or 26 |

Note: The table above reflects a 70% stocks and 30% five-year U.S. Treasuries allocation, and uses a .07% expense ratio.

But you see the benefit, right? You probably want to delay the point you start Social Security. If you can. And if you do, you may be able to safely bump your retirement spending.

Want to check on whether the math works for your situation? Read on…

Measuring the Benefits of Delayed Social Security Benefits

To measure the impact of delayed Social Security benefits, follow these steps:

Step 1: Open the FireCalc web page.

Start your web browser—so Google Chrome or Microsoft Edge or whatever—and enter www.firecalc.com into the address box.

Step 2: Enter Your Planned Retirement Spending, Current Savings and Life Expectancy.

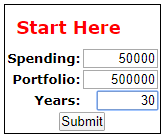

The main FireCalc web page provides text boxes (shown below) into which you enter your planned retirement spending, your current retirement savings, and then your remaining life expectancy. To double-check the math described earlier, for example, set the Spending to $50,000, the Portfolio to $500,000 and then the Years to 30, the planned years of retirement.

Tip: For folks not at the door step of retirement, the inputs look different. Suppose someone plans to work 10 more years and then to retire for another 30 years. Say their current savings equals $20,000. Further, say they want to spend $60,000 a year in retirement. For this situation, the Spending equals $60,000. The Portfolio equals $20,000. The Years equals 40.

Step 3: Describe Any Additional Savings

If you are still working and saving, click the Not Retired tab at the top of the FireCalc web page. Then enter the year you will retire into the What Year Will You Retire? text box and the additional annual amount you will save into the How Much Will You Add To Your Portfolio Until Then, Per Year? text box. The screen fragment below shows an example of this:

Note: If you’re at the doorstep of retirement, enter the year input as the current year. For example, enter 2020 if the year is 2020. And then enter the savings amount as zero if you’re done saving.

Step 4: Estimate Your “No Delay” Social Security Benefits

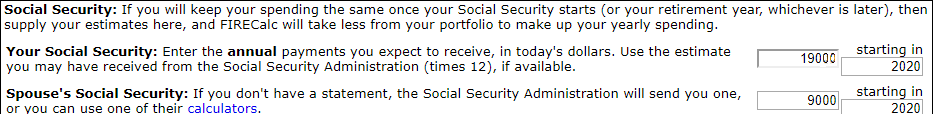

Click the Other Income/Spending Retirement tab. Then enter your anticipated “full retirement age” benefit into the Your Social Security text box and the year you receive that benefit into the Starting In text box. If you’re married, enter the same information for your spouse into the Spouse’s Social Security text boxes.

The worksheet fragment below shows a married couple planning to both retire in 2020 with one spouse receiving $19,000 in benefits and the other spouse receiving $9,000. And note: At this point, you’re entering the Social Security benefits you would receive if you don’t delay starting Social Security.

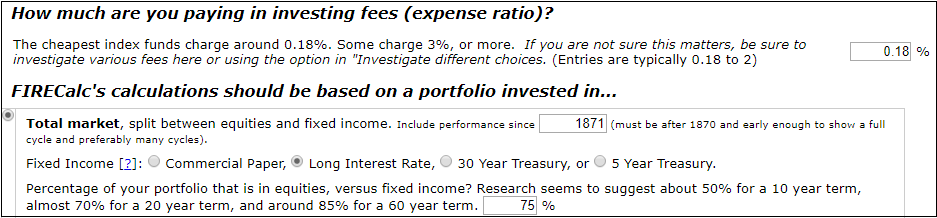

Step 5: Describe Your Investment Portfolio

You can use the default FireCalc investment portfolio description for your calculations: 75 percent in stocks, 25 percent in long-term U.S. Treasuries, and a .18% expense ratio. But if you want to tweak the description so it better matches your own portfolio, click the Your Portfolio tab. Indicate your annual expense ratio using the How Much Are You Paying In Investing Fees text box. Indicate what percentage of your portfolio you’ve invested into stocks using the Percentage Of Your Portfolio That Is In Equities, Versus Fixed Income box.

Step 6: Calculate the Success Rate Assuming Not-delayed Social Security benefits

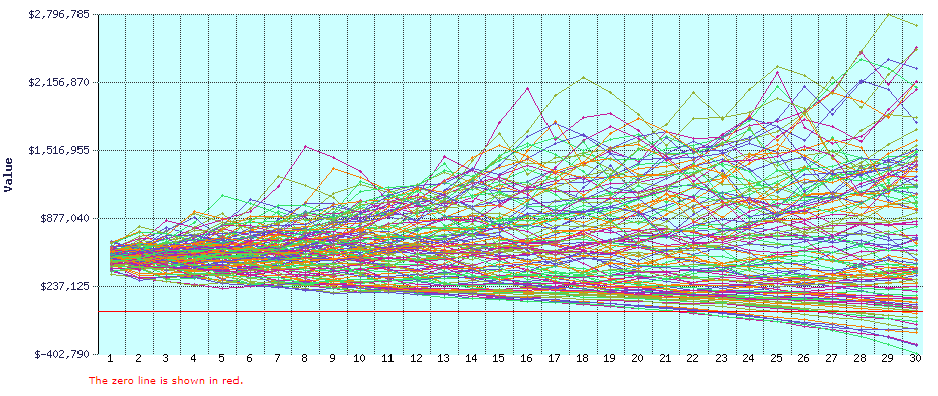

After you complete step 4 or step 5–whichever is your last step—click the small button labeled “Submit” at the bottom of the web page. FireCalc calculates the historical results for each of the possible scenarios it can test. It then displays a very busy line chart (see below) that plots out the retirement nest egg balances over retirement for each scenario. And it calculates the success rate, worst-case, median-case, and best-case investment balances.

Pay attention to the success rate for sure. Look at the range of investment account balances. Also, pay attention to the year of the first failure. (In the line chart shown above, for example, the first failure occurs in year 22.)

Step 7: Re-Calculate the Success Rate Assuming Delayed Social Security Benefits

Click the Other Income/Spending Retirement tab again. Then enter your anticipated “delayed” benefit into the Your Social Security text box and the year you receive that benefit (probably the year you turn 70) into the Starting In text box. If you’re married, enter the same information for your spouse. To model the case discussed here, for example, you might show a married couple planning to start Social Security benefits in 2023–three years into their retirement–with one spouse receiving $24,000 in benefits and the other spouse receiving $11,000. These inputs would roughly reflect a three-year delay and the bump from $28,000 to $35,000 in Social Security benefits.

Next, click the “Submit” button at the bottom of the web page. FireCalc again calculates the historical results for each of the possible scenarios it can test. It again displays that very busy line chart that plots out the retirement nest egg balances over retirement for each scenario. And it calculates the success rate and the worst-case, best-case and median-case investment account balances.

With this new information, you can estimate the success rate effect of delaying Social Security benefits, the impact of the delay on the range of investment account balances, and then year of the first failure.

Not always but in many cases, you will see a marked improvement in safety.

Four Closing Comments

Neat, right? So, four quick comments to close.

First, don’t assume you can bump your retirement spending by delaying Social Security. Maybe you can. Maybe you can’t. You want to “run the numbers.” My modeling suggests that most people with six-figure retirement accounts and a decent earnings history get a meaningful bump.

A second point… Something magical, in a sense, happens here. You should know that. Lots of people have talked about the attractiveness of delaying when you start taking Social Security. Blogger Michael Kitces provides maybe the most articulate description of what’s going on here, saying,

…the decision to delay Social Security delivers the best results when there is either unexpected inflation, unusually long longevity, or especially bad market returns, which are the exact three scenarios that traditional portfolios are the least effective at managing…

However, perhaps the best technical descriptions of how delaying Social Security strengthens your retirement plan appear in a paper that Wade Pfau wrote and which appears here. (Pfau focuses on the insurance features of Social Security.) And then in a paper that Luke F Delorme and Clara Case wrote and which appears here. If you want to go down the rabbit hole on this topic, do look at both papers.

A third important point. The actual bump to your Social Security benefits when you delay isn’t always 8 percent. (Click here for more information.) You also probably want to use really good estimates of your Social Security benefits which you can get here: Benefits Planner.)

Fourth, the discussion incorporates inflation but I tried to keep that hidden from view to make everything easier to read. Just so you know…