If you’re preparing the California payroll tax forms for a single shareholder-employee corporation, you can make the process pretty easy.

In fact, no kidding, you can make the process so easy, you can do it yourself. In about five minutes time. Per year.

Note: In addition to the state payroll tax forms, you would also need to prepare and file quarterly payroll tax returns with the IRS, as described here and as mentioned in the write up entitled, “Five Minute Payroll” at the bottom of this post.

Simple Example of One-Employee California Corporation

Don’t believe me? Let’s say you pay yourself $10,000 a quarter as a shareholder-employee in a one-employee situation.

Further assume that you pay the standard California new employer unemployment insurance rate of 3.4% on the first $7,000 of wages an employee earns in a year and then the employer training tax equal to .1% on the first $7,000 of wages.

This means, if you do the math, that the small corporation owes $238 in state unemployment insurance tax and $7 in employer training tax. Or $245 in total.

Note: If you want to check your actual unemployment tax rate, you can use the following web page (click here). All you need to do is enter your account number into the box provided.

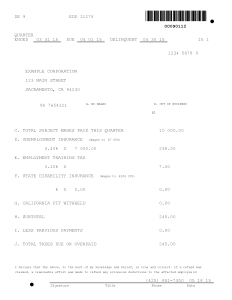

Preparing the California CA DE-9 Return for Quarter 1

If you withhold no state income taxes, you prepare the first quarter’s quarterly return, which is known as a CA DE-9, as shown in Figure 1. Note that while in our example you report $10,000 of wages, you only pay the taxes on the first $7,000 of wages.

Note: You can get an equivalent paper form from the state’s website by googling on the term “California CA DE 9 form”. For the 2015 form, you can also just use this link. You can also get a more legible PDF version of the form shown in Figure 1 by clicking here.

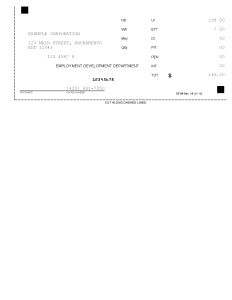

Remitting Taxes Due with a California Payroll Tax Form

If you do owe money—in this example scenario I’m saying you owe $245 of taxes—you need to prepare and print a DE 88 voucher form (available here) that indicates you owe this money. And then you send in the voucher form and your check to Employment Development Department, P.O. Box 826276, Sacramento, CA 94230-6272.

Figure 2 shows an example completed DE-88 form:

Note: Sorry about the poor quality of the image of the payroll voucher. You cam get a more legible PDF of the voucher by clicking here.

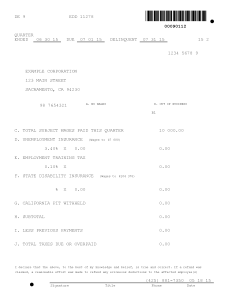

Preparing the California CA DE-9 Return for Quarter 2

If you withhold no state income taxes, you prepare the second quarter’s quarterly return as shown in Figure 3. And note that you pay no state unemployment or employer training taxes in the second quarter because you will have already paid the taxes on that first $7,000 of wages earned in quarter 1.

Note: Again, sorry about the, er, poor image quality of the payroll tax form. You can grab a more legible PDF copy here.

State Income Taxes

The California quarterly forms shown here provide for no state income tax withholding. This omission means that the shareholder-employee will need to directly make quarterly estimated tax payments. Yikes! Is that even legal?

Well, it is. But you will need to pay the taxes. And you should pay them over the year to avoid penalties and interest charges. You can do that using this form. (By the way, if you have an S corporation, you may already be making quarterly estimated tax payments to the IRS and the State of California to pay taxes on the part of your business profit that isn’t wages.)

Slick Trick to Save Time

You want to know a trick for saving time when you use the approach outlined here for handling this employee payroll stuff? Do all four quarters at once.

In other words, because the second, third and fourth quarters are nearly identical (only the quarter is different) do them at the same time.

California State Disability Insurance

If you’re eagled-eyed in your review of the example forms shown here, you may have noticed that the CA DE 9 form also calculates and shows any state disability insurance you owe. But a shareholder-employee of small corporations can opt out of this coverage if the shareholder is the sole employee and a corporate officer. You use this form.

And Now A Plug for Our Five Minute Payroll eBook (Cost $20)

People have regularly asked us to provide a cleaner, fuller ebook that goes into all the details of the approach to payroll described here. (We call this approach the “Five Minute Payroll” system.) In other words, people want more precise instructions, fully completed example IRS forms, and then also nearly complete IRS forms to which they can add their name, address and EIN. So that’s what we’ve finally done with our $10 ebook, “Five Minute Payroll.”

The “Five Minute Payroll” ebook explains how to do simple cookie-cutter payroll for most one-employee S Corporations using base salary amounts of $10,000 a quarter or $16,000 a quarter. (These amounts should work for just about everyone.) The e-book includes sample and nearly complete IRS forms as mentioned which you can copy to get payroll tax returns done in a few minutes. And the e-book provides some common-sensed tips you can use to set a reasonable salary for yourself.

Interested in our $20 ebook? Use this button to download the 2017 version:

All our digital products come with a money back guarantee. If you don’t think our ebook is worth it, just let us know (email works best) and we’ll refund your $20 purchase. By the way, we do promise the ebook delivers great value. Once you learn our “Five Minute Payroll” system you can skip paying some outside payroll service hundreds of dollars each year. And you’ll also reduce your payroll return preparation to, oh, about five minutes a year…

This article is 2015.

I want to know how to file online for one employee in CA in 2018.

You are required to use e services for business.

Does your book cover that?

The e-book doesn’t cover state payroll tax return preparation specifically, sorry.

For all states, not just California, you want to (a) determinate whether the state requires payroll tax returns for shareholder-employee-officers… and then (b) stay up to date on the current rules.

If you operate in a state that requires payroll tax returns for shareholder-employee-officers, therefore, you can use the “five minute payroll system” but many small business owners will probably conclude in that case that paying Gusto or Paychex or ADP $500 to a $1000 a year for the payroll service is a better deal.