Not every one-person corporation pays or even can pay an annual salary of $40,000 to the shareholder-employee. But a salary of $40,000, it turns out, is roughly the average salary paid by a single-shareholder S corporation to its shareholder-employee.

Accordingly, this post describes a quick-and-dirty approach to simply, easily and correctly prepare payroll for a one-person corporation when the shareholder-employee makes $40,000.

Step 1: Set a Reasonable Salary

Step 1 is setting a reasonable salary. And so let me issue a caution here.

While I’ve arbitrarily set the salary to $40,000, you absolutely must verify the salary you pick for a one-person corporation is reasonable.

Tip: You may want to review the average S corporation salaries data we provide at our “S Corporations Explained” website.

By the way, you may very well conclude that a $40,000 annual salary is appropriate. And if that’s the case, you can use the numbers and examples provided here as your own.

Step 2: Calculate the Payroll Amounts and Taxes

Once you know the correct salary to pay yourself as a shareholder-employee, you calculate the payroll amounts and taxes.

For purposes of the method described here, you think in terms of quarterly payroll amounts and taxes.

Rather than a $40,000 annual salary, for example, you think in terms of a $10,000 a quarter salary.

Calculating the employer’s payroll tax burden

Your corporation pays a 7.65% Social Security and Medicare payroll tax. If your S corporation pays you payroll of $10,000 a quarter, that amount equals $765 obviously.

Calculating the employee’s payroll and income taxes

You (the employee) also need to pay a 7.65% payroll tax as an employee. If your corporation pays you payroll of $10,000, that’s another $765.

You also need to pay federal income tax. Rather arbitrarily, I’m going to set the federal income tax to $750 a quarter, so over the year, you’ll have paid $3,000. But in many situations where $40,000 is the appropriate wages amount, this amount of federal income taxes will pay the federal income taxes.

Calculating the net wages amount

With a $10,000 a quarter salary and the preceding payroll taxes, you need to pay yourself $8485 each quarter in net wages.

Note: The corporation will hopefully disburse more than $8485 a quarter to you. But the first $8485 will count as wages. The checks you write after reaching the $8485 threshold will represent shareholder distributions. For example, if you also write a $1000 or $2000 check each month payable to the shareholder and this amount is not payroll, you categorize that disbursement as a distribution.

Step 3: Preparing the Federal Quarterly Payroll Tax Return

With a $10,000 quarterly payroll, you don’t need to make next-day or next-week deposits of payroll taxes you’ve withheld from employee payroll checks.

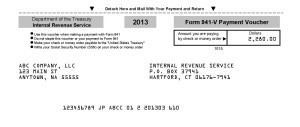

Instead, you can deposit the taxes when you file the quarterly 941 payroll tax return, which you can download from the Internal Revenue Service’s web site (click here to grab form).

I’ve included an image below that shows you what a completed 941 looks like when you’re paying a shareholder-employee $10,000 a quarter and withholding $750 a quarter in federal income taxes. You of course enter the employer identification number, name and address information with your actual information.

You also need to check the right “Report For This Quarter” box in the upper right corner of page 1 (check January, February, March for the first quarter, for example). And you need to sign the return. Note also that your state and whether or not you send in a payment determines which address to send the form to. But all the other information shown on the 941 in boxes 1 through 15 and on the 941-V would match what I’ve plugged in here.

After you complete and sign the 941 form, you write your check for $2,280 and then mail the 941 return, including the 941-V coupon, and your check to the appropriate address.

Tip: If you want more information, you can get that information from IRS instructions. Click here to download those instructions.

Step 4: Record the Payroll Transactions into Your Accounting System

You’ll also need to record your payroll transactions into your accounting system. So let me just talk about that quickly.

Recording the employee checks

You need to pay your shareholder-employee (this is you of course) $8435 in wages during the quarter. And you can do this in any way you want. You can write a check on the first or the last day of quarter for $8,485. Or you can write several checks over the course of the quarter that total $8,485.

All of these checks should be categorized as wages expense.

As noted earlier, if you make additional disbursements to the shareholder (and hopefully you will be doing this), you categorize these amounts not as wages but as shareholder distributions.

Recording the $2,280 check to the IRS

Recording the $2,280 check to the IRS works a little differently. This check actually represents two expense categories. A $765 chunk of the check represents the employer Social Security and Medicare taxes triggered by the $10,000 in total payroll. The $1,515 remainder represents the employee’s taxes that the law says the employer needs to withhold and then remit on the employee’s behalf.

This $765-$1,515 breakdown means is that you need to split the $2,280 check which gets included with the 941 form into two categories: $765 categorized as payroll taxes, and $1,515 categorized as wages expense.

Note: After you’ve categorized the $8,485 check to the employee as wages expense and also $1,515 of the check that goes with the 941 return as wages expense, your total wages expense for the quarter equals $10,000 ($8,485 + $1,515 = $10,000).

Step 5: Preparing State Payroll Tax Returns

Some states (like Washington State where I live) don’t require additional state quarterly payroll returns for shareholder-employees in one-person corporations. And if you operate in a state like this, you may only need to prepare and file the federal 941 tax returns over the course of a year.

Tip: If you are in Washington state, though, see this post so you don’t get caught in a dumb trap set by our state legislative.

But many other states you to prepare quarterly state payroll tax returns. As a generalization, these state quarterly payroll tax returns (if required) are pretty simple to deal with.

Some of the quarterly state returns amount to simple worksheets that, for example, levy a 3% tax on wages for state unemployment insurance premiums. Or simple worksheets that, as another example, charge a $.10 per hour tax on worker hours for workers compensation insurance. Other quarterly state payroll tax returns resemble the federal 941 return.

But you shouldn’t need to worry too much about all of this. Probably, your state employment agency will send you automatically information on these state returns. In this case, you need to make a couple of phone calls so you get any quarterly forms you need.

Step 6: Dealing with Any Tax Shortfalls

If paying $3,000 in income taxes won’t be enough using the method described above is not enough, you should augment the federal income taxes paid through your payroll by making quarterly estimated tax payments using the 1040ES form. For example, suppose that you know you’ll really owe $6,000 in income taxes. If through payroll withholding you’ll only pay $3,000, you’ll want to pay another $3,000 annually, or $750 a quarter, in quarterly estimated tax payments.

You can determine precisely how much federal income tax you should pay over the year by downloading the 1040-ES estimated tax payments form from the www.irs.gov website and completing the tax liability worksheet included with that form.

Note: To make regular state estimated tax payments, use your state’s equivalent to the federal 1040-ES form. For example, if you’re in California and need to pay, say, $500 a quarter in California state income taxes, you can use California’s 540-ES quarterly tax payment form.

Step 7: Preparing the Year-end Payroll Tax Returns

Even after you prepare the employee paychecks, file the quarterly payroll tax returns, and make the payroll tax deposits, you still have a small handful of additional, year-end payroll returns that need to be completed.

For example, at the end of the year, you’ll need to prepare and file a 940 Federal Unemployment Tax return. That return will assess a $420 tax if you’re a one-employee corporation in a state that doesn’t levy state unemployment tax on shareholder-employees. And that return will probably assess a $42 tax if you’re a one-employee corporation in a state that does level state unemployment tax on shareholder-employees.

Furthermore, you will need to prepare a year-end W-2 and W-3 for your employee and submit to the Social Security Administration and, possibly, to a state agency.

And it’s possible that you may have one or two additional, state related year-end tax returns to file as well.

Here’s my suggestion as to how you handle these year-end payroll tax returns: Have the person who prepares your corporation tax return prepare these year-end payroll tax returns. In other words, have the CPA who’s already doing the 1120S or 1120 corporate return do your 940 FUTA return, your W-2 and W-3 and any other state returns. He or she can easily and economically prepare these returns with the corporation return. To outsource the year-end payroll returns, get in to see your accountant early in January. Most payroll returns need to be filed by the end of January.

Some Final Comments

You have a bit of flexibility in applying the quick-and-dirty method described here. For example, if $40,000 a year in salary is too high, you can simply halve the wage and tax numbers given in the preceding paragraphs. This would of course mean you pay $20,000 in payroll over the year.

Furthermore, if you don’t or can’t do a full year of payroll, you could do, say, three quarters of $10,000-a-quarter payroll over the year. (This might make sense if your total payroll for the year should be $30,000.)

If you need to pay a reasonable annual salary of more than $40,000, you can use the basic approach described here but pay not $10,000 a quarter but rather $16,000 a quarter. (The numbers you use to do $16,000 a quarter of payroll differ as discussed in our “Five Minute Payroll” e-book which is described below.) And a $16,0000 quarterly payroll gets your shareholder-employee compensation to $64,000 a year–which should work for many S corporations.

Here’s why all this works: The quick-and-dirty payroll method described here works because of an intentional loophole in the payroll tax laws. The loophole, in a nutshell, says you can make your payroll tax deposit with your 941 tax return as long as the amount you owe is less than $2,500. If you need, therefore, to pay yourself $20,000-a-quarter, you’ll owe more than $2,500 by the end of the quarter. This breaks the loophole-related rule that opens the door to the quick-and-dirty method.

Five Minute Payroll System: Get More Details in our $20 Monograph

The Quick and Dirty Payroll Method described on this page provides a fast and easy way to handle payroll in simple situations where your annual shareholder-employee compensation is less than or equal to $40,000.

However, people have regularly asked us to explain how to use the system with a larger salary amount and also to provide a cleaner, fuller monograph with forms that the small business corporation can simply add their name, address and EIN to. So that’s what we’ve finally done with our $20 monograph, Five Minute Payroll.

The Five Minute Payroll monograph explains how to do simple cookie-cutter payroll for most one-employee S Corporations using base salary amounts of $10,000 a quarter or $16,000 a quarter. (These amounts, especially if combined with a pension or health benefits, will work for almost everyone.) The e-book includes sample IRS forms you can copy to get your quarter end or year end payroll done in a few minutes, including 941s, W-2/W-3 and 940. Furthermore, the e-book provides some common-sensed tips you can use to set a reasonable salary for your S corporation and to minimize your state payroll taxes burden, too.

Interesting in buying and then immediately downloading this monograph? Click this button:

As with all of our monographs, our products come with a money back guarantee. If you don’t think what we deliver is worth it, just let us know and we’ll refund your purchase price. We make this promise to you confident that paying $20 once to save hundreds of dollar a year (or more!) on an outside payroll service will be a great investment. Note, too, that the biggest saving to you probably won’t be the money but the time.

Running a small business? Subscribe to our free newsletter!

We regularly cover tax and small business topics here at this blog. If you’re running a small business, maybe you should subscribe to our free monthly-ish newsletter… You can unsubscribe anytime.

I know you have mentioned that the $750/quarter in federal income taxes is arbitrary, but would this amount be higher for those who are single and have a low # of allowances (vs married and have high # of allowances)?

hi Daniel, yeah, absolutely. so you’d need to augment that $750 with whatever additional withholding is necessary to pay enough tax.

Hi Daniel,

I would consider that $750 a quarter the “first” chunk of income tax you owe… and if you owe more than that–say because your income is higher or because you have fewer deductions than average–you would need to also make quarterly estimated tax payments.

Note: You could make a larger deposit for federal income taxes via withholding from wages… but that would mean you probably need to use the eftps.gov system to remit the tax deposit. The approach I describe here in this blog post keeps your total deposit small enough that you can simply send in with the 941 tax return.

Would the payroll computations and tax forms mentioned in this article work the same way for a one-person C-corp payroll? Are there different filing requirements or tax amount cut-offs that would affect a C-corp differently than the S-corp used in the example? Thanks!

For a C corp, you would report the shareholder-employee and non-shareholder-employee medical insurance as a fringe benefit deduction on the face of the 1120 tax return.

In other words, you don’t need to worry about fiddle-faddling with the shareholder-employee’s W-2…

What if your new SubS is only able to pay extremely small wages to sole owner during the first few years of business — wages far below industry median? (No employees)

You probably don’t need to worry about small wages if you aren’t making any money. The reason is IRS can’t make you pay wages… they can only recategorize distributions. And if you’re really not making any money, you don’t have an distributions to make either.

if you also took distributions, would those be reflected on the quarterly 941 on line 2? So if you were “paid” $10,000 – but then also took $2000 in distributions, would you put $12000 on line 2?

Distributions to a shareholder don’t appear on the 941. They get reported inside the entity’s tax return. You want to confer with your accountant if you have questions about how to do the bookkeeping.

S-Corp newbie here…

So if you’re a single owner LLC elected to be taxes as a S-corp, the wage expenses I pay myself throughout the year (let’s say 10k per quarter for a total of 40k for the year)– are they considered business or Non-business Expenses for tax purposes? It seems too good to be true they would be business expenses for tax purposes and lower my net income thus tax burden.

Awesome blog–thanks!

Hi Louise,

So you’re right that if your S corp pays Louise the employee $40K for the year, it gets to put a $40K deduction on its tax return. And as a result, the K-1 that the S corp sends its shareholders will be in total $40K smaller.

For example, if the K-1 goes to Louise the shareholder, that K-1 will be $40K less than it would have been otherwise.

But note that Louise the shareholder-employee will also get a $40K W-2 from the S corp. So once you get to her 1040 return, everthing sort of washes out.

Thanks so much Steve. You’re a great teacher and make this all very clear and easy to understand.

One more question 🙂

So let’s say you still want to use this method, but you need to pay a salary slightly higher than 10k/quarter, but know you still need to keep the deposit amount under $2,500 per the loophole rules. You also know you’ll need to pay more than $750 quarter in estimated taxes due to distributions, significantly more. Can you just not withhold any federal income tax from on the 941 to still get away with the loophole and instead just pay it all through quarterly estimated tax payments using the 1040ES?

Hope this makes sense 🙂

Yes, you can do that. E.g., you can pay the shareholder-employee $16K a quarter and withhold no income taxes. Social Security and Medicare will run $2448 a quarter in this case (15.3% of $16,000), so you can pay that amount with the 941.

What individual will need to do, as you note, is top off with 1040ES quarterly payments. E.g, this person might make $10K a quarterly 1040ES payments.

Just chiming in to say that I found this whole article and comment section hugely helpful. Can’t thank you enough Steve!

Thanks very much for this guide Steve, it is extremely helpful for me as a new S-Corp owner. I have a question that I think I know the answer to but would appreciate if you could confirm:

If my S-Corp has no earnings for a quarter, I should file form 941 but report 0 as income. If I file the next quarter, my total withholding must be less than $2500 to use this trick. If my withholding for the first three quarters of the year is less than $2500, and my withholding for the last quarter is more than $2500, I can still use this trick. Is this accurate? If so, it seems the obvious thing to do for companies with varying cash flows is to pay salary primarily in one quarter.

The trick here is that you can make your payroll tax deposit with the 941 form is the deposit amount is less than $2500. That’s it. So in your example, you can use the trick in quarter 1, 2 and 3. But in quarter 4.

BTW, what I would suggest someone attempting to avoid the hassle of eftps do is make a standard quarterly payroll amount (for example, $10,000)… and then get into habit of just doing the quarterly deposit of, for example, $1530. No matter what.

The problem with a new S corporation and with a small S corporation is getting to the end of the year and finding you have not paid enough reasonable compensation. After the year ends, there’s little you can do about this that truly works.

Thank you very much for this great article for new S-corp owners.

I’ve recently established a S-corp, and honestly, I am estimating a net loss on the first year. I am paying myself little weekly wages.

question 1: I have calculated my medicare and social security taxes. Should I pay them through eftps once every quarter according to 941?

question 2: because of my dependents/# of allowances, I dont think I’ll have to pay individual income tax (according to estimated tax worksheet). Thus, do I still need to fill 1040-es and pay quarterly deposits?

thanks in advance

You probably don’t need and don’t want to pay wages if you’re incurring a loss. That’s one thing to note. I.e., you shouldn’t have to feed money into an S corp so you can then withdraw it as wages. That roundtrip costs you 15.3% payroll tax. Ugh.

To answer your questions, though, you can pay taxes with the 941 if you’re below the $2500 threshold for the quarter… and you can skip 1040ES payments if you don’t owe tax.

Steve,

First, thank you so much for the incredibly helpful article…really great information! It looks like I’m in luck and you’re still answering questions.

So, for the last two years I have filed my quarterly returns and paid using this method for my one person S-Corp. I recently had a baby and am not doing any business at the moment and likely will be inactive for the remainder of 2015. As I interpret the IRS instructions, since I’ve started filing 941 quarterly returns, I should continue to file each quarter going forward showing 0 wages until I end up getting back to work. Is this correct?

Yes, you should continue to file 941 returns but just show zero wages.

BTW, you may also want to mark the “seasonal employer” box on page 2 of the 941 form. That’ll maybe signal to the IRS that you’re not employing people every quarter.

P.S. Congratulations on the new baby!

I have one more question for you Steve. So let’s say I write my wages check of $8,485 to myself and deposit it into my personal account. At the end of the quarter I need to pay the taxes on this amount. I am confused as to which account this amount comes from. Do I actually write a check from the business to myself for $8,485, then later write another check from the business for the $2,280 taxes due? Doesn’t the business actually pay $10,765 ($8,485 personal check + $2,280 in taxes)? Or do I in fact withhold the $1,515 from my personal salary check, and actually cash a check into my personal account of $8,485 – $1,515 = $6,970?

Thanks for your amazing website, it is seriously the ONLY detailed source of this information that I can find, you are filling a much needed gap in knowledge!

Assuming you’re talking about a corporation, you write a $8485 check to Camden the employee, calling that amount wages. This check is payable to Camden.

You also write a $2280 check to the IRS. $765 of this check represents employer payroll taxes, and the other part is really wages. (This other part is Camden the employee’s wages… but the employer withheld the money because its taxes and goes to the IRS.)

But doesn’t that total to $10,765 of corporation expenses each quarter?

Yes–and that’s exactly the right number… Camden the employee earns $10,000 a quarter (some of this going to pay taxes and some appearing in the net wages paycheck.)

And then the IRS gets a 7.65% payroll tax for the matching Social Security and Medicare which means $765 of payroll taxes.

On the corporate return, if these were the only two deductions, you would show $10,000 of wages and $765 of payroll taxes.

Yeah the lightbulb went off as soon as I clicked reply on that last comment…

Thanks for clearing that up.

🙂

My fingers are often faster than my brain.

so on the W2, I log the $10,000 in the wages box even through they only got paid cash $8485. Correct? It is gross, not net.

Yes. And note this important point: You actually did get paid full $10,000…

But the employer withheld $765 of your money to pay your Social Security and Medicare taxes… and remitted that to the IRS on your behalf.

And then employer may have also withheld some chunk of your money for your federal income taxes… and remitted that too.

I hope this doesn’t sound like a dumb question, but my husband and I are new to all of this and we are trying to do all of this on our own without having to pay anyone. So I want to make sure all of our questions are answered. Do I need to physically write out 2 checks showing that $765 is going towards payroll taxes and $1515 is wages and expenses when I file our quarterly taxes? You said in your website I need to split the check into those two categories so I am assuming I need 2 checks.

I’m not sure that I perfectly understand your question… but if you’re paying someone $10,000 a quarter, when you’re done, your books should show $10,000 of wages expense. Because that’s what you’ve paid.

And your Social Security and Medicare taxes will equal $765 because that’s the employer match… so when you’re done, your books should show $765 of payroll taxes expense.

The one thing–the only thing–that’s tricky about this is that you’ll actually make potentially two disbursements… one via the 941 form which pays both the $765 of employer payroll taxes and then also the $765 of employee Social Security and Medicare taxes–SO THIS EQUALS $1530…

And then you might also have the “net payroll check” equal to the $10,000 minus the $765 of employee Social Security and Medicare.

You probably would benefit by buying and following the Five Minute Payroll ebook system… if it doesn’t work, we’ll happily refund your money.

Steve,

Thanks for the great info! I recently set-up an s-corp in CA for my wife (she’s an actress) of which she is the only shareholder. I’m in the midst of setting up the payroll and I’m at a loss to determine reasonable salary. She may make 40k in one week, then 0.00 the next with large gaps of income in between. How would you recommend I determine what the s-corp should pay her? Can we determine salary qtr by qtr and pay taxes accordingly? Thanks for any help!

I would think quarterly payroll works fine… the main thing you guys want to do is get to the end of the year and have done something reasonable in the way of wages.

BTW it might be most practical in your case to just ignore her weekly earnings which bounce between (in a sense) feast and famine… rather you might want to do $10K or $16K a quarter just to make sure you get some wages accumulated over the first quarters of the year… and then sure that in the fourth quarter you do whatever number makes things look reasonable.

If I go from reporting 1099-Misc on Sch C to a S corporation route, can I postpone paying taxes this year to next. I work on one client , get 1099-Misc. Want to defer taxes to years when I may have little to no income. Is that possible?

Thank you for such informative blog

No, sorry.

BTW, an S corp might greatly reduce your self-employment taxes (which are probably a lot of the taxes you pay). But you can only use the S corporation once you have an entity in place that can use the S corporation bookkeeping rules. So you need either a corporation or an LLC (either entity can use the S corporation bookkeeping rules.)

Refer here for more info:More about S corps.

Good afternoon,

I have a question for you. I currently have 2 formed llc’ sin the state of Wisconsin. One is a tax preparation business and the other independent insurance agent. They each have their own EIN.

I outsource my payroll and have all employees paid through the tax business. As I run both businesses out of the same office.

I would like to switch to an s corp and start drawing wages for myself as the only owner.

because I have two EIN’s, would I have to make both businesses s corps? So I would have to draw a salary from both businesses? Thus having to outsource payroll for both companies? Also having to dile 2 scorp returns?

Last question, if I make this change now, being almost September, will I file s corp return come tax season January 2016 when filing 2015 taxes or is it too late and I would have to wait To file s corp taxes in 2017 when filing 2016 return.

Thanks in advance for any help you can give me.

I would think in your case that you want to have a single S corporation (if possible) so you can worry about the reasonable compensation issue on a single S corp return… You could pretty easily make one of the LLCs a disregarded entity of the “S corp” LLC by contributing the LLC to the S corporation. But if you’re not up on this kind of tax stuff, probably conferring with a local CPA firm would make good sense.

That makes sense to combine the businesses into one s corp.

My last question, I promise… If I make this change now (aug /Sept) can I file s corp for this tax year? Or do I have to wait until the next filing season?

Again, thanks in advance.

I’m not sure I understand your question but one can typically make *very* late S elections as long as one possesses a good excuse. Or at the very least an excuse.

The real issue sometimes is whether you can get adequate “payroll” for shareholder-employees into that first year.

Hi Steve,

Thanks to you for your very concise & helpful responses here — There’s hope!

I started and maintained an S-Corp over the past 10yrs to initially maintain a few seasonal project clients while I worked from home raising our children. During this time my spouse completely supported the family especially during the very slow months when the business overhead expenses continued.

Last year was the 1st year the S-Corp made a profit. My spouse was recently laid off.

I would like to start paying myself wages/salary though may continue to be seasonal.

Q1: Where do I start?

Q2: Will there be “red flags” from the IRS or State agencies as to why the S-Corp is now starting payroll?

Q3: How do I determine if or when to start this year since it’s already September?

Again, THANK YOU in advance!

You can (and should) just start doing payroll. You can use the approach described on this page… or you can outsource to a service.

The main thing, though, is to make sure you’re paying your shareholder employee reasonable wages…

Thanks for your very informative and easy to understand site. I am wondering if you could point me to blog or website that could give me a sample chart of accounts for a one person s-corp? My primary question is how to post (I’m using QB) the initial investment to start the s-corp and how to post the value of equipment. Thanks.

You can use the income and expense categories shown on the first page of the 1120S and then the asset, liability and equity categories shown on page 4 for the Schedule L balance sheet as your chart of accounts.

Steve,

Does a single-member one-employee LLC taxed as S.Corp that provides services need to complete the L Schedule EVEN if it does not have:

– inventory

– bad debt

– loans

– securities

– bonds

– mortgages

– real estate properties

– no office space rental

– no office space of its own (it a home-based service business)

thank you

If you’re over that $250,000 in revenues or assets, you need to Completing Schedule L and Schedule M-1.

thank you,

does this mean that (given the terminology I see in these two schedules) I necessarily need to do double-entry bookkeeping even though I have no account receivables, payables, or inventory?

I definitely prefer doing single entry cash accounting…

You don’t have to do double-entry bookkeeping to process payroll. But you will save money and have a much better handle on your business if you do use a real accounting system. Even a checkbook-on-a-computer software program like Quicken (or any equivalent) will do a pretty good job for most small service businesses.

Hi Steve-

I was just granted S-Corp election retroactive to Jan 1 (first business year); do I need to file quarterly reports for all of 2015? I’ve been making estimated payments but not sure where to go from here.

Thanks, and GO COUGS!

You should do payroll returns for first three quarters of year probably… just to be safe.

BTW, I would think those quarterly returns show wages as “zero”… so you’ll want to make your four quarter wages big enough to get shareholder-employee to a reasonable amount.

P.S. Watched the Cougs play on Saturday night.

Hi,

Thank you so much for this information. I am just curious about one thing. If you are a single person LLC that chose to be taxed as an S-Corp do you still have to cut payroll checks and follow this same exact procedure? File quarterly taxes, etc.

I think it’s a good idea to do payroll this way… You can do something more formal, of course. E.g., weekly payroll. But that’s a lot of work for a simple situation where the employee (the shareholder-employee) may be okay with something informal.

BTW, we have a pretty large S corporation practice and so do regularly engage with IRS auditors on reasonable compensation questions. The auditors really like to see shareholder-employee payroll as “regular” and “proceduralized” as one can make it. Doing an annual payroll, while arguably totally correct, seems to be a bad idea. For what that’s worth…

Hello Steve and Happy Holidays!

Per Sarah’s post above……

My understanding was that health insurance for greater than 2% shareholders had to be paid from or reimbursed to the shareholder of the s-corp then added to wages in box 1 only to get the above line deduction on page 1 of the 1040?

Doesn’t the insurance plan have to be established under the s-corp?

I am trying to understand how the shareholders in Sarah’s case can still get the adjustment deduction on form 1040 even though their salaries have been increased and fully taxable?

Thanks!

Hi Juan,

The article’s approach is right way… and the health insurance deduction gets onto the shareholder-employee’s 1040 tax return because it’s a self-employed health insurance deduction if you add the insurance to box 1 of the W-2 and then also describe it as self-employed health insurance in box 14 of the W-2. Note that you don’t under current rules include the health insurance in box 3 or box 5 of the W-2 because the health insurance isn’t subject to payroll taxes.

What about FUTA (Federal Unemployment tax) that you file the 940 IRS form for? I calculate mine at 6% for the first $7,000 of my S corporation wages paid in a year since I don’t pay into the state unemployment system.

That’s another hit at $420 a year and makes me wonder if being an S Corporation is the way to go. Wouldn’t it be better to be self employed and get the deduction for 1/2 of self employment payroll taxes paid on my 1040? It seems there is a threshold where being a S Corp makes economic sense.

Good question, Keith. I provide a pretty detailed answer here to your question: https://evergreensmallbusiness.com/blue-collar-s-corporations/

But the way an S corporation works you will get the deduction for employer component of payroll taxes. So that won’t impact your analysis. FUTA is an issue. A bigger issue for many small businesses are the compliance costs.

Hi Steve,

I’ve had a single member S-Corp in the past for a commercial fishing business where I would only receive payment a couple times a year. I had my accountant only file on a yearly basis and then I paid the tax due, often close to $20k.

However now I run a “normal” small business in its second year as an llc with income regularly coming in each month. In June 2015 I elected to be treated as an s-corp, retro to Jan. 1. However from my past experience I didn’t realize that I should be filing 941’s quarterly and running payroll. I am the only owner and operator. I have not paid any estimated taxes due for 2015. I want to now try to get things straight and start 2016 properly. Gross income is just over $60k, fair wage would be right at your $40k example. Perhaps I should report all the earnings for the 4th quarter or would it be better to file all 4 reports and spread the $40k evenly? Any advice would be appreciated! Cheers,

Ben

At a minimum, I think I’d suggest you do a $16K fourth quarter payroll (thereby implicitly recategorizing $16K of distributions as payroll) and report that amount on a 941 and on your 1120S, etc. (This results in a $2448 payroll tax payment which you can make with the 941 return.)

BTW, if you also provided Ben the employee with health insurance, that amount would be nice to add to the 941 and W2 and 1120S as wages too. Note that this might bump up the payroll (by say $4K or whatever) but then not bump up your payroll taxes. Note that this transaction would also in effect reduce distributions and then jack payroll.)

Once you had these easy payroll amounts, I’d look at the “leftover” distributions you paid to Ben the shareholder. If you didn’t pay “leftover” distributions to Ben, you don’t need to worry about paying more payroll. (Though you want to get everything clean and pristine in 2016.) If you did pay some “leftover” distributions to Ben, you might want to look at doing either a SEP-IRA contribution to get Ben the employee’s compensation up. (With a combined $20K of payroll and health insurance, you should be able to do a $5K SEP… so now Ben’s compensation package is $25K and maybe that’s reasonable?) And you could also look at doing a late third quarter payroll transaction. You’ll be making the third quarter deposit WAY late and so get penalized… but you might need to do this to get to the point of “reasonable.”

Good luck. Hope this helps.

Steve,

This post of yours and its followup questions are incredibly helpful.

I’m the single member and only employee of an LLC that was created earlier this month, and for which I have already 2553-elected it be taxed as S Corp.

I will run payroll only 4 times a year. Once at the end of each quarter.

I would like to take advantage of the tax savings available through S Corp taxation for items such as:

– max out employeR contribution to employeE 401k

– max out employeE contribution to Roth account of employeE’s 401k

– max year employeR contribution to family HSA

– family health insurance premiums deductions

Questions:

Q1. Do QUARTERLY payroll calculations need to take the health insurance premiums and HSA/401k contributions into consideration?

Q2. If so, does your 5-Minute Payroll product help with payroll calculations of health ins/HSA/401k and with calculation of employment (FICA) tax for yearly wages of about $260K (reasonable) compensation?

I’d like to contribute employer and employee 401k and HSA max prorrated contributions each quarter, so I’d like to learn IF and HOW those numbers are entered into payroll.

Since payroll will be just four times a year, I’d like to learn to do this myself.

It should not be too time consuming.

Q3. For the purpose of being able to enter the health insurance premiums in box 1 in W-2, is it relevant whether the employee/member’s credit card or the LLC’s credit card was used to pay for the premiums?

Q4. S Corp bookkeeping:

Is it correct for the S Corp to reimburse member for several items (mileage, phone, health ins…) in one lump transaction? Or does the S Corp need to reimburse each of those separately?

Thank you very much

The ebook answers most of these questions. Regarding question #5, which is not about payroll, you can bunch reimbursements.

BTW, if you’re using an S corporation, you probably really want a CPA or EA to do the return. (You basically want to use some of your payroll tax savings to pay for an accountant to make sure you do the accounting right.) Accordingly,I’d suggest you find some a local person or firm and then they’ll probably be happy to answer these sorts of questions as you move through your first year.

Good luck! 🙂

Thank you, Steve.

I am hiring a CPA for advice and tax preparation.

But, I’d like to learn how to do payroll by myself, since it should not be too time consuming doing so (once I’ve learnt) once a quarter for just one employee.

Can high earners learn to run payroll with use your “5-Minute Payroll”?

thank you

The five minute payroll approach works for situations where you’ve got one shareholder-employee and no other non-shareholder-employees… and you don’t want to pay $500 or $1000 a year to a payroll service.

Many (most?) one employee, one shareholder S corps can use this approach. And this is especially the case if you work in a state where there aren’t complicated state payroll taxes you have to deal with.

I see. Thank you for clarifying.

I asked you if the Five Minute Payrol ebook works for higher earners because https://evergreensmallbusiness.com/ebooks/five-minute-payroll-ebook/ says it only works if the quarter’s wages are not above $16000.

does it also work for higher-than-$16000-a-quarter wages?

Probably $16K a quarter will work for people with higher business profits if you carefully structure things. Consider this example:

Base pay is $16K a quarter or $64K a year…

If you add (say) $10K of health insurance and $6K of Health Savings Account, you effectively bump your payroll by another $16K but only the original base $64K is subject to payroll taxes.

If you do a 25% SEP-IRA match (so 25% of the $64K plus the $16K), that’s another $20K of nontaxable fringe benefits. Again these amounts aren’t subject to SS/MC payroll taxes.

So in a situation like this, if IRS or state auditor questioned you, you’d say “Well, my wages and benefits equal $100K. Maybe the wages are a little low but the benefits, which I’ve accounted for using applicable statutes and regulations, are pretty high… seems like $100K a year is enough.)

In many cases, $100K a year would be enough. Not in every case, obviously. But in many.

I don’t want to start a political discourse–that’s not point of this blog–but Warren Buffet has in recent years said things that make one think he’s being paid $100K a year in wages. (This would explain the $15,300 of payroll taxes he’s paid since payroll taxes would equal 15.3% on first $100,000). If Mr. Buffet earns $100K for running Berkshire Hathaway, probably small business owners don’t need to worry too much about getting way above that.

Again, though, these are general principles. You’d need to adjust everything for your specific situation.

Final comment: Another big issue is how the wages compare to your distributions. But that’s beyond the scope of your question.

Steve, suppose I want to pay myself $270K so I can max out both my 401(k) and my CBP. I am the single, shareholder, employee and know nothing about payroll (first year as S-corp).. Will the method in Five Minute Payroll work for me?

No, sorry, it really only works for people who pay either $10K or $16K a quarter. In your situation, you want to outsource the payroll to a real service. Like Gusto.

Hi Steve Thank you so much for your helpful post and comments – i just started my llc which is being taxed as an s-corp this year …. what if i don’t have enough funds in the bank to pay myself $10,000 for the first quarter by April 1 ? this is also right around tax time and i owe a lot so really good chance i won’t have the funds to do payroll…but i really want to stick with the quarterly system you describe and use your plan here ….and as a seller of online merch i am going to set my salary at 40k which seems to be reasonable i don’t imagine my profit will be that much even this year hope i’m wrong though …but what would you suggest i do this first quarter if i don’t have the 10k to pay myself? can i just pay the taxes on it and then pay myself whatever i can ? i could see paying myself something from now until april 1 … but i doubt it will be close to 10k

thanks!

The big thing you need to worry about is getting to a reasonable compensation level by the end of the year. You *must* do that. If you can’t do that, you shouldn’t operate as an S corporation.

But that said, you can bunch your payroll in certain quarters. Some S corp shareholders just do payroll one quarter a year and pay themselves like $40K or $80K or $120K at that time.

BTW, you will need to use a different payroll “system” that includes EFTPS.gov deposits if you want to pay more than about $16K a quarter in payroll.

Hi!

Would this work for a new 2 person s corp as well, as long as the total due remains under $2500? One owner is very active in the business right now, and the other does minimal work. That may change – can we adjust payroll amounts quarterly to reflect that, or would it be better to wait and just run payroll once a year?

Also – if only one owner is active and gets a salary, how would that work for distributions? Could the minimally active owner still get those without setting off alarms?

Last question: I make more than 117000 in wages at another company, so in my case, the s corp will not save me ss taxes, but actually add to them (the employer part of payroll taxes) – any advice in that regard? We chose this entity type anyway as a lot of clients insist on a corp vs partnership.

Thanks a lot!

You probably shouldn’t be an S corporation. Rather, you should be an LLC.

Regarding payroll, you probably just want to pay the working shareholder and in that case, the five minute payroll system should work.

Can you please explain how to configure the FUTA quarterly tax payments. I understand to take the first $7,000 of each employee and multiply it by .006. Then what do I do from there?

I’m in Florida so we don’t pay SUTA. I’m trying to file my 940 for last year and my figures are not matching up. Line 12 and 17 are not the same and it says it should be.

Thank You!

If you don’t pay SUTA, you pay a 6% FUTA tax on the up to the first $7,000 that every employee makes. E.g., if you have one employee who makes $40,000, you pay a $420 FUTA tax.

In this situation, BTW, line 8 of the 940 return shows $42 and line 9 shows $378… so total equals $420.

Hi Steve;

Thank you for all the great information!

My question is how do I go back, if possible, and to set up a federal payroll tax returns and deposits for last year, 2015? I have a single employee/shareholder S Corp. Unfortunately, I did not set up payroll or make deposits during the year.

Thank you in advance.

I would (belatedly) go back and do a payroll for the fourth quarter that gets you at least something reasonable in terms of payroll.

I wanted to thank you for this informative post, and for the one about avoiding state payroll taxes. I still had a few questions about our particular situation, and so I called your offices. The woman who answered the phone was extremely helpful, and verified that I would receive a full refund if I paid for the ebook and found it did not help answer my questions. I did purchase the ebook and it was definitely worth the $10! Before I found your website, I was utterly confused about doing my own payroll and was about to pay hundreds of dollars per year for someone to handle it for me. Now I feel completely confident in doing it myself, and it doesn’t take much time at all! THANK YOU!

Hi Steve,

Thank you for this useful information.

I created an LLC on 2015, but for a personal reason I couldn’t open the business that year.

I am the only one member/owner, I just created (Feb. 2016) an EIN for such LLC electing be treated as S Corp. Single Member.

For a couple of months I will be the only employee and then my plan is to hire 2 or 3 additional employees.

I want to start the payroll only with my self now then add the new employees.

My question, as the only owner and single shareholder for this LLC, could be myself treated as a regular employee in a payroll system or is there some difference between the owner and another employees regarding payroll?

Thank you,

For 2015, your LLC basically doesn’t exist for tax purposes. E.g., it didn’t make an election to be treated as a corporation. And it has no activity. Therefore, the “no activity” appears on your 1040…which basically means the LLC is a “tax nothing” for 2015.

For 2016 (or at least the part after your S corporation effective date) you’re a corporation and you treat employees (both shareholder-employees and nonshareholder employees) as employees. One caution: The rules for some payroll taxes are a little bit different for shareholder-employees. I would think that you want to outsource your payroll, therefore, to one of the payroll service bureaus like Gusto, ADP or Paychex…

You might also (if you’re really organized and disciplined) consider using one of the payroll options built into QuickBooks.

Steve – Thank you for this EXTREMELY helpful post.. I have learned so much going through the comments and your articles!

I really cant find an answer anywhere about this and trying to make the 2015 deadline.. I have a first time client single-member S corp that I am preparing her S corp and personal tax return. She had recurring losses in PY and never paid herself a salary. This year her profit increased 40% but she still didnt make any tax payments throughout the year. I am able to calculate her Income Tax liability and related penalties but not sure how to go about filing the 2015 employment taxes . She transferred $36K to herself during the year which seems appropriate to be categorized as “reasonable salary”. But at this stage (April 2016, 2 weeks before the deadline), do i :

1) Issue a W2 (past the due date?)

2) Deposit the Employment taxes for the year along with form 941 and wait for them to asses the penalty, if any? Seems this is a quarterly form but there hasn’t been any quarterly payments made, haven’t seen anything that refers to a different form when making $0 deposits…

I flied an extension for her S corp taxes ( it’s a disaster) but trying to submit all finals with her personal tax return..

Any input on this is greatly appreciated!

I’m not saying this works, but what I’d consider (if I was you) is possibly of doing a fourth quarter payroll for $16K that shows only SS and MC taxes due and not any income taxes due. This would produce a $2448 payroll tax liability and your client is more than two months late on this. But you’d at least get some decent amount of payroll into the books, pay the FUIA, etc.

In essence with this approach, you’d be saying that $16K of the $36K paid out to the shareholder as for payroll.

So would a W-2 still be issued late? And if so, it would just be for the 4th quarter amount?

It would be late if you’re talking about issuing it for 2017 at this date (mid February)… sorry.

Hi Steve,

Really appreciate the article on single member S-Corp payroll …. The article was posted in 2013. I was wondering whether your e-book (5 min payroll ….) consists of up-to-date information for 2016? I’ll buy one if YES.

Thanks and best regards

Chris

The book is up-to-date as of April 2016. (It was actually updated earlier this month.) Note that the 941 forms are 2016 forms… but the W-2 and 940 forms are 2015 forms. The 2016 versions of the W-2 and 940 won’t be available for months.

Hey Steve,

This page and the e-book are by far the best guides I’ve found for dealing with the tax situation on an S-corp. Page 6 references the the potential use of a SEP-IRA or solo 401k and page 7 expands on that, but there is no Appendix specifically demonstrating contributions to these accounts. Page 7 very specifically states that base compensation of $64,000 per year could also include $12,000 in health insurance (included in box 2 of form 941) and $19,000 of SEP (no reference to it being listed on the form).

My situation is a solo 401k. I expected to pay myself a total compensation package of $30,000 per year (expecting business to make $40k to $60k per year). I intended to cap out the solo 401k.

1. If I put the first 18k employee contributions in, does that reduce my W-2 Wage Income to 12k on the year? Part 2- If I make employee contributions of $4500 per quarter, does that reduce box 2 on the 941? It is my understanding that employee contributions to the 401k (or solo 401k) would not impact the taxable wage base used for line 5a-e.

2. Would my total employer contribution be (Option A) 25% of the 12k remaining (4k), (Option B) 25% of the 30k total (7.5k) or (Option C) 25% of of 24k (6k) based on creating a baseline of 24k and then contributing 25% of that to reach the 30k total that I believe would be reasonable for the size and scope of my small business? Or would it be (Option D) of some value I have not reached as a possibility? Calculating the .124 x30k/4 and .029 x 30k/4 won’t be a challenge. I deal with a substantial amount of math, but these taxes are still tough. If I was not contributing to to a retirement account, doing this with the book would’ve been a complete breeze.

3. It sounds like employer contributions to the solo 401k have no impact on the SS/medicare taxes. Is that because they are essentially coming from distributions rather than wages? If so, despite that, are we able to point to to this amount as part of the total compensation package in estimating the reasonable salary for our position?

Thank you. Hoping to have this finally figured out so I don’t have to struggle anymore. I’m well into day 2 of trying to find these complications and finally realized it just isn’t available on the internet because most people don’t figure out to form their LLC taxed as an S-corp (election already approved) and establish a solo 401k with the intent to max all contributions.

Thank you again for your help.

Hi Michael, so let me try to answer your two questions really simply. You’re making some of this maybe a little bit too complicated…

First part… WHERE does an employer’s pension fund contribution get reported? It gets reported as just another business deduction in the corporation return. I.e., if a corp pays $10K to some employee’s or shareholder-employee’s SEP or makes a $10K matching contribution to an employee’s or shareholder-employee’s 401(k), this is just another business deduction. (It happens to get reported on Line 17 of page 1 of the S corporation form.) There is nothing special about this business deduction, in order words. BTW, this regular old business expense has nothing to do with distributions or payroll taxes. In terms of the corporation tax return, it’s basically equivalent to office supplies or factory rent expense.

Second part… If an employee contributes to a 401(k) plan (or to something like a Simple-IRA), WHERE does that money get reported and deducted? Well, remember that this money is the employee’s money… so the money you pay to the employee is reported as wages on the corporation return… even if it’s used by the employee to make a pension fund contribution. On the corporation return, the employee’s wages get reported on line 7 or 8. Even the amounts used for pensions. Note, though, that the elective deferral does get disclosed and accounted for on the W-2. If an employee contributes (say) $12K to a 401(k) or Simple-IRA, that $12K reduces the amount reported in box 1 of the W-2 and that amount appears in box 12 with a code telling the IRS what type of adjustment has been made. A 401(k) deduction gets shown with a “D” code for example.

Hope that helps.

Thank you Steve, that does help a great deal. So to clarify, that means line 2 would not be reduced by my deferral to the solo 401k?

I’m so glad you responded quickly. I was starting to make this significantly too complicated.

This was very helpful. If you are a single owner S – Corp can and you have a $50,000 salary, can you not pay yourself for the first quarter and pay the salary over the last 3 quarters, if for instance you didn’t make any money until the very end of March?

Sure. And lots of people do that.

Hi Steve,

Awesome information here. I just bought your PDF and it’s great!

My 3 year old North Carolina SMLLC just elected for S-corp taxation starting 1/1/16. Please bare with me on some basic questions: Let’s assume I use your system and take a 40K salary/10k quarterly with $750 withheld for income taxes but actually make 70K total by the end of the year. Should I be making estimated quarterly payments(1040es) on the additional 30K(distributions) to cover personal income tax not withheld on the 941?

Can I literally cut a handwritten check from my company with the 941 and avoid payroll services?

Additionally, do I make my 1040es quarterly payment check from the employee,”Kenny” or from the company paycheck?

What is the main advantage to not using eftps.gov to make payments vs this system.

Thanks in advance!

> Should I be making estimated quarterly payments(1040es) on the additional 30K(distributions) to cover personal income tax not withheld on the 941?

Yes

>Can I literally cut a handwritten check from my company with the 941 and avoid payroll services?

Yes

>Additionally, do I make my 1040es quarterly payment check from the employee,”Kenny” or from the company paycheck?

from Kenny

>What is the main advantage to not using eftps.gov to make payments vs this system.

eftps is great… you can still use it to make the payments. What the system lets you do is turn payroll into a very simple, after the fact process.

Hi Steve,

Thanks for your response.

Looking at the 10K per quarter example I’m trying to figure out how $8485 is the net wage amount? Also, assuming this was $12,500 a quarter w/no income tax withheld what would be the net wage amount. Thanks for your help.

You want to remember that the employee pays $765 of social security and medicare and then also per the example $750 of federal income taxes.

Subtract these two amounts from the $10,000 and you get to your $8485.

Hi Steve, thanks so much for this article, it is very useful. I have a somewhat related, and yet unrelated question. I’m in the process of setting up a business, and my plan is to set up two LLCs. The first will be for the “operating business”, and I’ll elect S-corp taxation. The second will be a “management” entity, earning a management fee from the S-Corp, with the funds used for retirement accounts, etc. I also have a regular day job where I receive W-2 income. I have a couple questions with this set up.

1. Should I make myself an employee of both the S-Corp and C-Corp and pay myself W-2 wages from both, or just the C-Corp and take 100% distributions from the S-Corp?

2. Instead of the C-Corp LLC contracting to provide management services to the S-Corp LLC, would it be better to instead establish the C-Corp LLC as the managing member of the S-Corp LLC and apportion the distributions such that the amount that goes to the C-Corp LLC is sufficient to fund the W-2 wages, fringe benefits, and expenses and leave as little taxable business income in the C-Corp LLC as possible?

Any advice you could give me would be great. Thanks!

Hi James, I would guess (if you already have a W-2 job) that you don’t want to complicate your business and your accounting by setting up multiple corporations. Here’s a blog post we did about using S corporations for part-time businesses: https://evergreensmallbusiness.com/should-you-use-an-s-corporation-for-a-sideline-or-part-time-business/

You can read through the details, but the quick summary is “you don’t benefit from an S corp (usually) if you’ve already got a regular W-2 job…”

BTW, a C corp can’t be a shareholder in an S corp…

Hi Steve, thanks so much for this article,

with $30,000 payroll salary / year to my self from the S corp how much distribution is normal to take / year as a only owner in the corporation?

I don’t really think the size of the distribution matters very much. What really matters is that your compensation is reasonable. That said, if you pay John the shareholder-employee $30K in wages, I would think a distribution of $5K a year wouldn’t even be close to being a problem. $10K wouldn’t, I would guess, cause any issues either. Heck, $20K could in many circumstances be totally reasonable.

Two other comments about this…

If you’re taking $100K or $200K in distribution, that seems problematic. I have to wonder why your salary isn’t more than $30K… (but that said, who knows… $30K may be the perfect salary. even if your distributions are six figures.)

Finally, there are things you can do to get your distrbutions value down. E.g., if you or your family do charitable giving, that many can come out of the S corporation and so “use up” or reduce the distribution.

Hey Steve. Hoping to make more this year I Incorporated with S selection in beginning of jan. got the s selection confirmation in march. Its May 26th And I have barely been able to pay and cover cost of goods sold and buying more inventory. I work full time at another job and this is only an ebay business that gets a 1099k from paypal. It looks like my profits will go directly to payroll at the end of the year, obviously. As things are now, It looks like I will only clear 10k in profit for the year. How is 10k a year going to look like a normal salary? I only work about 8-10 hours a week though. Is this something I can expect to hear a call from the irs? Do I just start sending 941’s from here on out or file past 941’s with zero and pay myself at the last quarter? do I file them 2500 in income a quarter? I am lost. Also, Can I just 1099 myself at the end of the year?

I would look at this blog post…

https://evergreensmallbusiness.com/should-you-use-an-s-corporation-for-a-sideline-or-part-time-business/

I doubt you should have made the S election for 2016 given the (very understandable) modest profits earned the start-up phase of your venture.

BTW, if you take no distributions because you’re leaving the profit “in” the business, you should not have to take a salary. See this blog post for rationale:

https://evergreensmallbusiness.com/setting-s-corporation-shareholder-employee-wages-to-zero/

Hi Steve. Just a quick question, or confirmation. I too live in Washington state, and have set up a single owner S corp for my therapy practice. MY impression is that there is no need to register/pay into Washington state workers comp or unemployment insurance…but that I would owe FUTA via an annual 940. I was on another website and was told this is bad info, although I’m suspicious of that persons’ level of expertise wrt our state. In any event, it appears you affirm my position in your article, but would love it if you could confirm!?

If so, I think I’ll opt for the quick and easy payroll as you describe, and forego bothering with any software. Seems like quarterly 941’s and annual w-2/3 and 940’s would be pretty to knock out…hard to justify paying $300-400 annual to print these out of QuickBooks.

Pat, your understanding is correct. You should, if you’re the only employee and a shareholder, be able to skip employment security department stuff… also L&I. BTW, there are ways where the state essentially tricks you into paying this your first year if you’re a corporation making the S election rather than an LLC making the election.. So a call to ESD and L&I might be appropriate.

Hi Steve, if I am a Sole owner of Scorp.

If starting the method above, and file the 941 this quarter, Will I still file the Quarterly 1040-ES? If so, do I make the same payment that the account has figured for me (which is my last year liability/4)?

Thanks!

Via the 941, you’ll take care of the social security and medicare taxes you owe…

But your 1040ES payments, in essence, include social security AND medicare AND federal income tax payments. I think you’d want to still make 1040ES payments therefore. But they’d be smaller because they wouldn’t include SS or MC.

Hi Steve… Would you recommend an S Corp to pay the recommended $40,000 yearly salary ($10,000 quarterly) and upwards of $100,000(plus) yearly in distributions to the same shareholder? Or would this not be the appropriate system for an S Corporation yielding those amounts?

Thank you in advance for your advice!

That seems aggressive to me, but you’d want to look at what is a reasonable salary for the work the shareholder-employee does.

BTW, if the S corp provides the shareholder with (say) $8,000 in health insurance, that money counts as wages but isn’t subject to social security or payroll taxes. So your $40K becomes $48K.

If you could do a 25% match SEP, that would be another $12K. With a $40K base, $8K of health insurance benefits, and $12K of pension benefits, you’re still only paying payroll taxes on $40K, but your compensation is $60K. And you’ve reduced your distribution from $100K to $80K. Such an approach would probably be a lot less problematic.

But again, the question really is whether $40K is reasonable. If the business includes other people doing the same job as the shareholder and for wages of $30K to $40K, you should logically be okay at $40K.

Hi Steve, thanks so much for this article,

With $150,000 distribution / year, how much Net payroll salary / year is reasonable for S Corporation that have only one owner?

You need to look at what people doing the same job as you do get paid… so that’s one (and the most important) factor…

And then you’d want to think about how the tax return looks and how the shareholder-employees compensation works. E.g., if you pay someone $40K a year, that seems low, but if the person gets $20K of health insurance (counted as wages but not subject to income or payroll taxes) and you do a $60K a year defined benefit pension plan (which uses up a bunch of the distributive share), you’re going to look fine. In this case, you’ll have paid payroll taxes on the $40K… that $80K of fringe benefits will be income tax and payroll tax free. And you’ll only have that last $30K to report as a distribution, which will probably be fine.

Thank you Steve for this amazing post! I bought the Five Minute Payroll and have

a few questions:

1)- On the W-2 on page 26, the SS withheld and Medicare withheld are 2480 & 580.

Please explain their calculation. I thought they would have been 4960 and

1160, respectively.

2)- I have a W-2 day job and a single shareholder/employee S-Corp. I’d like to

avoid 1040es quarterly payments. On the 941, I should be able to withhold

about 25% Federal income tax on my wages and still keep the total less

than $2500. Is this strategy OK? Are their reasons why small withholding

and 1040es are better?

3)- Let’s say I use 1040es payments. I incorporated in August 2016. Can I make

just the 3rd and fourth quarter 2016 payments? Would their be a penalty since

I missed quarters one and two?

Ho Ralph, regarding your first question, only half of the SS and MC are the employee’s taxes. That half equals $2480 and $580. I think what you’ve asked about is the employer’s other half of the SS and MC. That’s another $2480 and another $580. But that money isn’t paid by the employee, right? It’s paid by the employer and appears on the employer’s tax return (probably as “payroll taxes”

Regarding your second question, that works fine. I.e., go ahead and “over-withhold”… just make sure you stay beneath that $@500 threshold if you want to pay with the 941.

Regarding your third question, don’t worry about the penalty. There probably won’t be one… if there is, it’ll be really small.

Hi Steve,

First off, I am learning so much from your site and articles! I am a new sole owner LLC, but looking to elect to be taxed as an S-corp. I missed the March deadline, so I’ll have to now file the late election and hope to be approved. But, I’m concerned about several things:

1) I have been paying myself monthly through electronic deposit (LLC business account to my personal account), but not withholding any taxes or doing through a payroll-now that I want to be classified as an S-corp, how will these distributions be converted to salary? I was planning to start a payroll, but unsure of what I should pay myself if I don’t get approval for the S-corp.

2) I have been a 1099 for a couple years prior to the LLC and chose to not pay the quarterly estimated payments (my penalties were so little compared to what they wanted me to pay ahead of time), and with all of my deductions-I’ve always owed much less so I didn’t want to pay so much early.

2a) But if I now elect to be an S-corp, I am supposed to make quarterly payroll payments and income tax payments and I’m hesitant to start this without knowing if I’ll be approved as a Late S-Corp election…

3) If I don’t pay any of the quarterly payments and just file everything timely by March 15th, what penalties will I incur? Example: LLC to-S Corp will net about 100K, with a 45K salary to myself. If I keep as an LLC, I am looking at 100K taxed very high…but do the penalties associated with late payments on S-corp out weigh these?

Thanks so much for any advice!

You need to do payroll. The good news (probably) is that for 2016, you can probably pretty easily say you’ve paid $16K in payroll for Q3 because that would require only a $2448 deposit and that would be a small enough payment that you can simply pay the money with the Q3 941. (In this case, you’d essentially be saying that the first $16000 of money you’d paid out for Q3 to Kurstin was “payroll.”)

The only tricky thing you need to worry about is that you need to by year end have paid Kurstin the employee reasonable wages. That means that over the fourth quarter, you’ll need to pay enough additional wages to Kurstin that the total for the year is reasonable. BTW, in your business, it might be that $16K for Q3 and $16K again for Q4 gets you to a reasonable wages number.

BTW to hit your $45K total for the year, this would mean that you need to pay $29K in wages to Kurstin during the fourth quarter. $16K plus $$29K equals $45K.

One other comment… I don’t think you’ll get hit with penalties using the approaches I describe here. Where you would get hit with penalties–and they wouldn’t even be that bad–would be if you said $16K of Q2’s payments to Kurstin were payroll. That might mean you should have paid $2448 by end of July… and now it’s two months later so you have two 5% per month penalties so roughly $120 times two.

But then this would mean you have $16K for Q2, could do another $16K for Q3 and then could do $16K for Q4 thereby bringing you up to $48K in wages for the year… which might be reasonable.

Hi Steve,

Thanks again for this article and your reply to my previous questions!

I plan on paying my S-Corp operating expenses (worker’s compensation insurance,

advertising, etc), then calculating my salary based on what is left over.

Does this sound reasonable?

Probably but maybe not necessarily… what sounds “reasonable” to me, if you want more confidence in your number, is looking at your job in your S corp and comparing your salary with what people earn in similar positions.

The other thing is, if you’re close to reasonable, you’re probably okay.

Hello Steve,

Thank you so much for the article. I had a question regarding calculation of federal withholding on my income. I am a sole owner S Corp and pay myself. We projected with my CPA that I will have an income of 55 K over for the months of August-December. We will deduce 5k as business expense and pay 50K out to myself. Out of this 50K, only 25K will be paid as salary, the other 25 K will be paid as distributions. Based on these numbers he calculated federal withholding of 2000 ( based on 5000 gross income per month and 5000 in distribution). I was wondering how he got to that number because my income situation has changed and I will make much less now. So I want to be able to calculate federal withholding by myself.

Thanks in advance

I would recommend you outsource your payroll to a service like Gusto… that’ll mean you have them deal with the withholding amounts in a manner that at least takes care of the tax on the wages.

For the taxes on the “other” part of the S corporation profit–what you’re calling distributions–you should be able to multiple the profit by your marginal tax rate(s). E.g., if you’ll pay a 10% tax on that other $25K, you’ll want to at some point pay another $2500 in income taxes.

Hello Steve,

I am already using Gusto but the calculations that gusto made regarding my federal withholding didn’t match the ones that my accountant gave me ( the amount from the accountant was much higher compared to the one from gusto).

Also I am not sure I understand your example with the 10% calculation above.

Thanks,

Adelina

Use your accountant’s numbers. He or she isn’t just trying to pay the taxes on your wages… but also on your shareholder profits.

Can you help me out how he got to this calculation?

That discussions and descriptions in the post do the best job we can do to describe the calculations. Sorry that they aren’t clearer. Ugh.

BTW, the math of payroll unfortunately isn’t very intuitive… and if it’s especially “un-intuitive” a small business owner may just need to bite the bullet and outsource payroll to someone like Gusto.

Hi Steve,

I purchased your 5 Minute Payroll pdf and found it very helpful!

This will be my first year in business as a SMLLC with S-corp election and I want to use your 5 Minute Payroll System immediately. I have a friend who is a CPA and says that since this is my first year of business, that the IRS requires that I do a monthly payroll and be a monthly depositor for my first year and cannot do a quarterly method to start. Is he correct? Or can I do the quarterly method you describe right away?

Second, can reasonable compensation be an hourly wage, especially if I want to work my business part time? For example, could I make my reasonable compensation $30 an hour (assuming that’s what employees make in my field, in my area etc), and if I charged $500 to a client for a job that took me 10 hours, could my W2 pay be the $30 x 10 hours ($300), and then consider the extra $200 earned to be distribution?

Hope that makes sense, and thank you!

You by default are a semi-monthly depositer rather than a semi-weekly depositor… so your CPA friend and I agree there. But if your payroll tax liability for the entire quarter is less than $2500, you don’t have to make your tax deposits semi-monthly. You can just make the deposit with your timely filed 941. The “de minimis” payroll tax liability rule, in effect, trumps the semi-monthly deposit rule.

Monthly payroll would be better, too. IRS agents and accountants too love stuff to be systematic and procedural. But that monthly-ness isn’t a requirement. The requirement is you need to get to the end of the year and have paid your shareholder-employee reasonable compensation.

Your hourly wage approach seems fine to me. But note I only have the info you’ve provided… 🙂

Hi Steve,

I have some basic questions about how to make distributions, both schedule wise and formalities. I’m stuck on a few issues.

For these questions, lets say I take a $40K salary but end up making $60K in a calendar year.

Firstly, in a single member S-corp, is a distribution made by just writing a check to yourself from the company? Is there any other necessary formalities one has to follow other than record keeping to use at the end of the year tax returns?

Secondly, to make things simpler, can I leave the additional money I made over my salary in my business bank account and then report the money as distributions at tax time(year end) or do I have to physically write checks from my business bank account to myself(the employee) throughout the year for record keeping?

Thirdly, I got a little busy and absent minded this year and only made 1 small distribution to myself(wrote a check) after my 1st quarter payroll. To make up for that, can I make 2 larger distributions before the year is finished?

Fourthly, how do I calculate how much to take in distributions each quarter so that at the end of the year I’ve taken everything I can? Is that the goal or should I leave some money’s undistributed in my business bank account?

Per above, let’s say my salary is 40K and but I make 60K total. I pay myself $8485 a quarter after PR taxes. With the additional 20K (5K a quarter) do I distribute that full amount(5K a quarter) or do I withhold self employment tax from it first and then distribute the difference?

Just trying to understand more and keep my taxes clean for the end of the year.

Thanks for your help.

David, you don’t need to worry about the distributions. You just need to pay “David the shareholder-employee” reasonable compensation. If you want to worry about something, worry about that. I.e., worry about paying an amount that is more than you need to pay or less than you need to pay.

Regarding the distributions, it doesn’t matter whether you pay it all at once… or in little chunks… just write checks whenever. Although that said, you may as well check your LLC operating agreement on the off chance it says something about how and when to do distributions.

Thanks Steve,

I’ve learned a lot from your Ebook and this post. Yes, i’ve paid myself a very reasonable salary this year following your system.

Just to be clear about distributions: Lets say i’ve made and extra $5K above my salary over this year, what happens if I don’t distribute the $5K to myself in 2016?

Will it effect what I have to report on my taxes at the end of this year? Can I distribute it later (2017) when I need it?

I would rather leave any excess profits in my business account for when I really need it. Are there any negatives here?

Great question. And a super common question for new S corporation owners.

As a general rule, you aren’t taxed on distributions. So if your S corp makes $5K and you distribute $0, you pay tax on the $5K regardless of the distribution.

BTW, if *next* year, you make $0 but distribute $5K, you pay zero tax because you made zero income. That $5K distribution, i.e., doesn’t create any tax liability.

P.S. The only time you may pay tax on a distribution is when you make a distribution in excess of your basis… in layman’s terms, that occurs when you use borrowed money to pay a distribution.

Steve,

You say above that…

…”…if your S corp makes $5K and you distribute $0, you pay tax on the $5K regardless of the distribution…”.

Does “you pay tax on the $5K” mean:

“the individual pays tax on the $5K”

or

“the S Corp pay tax on the $5K”?

As a generalization, S corporations don’t pay income taxes except in oddball situations…

In the situation you allude to, the shareholder pays the income taxes on the $5K of profit–and, yup, that’s case even though the money still sits in the S corporation’s checking account.

Hello, and thank you for writing this great article. I am hoping you can clear something up for me.