I want to throw out a silly idea about forming a limited liability company in Washington state: You can probably do the work yourself.

Here’s the deal: The Washington State’s Secretary of State provides free forms and an online application process you can use to do the setup in a few minutes—and without the help of an online service or an attorney or some well-meaning accountant.

Preparing the Documents

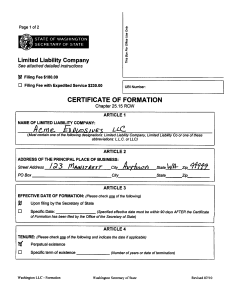

To see how easy you will find it to set up your own LLC, take a peek at the image below, as it shows the first page of the form completed so as to set up an imaginary LLC named “Acme Explosives LLC.”

Obviously, your name and address go into the “Name” and “Address” spaces. And no surprise, but you can’t use a name that’s the same or deceptively similar to another existing LLC’s name.

Tip: You can use the form here to see if there’s another business already using the name that you want.

The first page of form also provides some check boxes that you use to indicate when you want to form the LLC: immediately or at some future date.

And the first page of the form provides a set of Tenure check boxes (again, peek at the form) that let you specify whether the LLC will have a perpetual existence or a limited life.

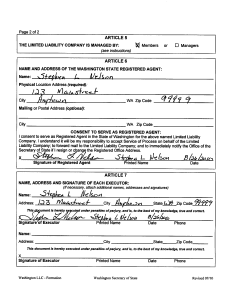

The second page of the standard LLC formation form (see image below) asks the only tricky question related to the LLC setup: Whether your new LLC will be managed by all of its members, or owners, or by only one or some of its members, who are in this case called managers or manager-members.

To indicate how your LLC will be managed, mark the appropriate checkbox in box labeled “Management of LLC is Vested in One or More Members: Yes or No.”

Tip: If you have multiple members or managers, ideally you’ll want to have an attorney draft an operating agreement. This operating agreement should describe who the manager is or who the managers are if you’re setting up a manager-managed LLC.

The second page of the standard LLC formation form also asks for the name, contact information and signature of a person or business the state should contact if it has questions—information you enter into the “Registered Agent” area.

And then you need to sign the bottom of second page again as the executor of the filing. And then you’re done.

Filing the Form

After you complete the form (click here to grab a free copy), you mail it and a check for either $180 for regular-speed processing or for $230 for expedited-speed processing to:

Corporations Division

801 Capital Way South

P.O. Box 40234

Olympia WA 98504-0234

That’s it.

A few days to a couple of weeks later, you’ll get a letter back indicating your filing has been approved and at that point all you’ll need to do, typically, is apply for an employer identification number from the Internal Revenue Service and then finalize your operating agreement.

Using the Online LLC Application.

Let me mention one other quick point. While you definitely can file a paper application to create your Washington LLC as I describe here, you may want to quickly prepare a draft paper application for reference purposes and then submit the application online.

The online application process (click here to start the application) collects the same basic information as does the paper form. And it is a little more expensive because online LLC applications are automatically expedited. But usually if you use the online LLC application, your LLC is set up the day you apply. Note that the Secretary of State’s website will take a few work days, typically, to show your new LLC.