Peter Theil, in his provocative book Zero to One, talks about the power law dynamics you want to get “going” if you’re an entrepreneur working in start-up venture.

But can I suggest something? Power law dynamics can (and should) show up in small firms too.

In fact, small business power law dynamics may just be the secret to you jacking the profits of your venture.

But let me give you the theory and then some real-life examples so you get what I’m rattling on about…

Power Law Dynamics: A Definition and Generic Example

The power law dynamic refers to a situation where a change in some formula input triggers a disproportionately big change in the formula output.

A simple example from the world of carpentry shows this visually.

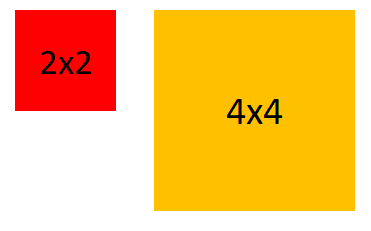

Say you have a square hole in a floor. If each side of the square measures 2 feet, covering this 2×2 foot square hole requires a chunk of plywood that measures 4 square feet. (The red square below shows this.)

But what if you double the side of square to 4 feet? Now covering the hole requires 16 square feet of plywood. (The yellow square below shows this.)

A doubling of the “size of side” input, therefore, quadruples the formula result from 4 square feet to 16 square feet:

A quick side bar: The reason people call something like this a “power law” is because there’s an exponential expression that “raises some value to an Nth power.”

For example, you can express the plywood required to cover a square hole measuring two feet by two feet like this:

22

And then you can express the plywood required to cover a square foot measuring four feet by four feet like this:

42

See that superscript 2 that appears in both formulas? That’s the two feet or the four feet being raised to the 2nd power.

And now, you know what? You can just ignore this stuff about “exponents” and then also that gibberish about “to the Nth power.”

We don’t need to spend any more time on that.

Instead you can focus on the core logic: a small change in some formula input can produce a big change in the formula result output.

And here’s where this gets really interesting in terms of small businesses and entrepreneurship…

Small Business Power Law Dynamics Real-life Example

I am absolutely sure that you and I, as small business owners, encounter small business power law dynamics all over the place.

Let me tell you about three examples we’ve experienced in our little operation.

Example #1 – Search Engine Ranking

You may know this if you use your website to attract new customers, but your relative rank on a search engine results page hugely impacts the new customers you get.

If you sit at the 8th spot on the search results list, for example, you might get 1 new customer a month. If, however, you get a decent link from a reputable website (maybe a small weekly newspaper), you may move up to the 7th spot… and then you will maybe get 2 new customers a month.

So, to summarize, every step up in rank your small business earns very possibly doubles the number of customers you get. (The math really does work almost like this, for the record.) And that’s a power law dynamic.

Example #2: e-Book Cover Design

Let me share an example from a sideline business I run. For a shamefully long time we sold our do-it-yourself incorporation kits with an incredibly amateurish “cover” that I whipped up myself using Microsoft Word.

One week I finally got smart and paid a professional designer a couple hundred bucks to create covers that show the states’ flags as each ebook’s cover, as illustrated below.

The new covers are nothing fancy as you can see. But people liked seeing their state’s flags. And they really were way better looking than the original covers,

But here’s the really important point: Our sales doubled the very next day.

I’ve mentioned this experience a few times. And sometimes folks laugh and laugh pointing out that of course better packaging makes a difference, that of course a professional designer does better graphic design than an amateur. I agree with all that.

But that’s not really the insightful point, I submit.

The insight is that a very economical modest change–you’ve surely heard the phrase “don’t judge a book by its cover” right?–immediately doubled sales. Immediately!

Example #3: Small Revenue Changes Trigger Big Profit Improvements

Let me give you one final example of where a relatively small change in an input triggers a surprisingly large change in an output.

Let’s say you run a small business with $100,000 of revenue. Further, say that your cost of goods sold for the stuff you sell equals 40% and that your fixed overhead equals $40,000.

The simple profit and loss statement shown below gives your operating profits: about $20,000.

| Gross Revenue | $100,000 |

| Less: Cost of Goods | $40,000 |

| Less: Fixed Overhead | $40,000 |

| Net Income | $20,000 |

But what if you can bump your revenues by 10% but keep your fixed costs “fixed” at $40,000.

In this case, because only your revenues and costs of goods sold increase by 10%, your profits rise to $26,000, as shown in the profit and loss statement below.

| Gross Revenue | $110,000 |

| Less: Cost of Goods | $44,000 |

| Less: Fixed Overhead | $40,000 |

| Net Income | $26,000 |

Notice the small business power law dynamic here: A 10% bump in revenues triggers a 30% bump in profits. Wow.

Again, a relatively minor change in a formula input triggers a surprisingly major change in the formula output.

Three Quick Comments in Closing

To wrap up this discussion, three quick comments:

- Surely the real-life formulas that accurately describe your or my business are too complicated to discover and then mathematically manipulate with precision. So what I propose we do is this: Let’s just recognize that there’s a power law dynamic to lots of the changes we can make. And that means small improvements, for example, may produce big changes in our profits.

- A related important point. We need to be careful. Because power law dynamics work in both directions. You and I might inadvertently or carelessly change some input and then find the formula results dramatically decrease, too.

- A tangential remark… The whole nature of small business power law dynamics suggests to me that seemingly-entrepreneurial activities like side hustles and part-time micro businesses don’t really make sense… As Peter Thiel discusses in his book, you want in a small business to actively search out all of the power law type opportunities that exist—and then exploit them. Another way to say the same thing? You need to go big.