We probably all expect to get the truly great business insights from some Harvard or Stanford business school professor who has just completed a clever bit of research. Or at least that’s what I tend to think.

We probably all expect to get the truly great business insights from some Harvard or Stanford business school professor who has just completed a clever bit of research. Or at least that’s what I tend to think.

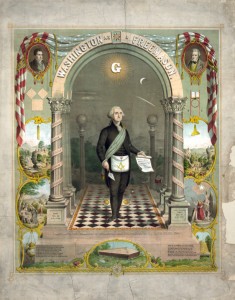

But you know what? It sort of seems like we can often get wonderful insights from history, too. Which brings up George Washington and his entrepreneuring, so let me explain.

I visited Mount Vernon last month. And to prepare for the trip, I read Edward G. Lengel’s recent book, “First Entrepreneur: How George Washington Built His—and the Nation’s—Prosperity.”

A Quick Book Review of First Entrepreneur

If you’re an entrepreneur or small business owner, you will find Lengel’s book really interesting and very educational.

Here’s why: The business history of George Washington provides tons of useful entrepreneurial tactics and tricks for people today. You might even call them secrets hidden in plain sight.

Accordingly, while I’m still riding a wave of Revolutionary War nostalgia, let me share what seemed to me to be three super powerful insights Washington displayed.

Systemic Risks Matter

A first thing that jumps out from Washington’s approach to entrepreneurship?

His sensitivity to the systemic risks his ventures encountered in the rough-and-tumble and downright-dangerous economy and society of Colonial America.

If you ponder this alertness to systemic risk a bit, you have to wonder if one of the reasons Washington was so successful–he was probably one of the hundred richest men in early America–was simply that he avoided catastrophic failure.

That’s something to think about a bit…

Washington’s business climate included at least two giant systemic risks. The first obvious risk was that his new country entered into a military conflict with a super-power, Great Britain.

But that wasn’t the only systemic risk. Another was that the Colonial America financial and banking system was a total, hyperinflationary mess.

Washington attempted to mitigate these dangers as best he could apparently. Lengel points in his book for example, that one of the very practical things Washington did was intentionally over-allocate investment in raw land to hedge his inflation risk.

Continual Learning Provides Continual Advantage

Here’s another thing that jumps out when you learn about Washington’s entrepreneurship: His continual, organized, energetic learning about the industries he operated in.

Washington, though he lacked much formal education, made continual business learning a giant priority. (Most of his ventures connected to agriculture, so he was often learning about cutting-edge agricultural practices or new farming inventions.)

Washington regularly ran his own agricultural research programs at Mount Vernon to develop his own best practices.

And then Washington not only read all the latest books about the industries in which he operated—remember that this was an era when books weren’t easy to come by–he reached out to and developed relationships with the expert authors.

Some these experts, he actually “imported” from Great Britain, which was basically the repository of agricultural “high” technology in his day.

And just to make this point: It wasn’t as if Washington didn’t have other balls in the air. I have a few dozen corporate tax returns to do some month and, gosh, I have trouble scheduling a haircut.

Washington? Hey, he ran a series of business ventures, conducted a war, all while helping found a new country. If he had time for continual learning, I probably do too.

Abundance Mentality Right Big Picture Model

I don’t want to tell you too much more the stuff in Lengel’s book. You’ll have more fun reading the book yourself. What’s more, you’ll surely spot insights I missed.

But let me share one quick final insight I think I see: Washington operated from a mentality of abundance and not scarcity. He appeared to see the giant wonderful opportunities in America’s future if he and other Americans did the practical stuff.

That mentality of abundance seemed to have been another factor that let him spot new ventures hidden in all the change and tumult. Maybe this is the biggest take-away.

NOW i know George Washington’s Business Secrets