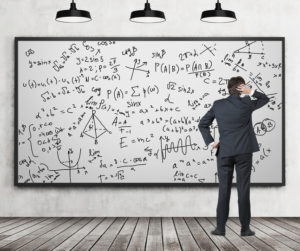

The Section 199A deduction phase-out calculations confuse lots of people. They even confuse smart accountants, as several readers of my Maximizing Section 199A Deductions monograph have told me.

Accordingly, I want to give a high-level overview of how the phase-out math works, including a quick review how the deduction works.

And one other note before we start: This blog post’s information has been updated for the 2025 Section 199A phase out amounts.

Section 199A Deduction in a Nutshell

The Section 199A deduction gives unincorporated businesses, S corporations and real estate investors a special “bonus” deduction equal to, tentatively, the lesser of 20 percent of business income or 20 percent of their taxable ordinary income.

For example, say you make $100,000 a year in an incorporated business but with the new standard deduction your taxable income equals $76,000. Assume all your taxable income is ordinary income, so no capital gains or anything.

In this case your Section 199A deduction equals the lesser of 20% of $100,000, which equals $20,000… or 20% of $76,000, which equals $15,200.

That means your deduction equals $15,200.

Section 199A Deduction Phase-out Calculations Usually Don’t Matter

The good news…

For most business owners and investors, the Section 199A Deduction phase-out calculations don’t matter.

For example, single taxpayers with taxable income less than $197,300 and married taxpayers with taxable income less than $394,600? Those folks don’t get “phased-out.” They can ignore this phase-out nonsense.

Further, single taxpayers making more than $247,300 and married taxpayers making more than $494,600 also don’t need to worry about the phase-out calculations.

Instead, taxpayers earning above these $247,300 and $494,600 taxable income thresholds apply a couple of simple rules:

Rule #1: High-income Service Businesses Disqualified

If the taxpayer earns her or business income in a specified service business—basically a white-collar professional, athlete, performer or one-person celebrity business—she or he doesn’t get the Section 199A deduction.

Another way to say this same thing? For high income specified service business income, the Section 199A deduction equals zero.

That’s a pretty easy—if an unpleasant—rule.

Caution: One semi-surprise that came into focus in the final regulations bears mentioning here. If your trade or business includes a little bit of “specified service” activity, that can “taint” your entire business as a “specified service.” The final regulations, as one example, describe a landscaping business that also provides some “consulting.” “Consulting” counts as a specified service. And if a small firm’s specified service activities equal 10 percent or more of revenues, the entire business counts as a “specified service” and so loses its Section 199A deduction.

Rule #2: High-income Taxpayers Need Wages and Property

And then a second and more complicated rule for these high income taxpayers…

The taxpayer’s Section 199A deduction can’t be more than either 50% of the business’s W-2 wages or 25% of the business’s W-2 wages plus 2.5 percent of the business’s depreciable property.

Suppose, for example, that a business pays $100,000 in wages and holds $2,000,000 in depreciable property.

In this case, the business calculates what amount equals 50% of its W-2 wages (that value is $50,000) and what amount equals 25% of its W-2 wages plus 2.5% of its depreciable property (that value is $75,000).

Whichever value is more—$75,000 in this case—the Section 199A deduction can’t be bigger than that.

A little bit of math, sure. But pretty easy to understand and even to calculate.

Unfortunately, things get tricky for taxpayers with taxable incomes that fall into the phase-out ranges (again, that’s between $197,300 and $247,300 for single taxpayers and between $394,600 and $484,600 for married taxpayers.) And we need to talk about that next. Two phase-outs appear in the Section 199A law.

Section 199A Deduction Phase-out Calculations for Specified Service Trades or Businesses

For specified service trades or businesses, the first phase-out works like this: At the start of the phase-out range (so either $197,300 or $394,600) the taxpayer or taxpayers get a deduction equal to the full 20% of the business income.

At the end of the phase-out range, the taxpayer gets a deduction equal to 0% of the business income.

And as a taxpayer’s taxable income “slides” from the threshold amount up through the phase-out range, the percentage proportionally “slides” down to zero.

The actual law doesn’t put the formula into a table, but if it did, the table would look something like what appears below:

| Deduction % | Single | Married |

|---|---|---|

| 20% | $197,300 | $394,600 |

| 18% | $202,300 | $404,600 |

| 16% | $207,300 | $414,600 |

| 14% | $212,300 | $424,600 |

| 12% | $217,300 | $434,600 |

| 10% | $222,300 | $444,600 |

| 8% | $227,300 | $454,600 |

| 6% | $232,300 | $464,600 |

| 4% | $237,300 | $474,600 |

| 2% | $242,300 | $484,600 |

| 0% | $247,300 | $494,600 |

You see what I mean by the percentage “sliding down” from 20% to 0%, right?

At $197,300 if single or $394,600 if married, someone gets the full 20% deduction. At $247,300 if single or $494,600 if married, someone gets zero deduction.

Note that $222,300 taxable income for a single person and $444,600 in taxable income for a married person sits exactly half way through the phase-out range. So at that income level, the 20% deduction gets “half” phased out, and equals 10%.

Section 199A Deduction Phase-out Calculations for Low W-2 Wages or Depreciable Property

A second phase-out looks at a firm’s W-2 wages and depreciable property. Specifically, low or zero W-2 wages or depreciable property also cause a single taxpayer with income between $197,300 and $247,300 or a married taxpayer with income between $394,600 and $494,600 to lose a chunk of the Section 199A deduction.

The calculations get a little more complicated. Unfortunately. But if you break down the calculations into half a dozen simple steps, the math makes sense.

Let me step you through how this works.

Step 1: Calculate the tentative “20%” deduction.

For example, if the business income equals $400,000, 20% of that equals $80,000. So that $80,000 potentially equals the tentative Section 199A deduction amount.

Step 2: Calculate the W-2 Wages or Depreciable Property Limitation.

For example, if the business paid $100,000 of wages and had zero depreciable property, the 50% of W-2 wages limitation amount equals $50,000.

Step 3: Calculate the difference between the tentative deduction and limitation

For example, if the tentative Section 199A deduction equals $80,000 but the W-2 limitation equals $50,000, the difference between the two amounts equals $30,000.

Step 4: Calculate Phase-out Percentage

Next you need to calculate the percentage that describes how far into the phase-out range a taxpayer’s taxable income is.

Let’s call this value the “phase-out percentage.”

If a married taxpayer’s taxable income equals $489,600, for example, the couple’s income is $95,000/$100,000ths, or 95%, into the $100,000 phase-out range that goes from $394,600 to $494,600.

Step 5: Calculate Phase-out Amount

To calculate the phase-out amount the taxpayer loses, you need to multiply the phase-out percentage (calculated in step 4) by the difference between the tentative deduction and the limitation (calculated in step 3.)

For example, if the phase-out percentage equals 95% and the difference between the tentative deduction and the limitation equals $30,000, the phase-out amount equals $28,500.

Step 6: Deduct the Phase-out Amount from Tentative Deduction

To finally calculate the real final deduction, you subtract the phase-out amount (calculated in step 5) from the tentative deduction amount (calculated in step 1).

If the tentative deduction equals $80,000 for example and the phase-out amount equals $28,500, the real Sec. 199A deduction equals $51,500.

Double Phase-outs Really Hurt

One clarification some folks have gotten confused about, too.

Someone can lose some of the Section 199A deduction due to being in a specified service trade or business. And someone can lose some of the Section 199A deduction due having a high income but not enough W-2 wages or depreciable property in the business. And these two phase-outs can both grind down the ultimate Section 199A deduction someone gets.

In other words, say someone enjoys a taxable income half way through the phase-out range–so at $222,300 for a single taxpayer.

If this person earned their income in a specified service trade or business, they would lose half their Section 199A deduction due to the specified service trade or business thing.

And then they could lose another chunk of that remaining half due to the W-2 wages and depreciable property limitation.

Closing Remarks

Once you grind through the math, the phase-out calculations make sense. The math works the way you and I would predict if we were just “guessing.”

Two other things to keep in mind though, since you’ve trudged through this discussion.

First, the Section 199A law says those threshold amounts, $197,300 and $394,600, do need to be adjusted for inflation. So you want to keep that in mind. Also note that the $50,000 “phase-out range” for single people and the $100,000 “phase-out range” for married people do not get adjusted for inflation. Just so you know…

Second, let me mention again the rule that your Section 199A deduction can’t be more than 20% of taxable income taxed as ordinary income. The amount calculated using the phase-out arithmetic may be further limited to that value.

Other Resources You Might Find Useful

The Section 199A deduction interacts with the optimal S corporation salary for shareholder-employees, so if you’re ready to think about that issue, maybe peek at this blog post: S Corporation Shareholder Salaries and the Section 199A Deduction

Determining whether a one-person business gets disqualified as a “specified service trade or business” is tricky, but I’ve got some additional information about that riddle here: Section 199A Pass-thru Entity Deduction and the Principal Asset Disqualification.

Finally, if you’re still learning the law, you may benefit by reading our blog’s Sec. 199A “primer” (available here: Pass-thru Income Deduction: Top 12 Things Every Business Must Know) and then skimming through the dozens of reader comments, questions and answers.

Interested in Section 199A? Subscribe to our free mailing list

We regularly blog about the small business tax laws including the new Section 199A deduction. You may want to consider subscribing to our free monthly-ish newsletter. You can subscribe anytime.

Steve – quick question. What is “taxable income”, is that e.g., “Total income” line 22 of a 2016 form 1040, or is it “Taxable income”, line 43 of a 2016 form 1040?

Taxable income… not total income… not adjusted gross income. And to be more precise taxable income less any capital gains.

Steve,

Have you been able to sort through when the pass-thru deduction applies to different real estate ownership ? Commercial real estate owned and occupied by a business owner, other commercial real estate owned by an individual, taxpayer that owns 100 rental houses, taxpayer that owns one rental house, etc. A BIG thanks for all your insight on the new laws.

I think it applies. Period.

Some people worry it won’t. But I think it’s pretty clear…

That said, we’ll get clarification from IRS before too long, I think… (In a few months)

Steve

A big deal was made about this law that Trump would benefit personally. Since i assume he would be above the $415,000 level will he still qualify for the 20% deduction?

Yes, because his business isn’t a specified service trade or business… and because within those entities he will surely get “credit” for either W-2 wages or depreciable assets.

Where do you see the Cooperative issue falling, I deal with a large farm client base and it appears to be the most controversial part on 199A

I haven’t focused on the agricultural cooperative angle much. Sorry. (I’m surprised, too, to hear that this part of the Section is most controversial, though I believe you…)

I will say this: The statute seems to be pretty friendly to agricultural cooperatives. Also this comment: If you’ve got lots of experience dealing with farmers and ranchers, you will probably get more out of the paragraphs that discuss the agricultural coops than I did.

Sorry I’m not more help.