You probably know that Thomas Jefferson wrote the Declaration of Independence. You may remember that he negotiated the best real estate deal in the … [Read more...] about Thomas Jefferson’s De Facto Bankruptcy

Perpetuating a Family Business

This week I want to talk about perpetuating a family business. I mentioned in last week’s blog post my recent trip to Virginia. And the trip, a … [Read more...] about Perpetuating a Family Business

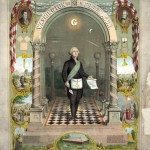

George Washington’s Business Secrets

We probably all expect to get the truly great business insights from some Harvard or Stanford business school professor who has just completed … [Read more...] about George Washington’s Business Secrets

Safe Harbor S Corporation Salaries

One of the challenges of setting a reasonable compensation amount for shareholder-employees of an S corporation is that no official “safe harbor” … [Read more...] about Safe Harbor S Corporation Salaries

Paying Zero S Corporation Shareholder-Employee Wages

I stumbled onto an online forum discussion recently where participants were berating some new S corporation owner about paying zero S corporation … [Read more...] about Paying Zero S Corporation Shareholder-Employee Wages

How Taxes Kill Successful Businesses

A handful of times this summer, I’ve helped successful business owners with a surprisingly common problem: That problem being a tax burden that seems … [Read more...] about How Taxes Kill Successful Businesses

Paying Payroll Taxes to Bump Pension Contributions

Jim Dahle, the physician who edits the White Coat Investor blog, hypothesized a week or so ago that it might make sense to add your spouse to a small … [Read more...] about Paying Payroll Taxes to Bump Pension Contributions

Ben Bernanke, Scenario Planning, & Your Small Business

So this blog post is a bit schizophrenic. I want to do a quick book review of Ben Bernanke’s book The Courage to Act. Then I want to delve into the … [Read more...] about Ben Bernanke, Scenario Planning, & Your Small Business

Why You Don’t Need to Worry about Taxes in Retirement

As a tax accountant, I am programmed to think about taxes. To worry about people paying too much in taxes. To obsess over tactics that allow clients … [Read more...] about Why You Don’t Need to Worry about Taxes in Retirement

Your CPA versus TurboTax

Because we’re CPAs, we get people asking us a lot about when someone can and can’t use TurboTax or a similar product to self-prepare a tax … [Read more...] about Your CPA versus TurboTax