Okay, an interesting idea. If you know what your small unincorporated business will generate in profits this year? And then you have a … [Read more...] about S Corporation Tax Savings Calculator

personal finance

Thomas Jefferson’s De Facto Bankruptcy

You probably know that Thomas Jefferson wrote the Declaration of Independence. You may remember that he negotiated the best real estate deal in the … [Read more...] about Thomas Jefferson’s De Facto Bankruptcy

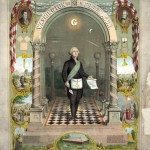

George Washington’s Business Secrets

We probably all expect to get the truly great business insights from some Harvard or Stanford business school professor who has just completed … [Read more...] about George Washington’s Business Secrets

Paying Payroll Taxes to Bump Pension Contributions

Jim Dahle, the physician who edits the White Coat Investor blog, hypothesized a week or so ago that it might make sense to add your spouse to a small … [Read more...] about Paying Payroll Taxes to Bump Pension Contributions

Understanding the Wash Sale Rules

Regularly during tax season, we see clients with a pretty large volume of trading activity across a number of brokerage accounts. And unfortunately … [Read more...] about Understanding the Wash Sale Rules

Excluding Foreign Income from U.S. Taxes

We get a lot of questions from people who earn money outside the United States and wonder how, and if, U.S. income taxes can be avoided. For this … [Read more...] about Excluding Foreign Income from U.S. Taxes

U.S. Tax Rules for Nonresident Aliens

If you’re new to the U.S. system of taxation, you’ll find the situation pretty confusing. The U.S. system of taxation (and we say this as tax … [Read more...] about U.S. Tax Rules for Nonresident Aliens

Why You Don’t Need to Worry about Taxes in Retirement

As a tax accountant, I am programmed to think about taxes. To worry about people paying too much in taxes. To obsess over tactics that allow clients … [Read more...] about Why You Don’t Need to Worry about Taxes in Retirement

Real Estate vs IRA and 401(k) Accounts: Part II

Last week, I blogged about the tax reasons direct real estate investment may be a better, more tax-efficient choice than using options like an IRA or … [Read more...] about Real Estate vs IRA and 401(k) Accounts: Part II

Real Estate vs IRA and 401(k) Accounts: Part I

I’d like to broach an awkward subject with you. Specifically, I’m going to present the case for direct real estate investment as an alternative to … [Read more...] about Real Estate vs IRA and 401(k) Accounts: Part I