You can pay one of those online services to set up a Washington corporation. But if you’re at all the do-it-yourself type, the actual steps you take to form a Washington state corporation are almost comically simple. Here are the seven steps:

Step 1: Check if the corporation name is available

Your first step? Check if the name you want to use is even available. To do this, you can use the Washington Secretary of State’s corporations search form (click here to use the form).

Click on “Search for a Business.” By entering the name you want to use in the search form, you’ll be able to see if there’s another business already using the name that you want. You can’t use a name that’s the same or deceptively similar to another existing corporation’s name.

Step 2: Grab the free Application to Form a Profit Corporation

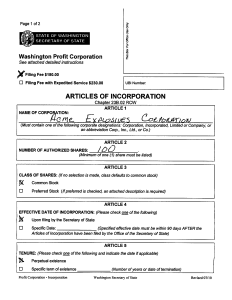

The Washington Secretary of State’s Corporation Forms web site provides free incorporation forms (see completed example below). Click here to download the current free form.)

Note: You can also work with an online version of this form, which is also available at the Secretary of State’s web site (Click here to start the online form application process. And note that you may need to scroll down the page, but under the heading “I would like to see online services available for:”, click on “Domestic Profit Organization”. On next page, click on “Proceed to Form a Washington Profit Corporation.”)

The online form looks and works in basically the same way as the paper form. All online applications receive expedited service. Therefore all online applications are charged a $20 expedition fee, for a total filing fee of $200.

Step 3: Use the free form to describe your new corporation

After you download and print the profit corporation application form, you’re ready to describe the new corporation you want to create.

Enter your business or investment name into the box labeled, “Name Of Corporation”. As this box’s label indicates, the name must include one of the phrases or acronyms, “Corporation,” “Incorporated,” “Limited,” “Corp.,” “Inc.,” “Co.,” or “Ltd.”

In the area beneath the “Name Of Corporation” box, enter the number of shares the corporation is authorized to issue. As the labeling of the box indicates, you must have at least one share in the company.

You also need to describe the stock your corporation will issue. A corporation can have both regular (or “common”) stock as well as preferred stock. Preferred stock owners enjoy preferences over the regular, common stock owners. For example, a preferred stockholder might get paid dividends before common stockholders or might receive preference over common stockholders in the event the corporation is liquidated.

Presumably, hopefully, if you’re taking a do-it-yourself approach to incorporation, your new corporation will issue only regular, common stock. In this case, you mark the “Common” check box. If you will also issue preferred stock, you also mark the “Preferred” check box and then attach a description of the preferred stock.

Step 4: Specify the start and end date for the corporation

Use the “Effective Date Of Incorporation” box to specify whether the corporation should be formed on some future date or when the Secretary of State files the articles of incorporation application. Usually, you just want to form the corporation as soon as possible, so mark the “Upon Filing By The Secretary Of State” box.

If you plan for your corporation to be an ongoing entity, check the box next to “Perpetual existence”. If you plan for your corporation to only exist for a specific limited length of time, check the box next to “Specific term of existence”. Then put in the date you plan for your corporation to end.

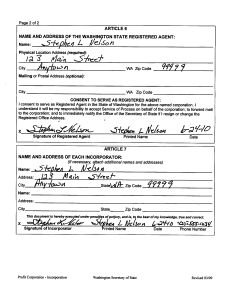

Step 5: Identify the registered agent and incorporators

Washington State wants to know the name and contact information for a real person within the state of Washington that the state can contact if it has questions or concerns about the corporation or its operation. You can pay someone else to be this registered agent, but it’s really easiest and cheapest to just be your own registered agent.

Accordingly, you want to enter your name and address information into the boxes labeled “Name And Address Of Washington State Registered Agent” on the second page of the free incorporation form (see below). Then sign on the line labeled “Signature Of Agent”.

Washington State also wants to know the names and contact information for the person or people incorporating. To provide this information, enter the names and addresses of the organizer or organizers into the boxes labeled, “Names Addresses Of Each Incorporator.” One of the incorporators (this will be you, surely) needs to sign and date the application at the bottom of the form where indicated.

Step 6: Mail in the Profit Corporation Application

After you complete the “Application to Form a Profit Corporation,” mail the completed form, a second copy of the completed form and a check for $180 to:

Corporations Division

801 Capital Way South

P.O. Box 40234

Olympia WA 98504-0234

Processing lead times vary, but in general it takes several weeks to get your incorporation papers and certificate back from the Secretary of State’s office. You may pay an additional $50 to expedite service. Write EXPEDITE in bold letters on outside of mailing envelope and check “Filing Fee with Expedited Service $230” on top of first page of application form. This will give you a 2 day (working days) turnaround.

Tip: You can also form a corporation online using the web address provided earlier. In general, when you form a corporation online it takes a few days for the corporation to appear as formed within the state’s records, but the incorporation date shows as the day you apply. Online filing of the application to form a profit corporation costs an extra $20, or $200 in total.

Step 7: Adopting By-laws, Issuing Stock, Electing Directors and Officers

After the secretary of state certifies your corporation—and at this point, your corporation legally exists—you still need to perform three other startup tasks:

1. The incorporator or incorporators (this is probably either you or you and the other founders) need to hold an organization meeting. At this meeting, you adopt your corporate by-laws and elect directors to the board.

2. Your board of directors needs to hold a board of directors meeting at which, among other items, the board elects officers to the roles of president, vice president, treasurer, secretary and so on. At this initial board meeting, you may also want to have the board, via a formal board resolution, approve setting up a bank account and make specific persons the signers on the account.

3. You need to issue stock to the shareholders contributing cash or property. You need to follow your corporate by-laws as to how this process works. As a generalization, however, you can use uncertificated stock, which simply means that someone (perhaps you) contributes cash or property to the corporation and then you simply keep a record of the stockholder’s shares as part of your corporate records. The sample corporate by-laws do allow you to use uncertificated stock. And especially in the case where you are setting up a one-shareholder corporation which you will own and operate, uncertificated stock—in other words, stock for which you don’t issue stock certificates—is probably easiest.

Dear Sir or Madam,

I am considering to incorporate a company in Washington state and I have several questions:

-What requirements does the company need to be filed as a S Corporation? This is for one U.S. owner, no employees for now. How the federal tax for the company would be filed, through my personal tax? Is there double taxation?

-I would like to offer legal services out of the state as well. I know there are states with an excise tax and I have a question about this. What happens if I offer the services through e-mail, that would be considered doing business in that state? And if I travel to that state and I do some visits there to potential clients, is that considered doing business?

I think you need to contact an accountant or attorney and ask that person your questions.

BTW, the subchapter S election may be made both by LLCs and regular corporations. So either an LLC or corporation can file as an S corporation.