Some bad news, I’m afraid. Covid-19 closures appear to be killing millions of small businesses.

That’s maybe not a huge surprise. Also, we’ve had bigger fish to fry. At the time I’m writing this, nearly 200,000 Americans have died from Covid-19, according to the CDC.

But in this blog post I want to to shine a light on the small business closures triggered by the Covid-19 pandemic.

More people—not just small business owners—need to understand the scope of the problem.

Further, small business owners need to understand mechanically how Covid-19 closures kill small businesses. That understanding may allow some to sidestep a permanent closure.

But first a quick review of the data regarding the pandemic’s impact on small businesses.

Small Business Covid-19 Closure Statistics

Good data on Covid-19 closures is still scarce. Yelp provided some painful statistics from their database of roughly 5 million small businesses. As of June 15, they calculated that 139,339 small businesses had closed. That works out to roughly a 3 percent closure rate.

Economist and professor Richard W. Fairlie did some early assessment as part of a working paper published by the National Bureau of Economic Research (available here: The Impact of Covid-19 on Small Business Owners: The First Three Months After Social-Distancing Restrictions.) Professor Fairlie estimated that roughly 8 percent of small businesses appeared closed in June.

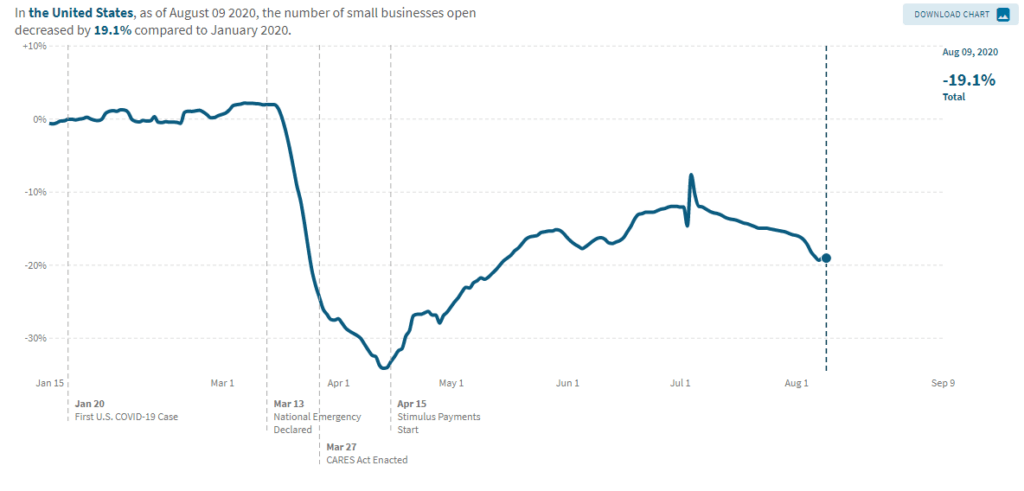

But I think the richest data at this point comes from the working paper, “The Economic Impacts of COVID-19: Evidence from a New Public Database Built from Private Sector Data,” written by Raj Chetty, John N. Friedman, Nathaniel Hendren, Michael Stepner, and the Opportunity Insights Team.

In that paper, the researchers describe data that at the time I’m writing this suggest about 19 percent of small businesses have closed in the U.S.

Here’s a line graph that depicts this from the Opportunity Insights Track the Recovery website the researchers helped build. You want to visit this resource and look at the data for your geographic area and industry category.

The shocking takeaway? If nearly 20 percent of small businesses have closed at this point, we’re talking maybe 6 million small firms. (The SBA reports 30 million small businesses exist.)

Another way to frame the situation: Roughly 60 million Americans work in small firms, according to the SBA. If nearly 20 percent of these folks are out of work due to Covid-19 closures, that’s 12 million unemployed workers who need these small firms to restart in order to have a job again.

That’s pretty bad.

Covid-19 Closures Matter More than Many Understand

Okay, so now a related point regularly missed by some policy makers and policy influencers.

A small business closure differs from someone losing a job. A small business owner can’t just reopen when a lock down ends or when consumer demand returns. And yet many people you hope know this apparently don’t.

Consider, for example, the policy advice provided by Michael Osterholm, the director of the Center for Infectious Disease Research and Policy at the University of Minnesota. Dr. Osterholm seems to be a proponent of lock downs, which contribute to Covid-19 closures. He explicitly recommended them in recent New York Times editorial.

But he appears to miss the long-time economic consequence of shuttering millions of small businesses.

Here, for example, is his comment in a recent podcast about Covid-19 with boldfacing added:

Are we going to take the short term pain, and this time do it right, and shut down, get the numbers down, keep the distancing in place, or are we just going to let it continue to transmit as is because it’s inconvenient…

The piece I worry Dr. Osterholm and others miss? Running a profitable small business that provides stable income to the owner and other employees requires a long runway.

Some of the reasons for the long runway are obvious. Consider a worker looking for a job in a normal economy. Someone might look for a new position. Interview. Then start work. Lag times vary. But for some jobs, you’re talking days. Other jobs, weeks. But pretty quick.

Reopening or restarting a small business works differently. The time frames stretch out to start or restart. For example, getting people hired or rehired. Updating websites. Ramping up advertising and marketing.

And then let me point out the other nearly hidden issue that all the now closed small businesses face.

But we’ll need to work from an example.

An Example Small Business

Consider a fictional small service business that typically generates the following annual profit and loss statement:

| Revenues | $300,000 |

| Payroll | $100,000 |

| Overhead | $100,000 |

| Profit | $100,000 |

To keep things simple, assume that $300,000 of annual revenue runs pretty evenly through the year, so $25,000 a month.

Let’s also assume that the expenses run pretty evenly through the year.

Note this also means the owner, or owners, therefore earns her, or his, or their profit in roughly even chunks. So about $8,000 a month. Or, if two people own the firm, about $4,000 a month.

The Forgotten Financial Statement

Small businesses often don’t pay much attention to their balance sheet. (I say this based on my experience as a CPA serving small businesses.)

But the imaginary business described earlier? That business should regularly prepare a schedule of the assets it uses in its operations, any debts it owes, and the left over amount—which represents its owner capital.

To keep this example really easy, assume the firm holds $25,000 of cash (to smooth out the rough spots) and a truck worth $25,000. Maybe we’re talking a little moving company.

With zero debts, the firm’s balance sheet looks like what follows:

| Assets | |

| Cash | $25,000 |

| Truck | $25,000 |

| Total Assets: | $50,000 |

| Liabilities | $-0- |

| Owners Capital | $50,000 |

| Total Liabilities & Owners Capital: | $50,000 |

See if that balance sheet makes sense. It should.

The main two things to spot? First, the business uses $50,000 of assets. Second, with no debts, that money comes from owner’s capital investment.

And then the other important but subtle thing to note: A firm needs the assets and the capital its balance sheet shows.

Now let’s get back to the hidden destruction that the Covid-19 pandemic causes small firms.

Why Covid-19 Pandemic Hurts Small Firms

Assume that the imaginary business described above sees its revenues go to zero. Further, for simplicity, assume the business continues to pay its overhead (rent, utilities, and so on) and its employees and then also pay out the usual amount to its owner or owners. That’s $25,000 in total each month.

The obvious thing that happens is the firm loses money. $25,000 a month. Everybody spots that. And people without business management experience assume that that’s the financial effect to focus on.

But something else happens, too. Given the $25,000 of cash disbursements, the firm burns through its $50,000 of capital in two months.

More precisely, the firm will need to spend its cash the first month. And then, in the second month, it will need to sell the truck and use the cash proceeds for expenses.

And then the firm will have to stop.

By the way? If the firm slows its spending, the firm extends its longevity. But not by much.

For example, suppose the firm terminates the employees and halves the amounts paid to the owner or owners. (Maybe two owners were each drawing $4,000 a month but they each drop that to $2,000 a month.) In that case, the firm disburses $12,500 a month for spending. But that spending rate burns through the firm’s capital in four months.

And then the firm will have to stop.

Restarting After Covid-19 Closures

You see the issue.

For a small business and its employees, restarting doesn’t just require an end to the lock down. Or a return to healthy customer demand.

Rather, restarting requires the firm to replenish its capital.

A little moving business, for example, needs a truck on day one. It also needs the cash required to pay its rent, gas for the truck, and weekly payroll since these expenses come before the customer remits payment.

That missing capital? That’s the reason that many of the millions of small businesses closed by the Covid-19 pandemic either won’t be able to restart. Or to restart quickly.

But I promised to make this quick. So no long, drawn-out requiem here. Rather, let me try to tease out some actionable insights small businesses and small business supporters can use.

Insight #1: Learn from the Scientists

A first suggestion. I think we need to start by getting our information about the pandemic from the scientists working in this area.

To better understand the details and the direction of the Covid-19 pandemic and the public health responses, I’ve been following the Twitter activity of a bunch of scientists and researchers talking about the pandemic and public health: Francois Balloux, Stefan Baral, Gabriela Gomes, Sunetra Gupta, John P.A. Ioannidis, Martin Kulldorff, Michael Levitt, Wes Pegden, Justin Silverman, and Alex Washburne.

I know. Twitter. Weird, right? But curiously, the Twitter activity of the forgoing list of scientists coupled with their published and pre-print research, and then candid discussions with each other? Wow, really useful.

Insight #2: Ask Policy Makers and Influencers to Consider Small Business Closures

Whether or not the damage and destruction to small businesses makes sense? That’s a political question our society has to work out together. No good choices. Terrible trade-offs.

But let’s ask policy makers and influencers to consider fully and explicitly the small-business-closure costs of their choices.

Insight #3: Ask for More Responsible Behavior from Media and Social Network Butterflies

A comment to journalists, reporters, and folks active in online social networks. Please show discernment and precision in your descriptions of the risks of Covid-19. Think carefully about how readers and listeners interpret your words. And for heaven’s sake, don’t exaggerate.

I recently pointed out in another blog post, Post-pandemic Covid-19 Small Business Planning, that people who should know better (including major media outlets) make wildly inaccurate statements about Covid-19 hospitalization and fatality rates in their reporting and online.

And that may matter more than one thinks at first. Lock downs aren’t the only thing shrinking the economy. Consumer worry dampens demand too. (See the earlier referenced research paper from Chetty and his co-authors.)

Accordingly, those spreading bad information contribute to small businesses failing.

Many of us get we can “mask up” to dial down the loss of life from this pandemic.

How about we also “dial up” the accuracy of the public statements we make about the Covid-19 pandemic?

Insight #4: Small Business Owners Must Protect Their Balance Sheets

If you own a business and your balance sheet is getting beaten up by Covid-19, I urge you to exercise extreme caution. Protect your balance sheet!

What most benefits you and other stakeholders (like your employees) is your firm returning to full, profitable operations.

Further, to return to your regular operations, probably you’re going to need not just for the economy to reopen and for customer demand to restart. You’re also going to need a “full-sized” balance sheet.

Very possibly, for example, you’ll need to grow your capital by first getting the small business profitable and then reinvesting some chunk of those profits.

You may be looking at a disturbingly long road here. Sorry.

One bit of good news? Rebuilding your business capital this time, inasmuch as you’re a veteran entrepreneur or manager, should go much faster than it did when you first started your business. (You know more now and should build capital more efficiently.)

Furthermore, and fortunately, government help has thus far been generous. (The Paycheck Protection Program may not have been a great way to protect jobs. But it may save small businesses by injecting them with capital.) Maybe that will continue. Keep your eyes and ears open for that.

One final thought. Keep in mind that you don’t have rebuild a mirror image balance sheet. Maybe in the post-pandemic economy, you guys operate differently. (You may this go-around need to rely more on debt—such as a Small Business Administration Economic Injury Disaster Loan.)

Insight #5: Consider Possibility Your Business Model Needs Update

The Opportunity Insights Economic Tracker website mentioned earlier—again, you want to spend some time with that tool—also highlights the dramatic drop in small business revenues over the course of the pandemic.

That drop? About 20 percent on average. Which is a face punch.

And another thing to consider? That 20 percent average decline hides the variability individual businesses experience. Different categories of small businesses experience different revenue losses. Some firms don’t get beat up at all, basically. Some get beat up so bad they don’t, or won’t, survive. (Kind of like the Covid-19 virus and people of different ages…)

But surely all small businesses need to update their approach and their plan for the future.

Look back at that imaginary small business described in the opening paragraphs of this blog post. Maybe the new normal needs to be this firm reworks its “formula” so the business works with revenues that run at 80 percent of what the firm enjoyed prior to Covid-19.

And then keep in mind that many small businesses—especially service businesses—can’t rely on price cuts to build volumes. (You need to be able to really scale up to make price-cutting strategies work.)

P.S. A Free Download of Our Business Planning Kit

By the way? It’s sort of overkill. (I created it for a book called the MBA’s Guide to Microsoft Excel a couple of decades ago.)

But we’ve got a downloadable e-book and Excel workbook you can grab for free to do business planning. We used to sell this… but who cares about that now.

If we can help even a tiny handful of small businesses better plan their way through a Covid-19 closure? No brainer.

Thanks a lot for information on this..for Small businesses us.

Dr. Osterholm must have failed Econ 1. Your most important points are directed at the media hyping up fear and hysteria. I personally know so many people still afraid to go out. It is disgusting what they have done to America.

Thanks for commenting, Wendy. I agree with you about the fomenting of hysteria by many in the media. Also by social media gadflies.

For what it’s worth, I received private messages from a handful (okay, a tiny handful) of some of the world’s top epidemiology professors and researchers affirming the message of the blog post… Their politics vary, I’m sure. But they say beating up the economy has a heavy public health cost. E.g., people in US often get their health insurance from a job. No job, no insurance. 🙁