If your company does business in Washington, then you likely need a Washington business license. Luckily, applying for a new business license in Washington is fairly easy. This blog post explains how to get one.

If your company does business in Washington, then you likely need a Washington business license. Luckily, applying for a new business license in Washington is fairly easy. This blog post explains how to get one.

Step 1: Make sure you have a SecureAccess Washington account

One of your first steps as a new business owner is to create a SecureAccess Washington account if you don’t already have one.

SecureAccess Washington is a login system that many Washington State agencies use. So, if you already have an account with, for example, the Washington Department of Licensing, you may already have a SecureAccess Washington account.

If you’re not sure whether or not you have a SecureAccess Washington account, you can check using this link. If you know you don’t have a SecureAccess Washington account, you can use this link to sign up for one.

Step 2: Sign in to MyDOR

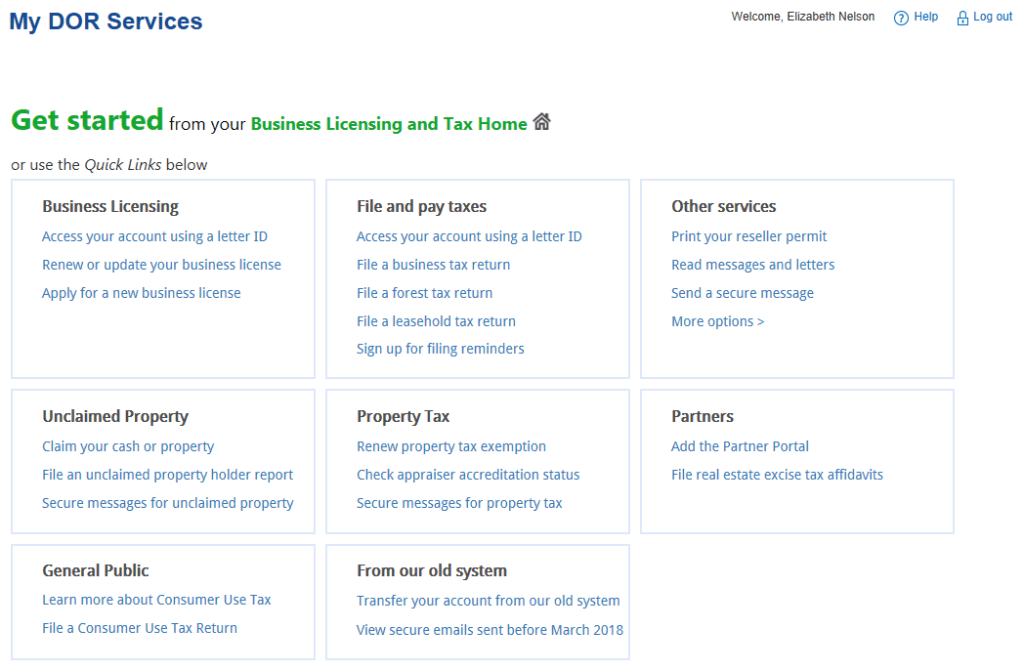

Once you have a SecureAccess Washington login, you can sign in to MyDOR here.

MyDOR is the Washington Department of Revenue’s online portal. This account is what you’ll use to file your initial business license application. You’ll also use this account in the future to file Washington excise tax returns.

After you’ve successfully signed into MyDOR, you’ll see a page that looks something like what’s in Figure 1, above. To continue to the new business license application, click the “Apply for a new business license” link, under “Business Licensing” in the upper left corner.

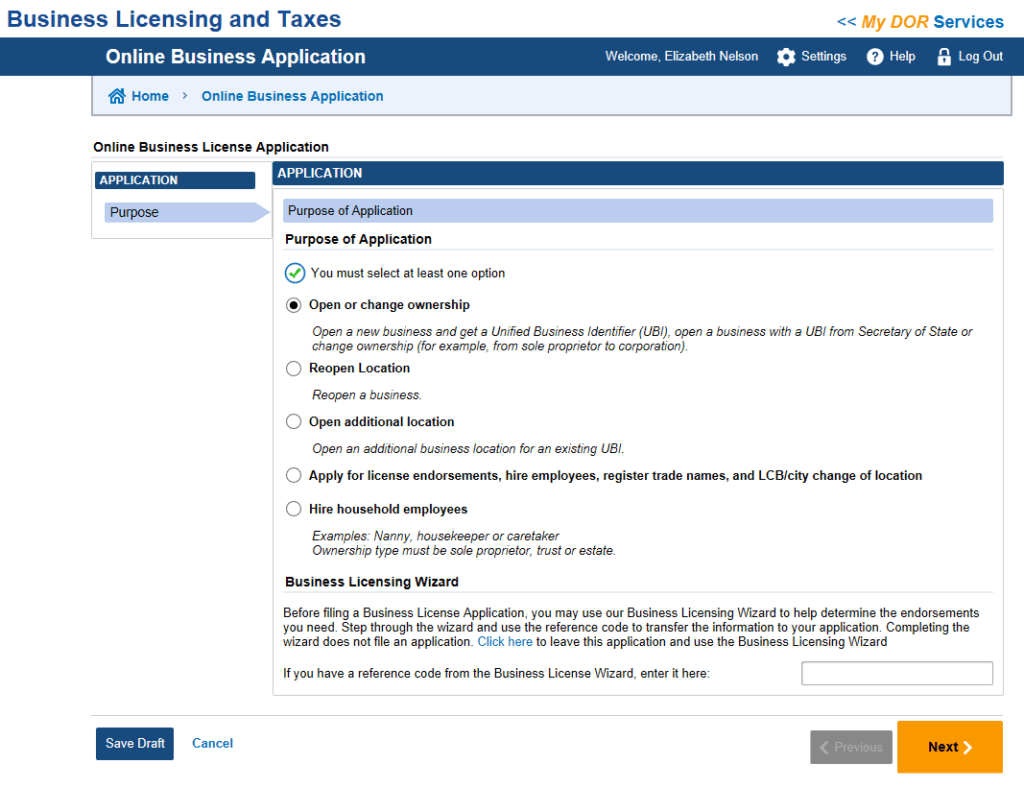

Step 3: Complete the Washington Online Business License Application

There’s a fair amount of information to have ready for this step, but other than that the application is quite easy.

Business Information

On the first page of the online business license application, select the purpose of your application. In this tutorial we’ll assume that this is an application for a new business that won’t hire employees and doesn’t require any special licenses (e.g. liquor, cannabis, cigarettes).

In later pages of the application you’ll need to enter the following information about the new business:

- The business’ name

- The type of ownership (for example, “LLC”)

- The country and state of formation (for example, “United States” and “Washington”)

- The Washington UBI number (assuming the business already has one)

- The formation date (assuming the business is operating as an LLC or corporation, not a sole proprietorship)

- The federal EIN

All of the information above but the last bullet point comes from filing articles of formation with the Washington Secretary of State’s office. The last bullet point comes from filing an online EIN application with the IRS.

Location Information

You should also be prepared to enter the date you’ll begin business operations in Washington State, a business phone number, an email address, an estimate of your annual gross receipts in Washington State, and a description of what your business does.

Be prepared to answer the following questions about your new business:

- Did you buy, lease, or acquire all or part of an existing business?

- Did you purchase/lease any fixtures or equipment on which you have not paid sales or use tax?

- Is this business owned by, controlled by, or affiliated with any other business entity?

- Are you changing your business structure (such as changing from sole proprietorship to corporation) and want to close the old account?

- Have you ever owned another business?

If you plan to use a trade name (i.e. a “doing business as” or “DBA” name), have that name ready, too. And have an address ready for where your business will be physically located in Washington State.

As part of the application, you’ll need to decide whether or not you want to opt in to workers’ compensation coverage as an owner. If you’re unsure whether you want to or not, then this would be a good question to ask a labor law attorney or a financial advisor.

Finally, have ready the first and last name of each governing person of the business. (For an LLC or a corporation, this information should match what’s been provided to the Washington Secretary of State about your business.)

City Licenses

Many local governments in Washington state require their own, additional business license. Some of these localities allow you to apply for their local business license as part of the same online application as your state-level license. Other local governments (such as the City of Redmond, where our CPA firm is located), have their own application system for business licenses.

If your city allows you to apply for their license through the state’s online business licensing system, you’ll add those licenses to your application in this step.

Specialty Endorsements

These are special licenses that most businesses don’t need to worry about. The Washington Department of Licensing has a comprehensive list of special business licenses available here.

Step 5: Pay the fee

The standard business license fee as of this writing is $19. If you have additional trade names or special licenses as part of the application, then the fee may be higher.

Step 6: Complete any additional local business licenses, if necessary

Like we mentioned above, many local governments use their own business licensing systems instead of the state Department of Revenue’s system. Check the licensing requirements for any city or town you plan to conduct business in and see if they require your business to be licensed.

What do I do after I’ve filed my state and local business license applications?

The Washington Department of Revenue might take up to 10 days to process your business license application. After they do, you’ll receive a letter in the mail that looks like this—save this letter for your records.

Depending on your situation, forming your entity, obtaining an EIN, and obtaining state and local business licenses might be all the paperwork you need to form your business. However, some businesses will want to take the following next steps:

Choose an Accounting System

Unless your business is very small scale, you’ll benefit from using a real accounting system sooner rather than later. We have some free articles on this blog on choosing an accounting system here:

- What Sort of Accounting System Does a Small Corporation Need?

- Accounting System Recommendations for Novice Bookkeepers

- Should You Use QuickBooks Self-employed?

- Tax Deduction Receipts

Make an S election

This is probably something you should do after consulting with a knowledgeable professional. However, we have some free articles on this blog explaining the benefits of S status. See, for example:

- C Corporation vs. S Corporation: A Short Primer

- What Are the Advantages of an S Corporation?

- The Million Dollar S Corporation Mistake

- Little Known Benefits of an S Corporation

Set up Payroll

Not every Washington State business has employees, but any business with employees (including shareholder-employees of an S corporation) needs to set up payroll. We have a blog post that explains how to do that here: Washington Small Business Payroll Setup Tips.

We also have this article explaining why we think full service payroll products are the best option for most small businesses: Why Small Businesses Should Outsource Payroll.