The numbers keep getting better.

The numbers keep getting better.

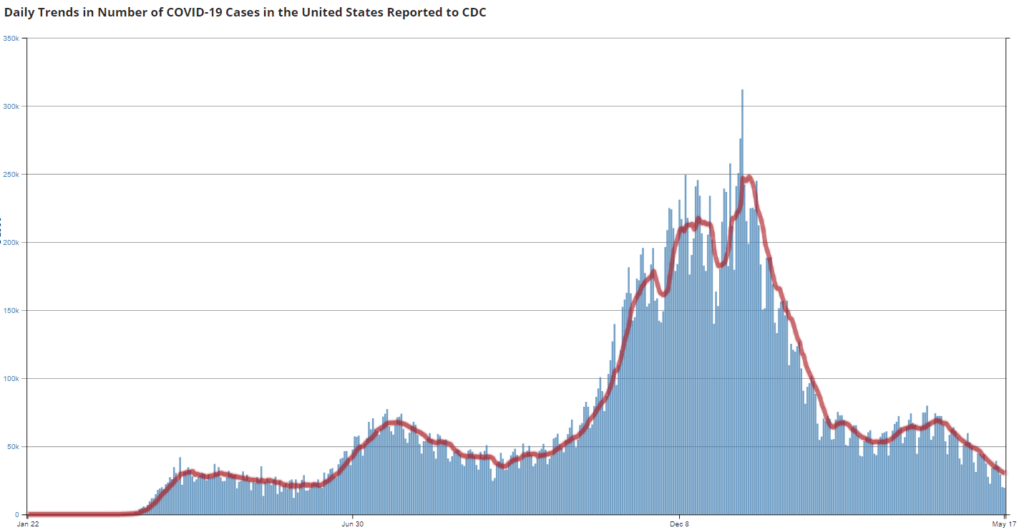

Cases, hospitalizations and fatalities have collapsed in the U.S. since the beginning of the year.

In the U.S., we no longer look for a light at the end of the tunnel. We are moving out of the tunnel.

But the pandemic ending—or more accurately, the end of local and regional epidemics across much of the U.S.—isn’t just good medical news.

The pandemic ending means small businesses need to quickly adapt to a new post-pandemic economy.

This blog post shares thoughts about this post-pandemic economy and small businesses.

Tip #1: Understand Competitors May Be Ahead

A first comment—which isn’t something to freak out about—but rather something to know: Competitors may be ahead of you on this. But let me explain.

The collapse in cases, hospitalizations and fatalities? That’s been apparent to some owners and managers for weeks or even months.

The line chart below—which comes from the CDC data tracker—shows Covid-19 cases in the U.S. since the beginning of 2020. And many scientists and mathematicians were saying even before the peak in cases at the year end that infections would or were collapsing. (See our earlier blog posts here and here for the names of those folks.)

Now obviously people disagreed. One could often read news coverage earlier this year that suggested the pandemic was worsening. In February 2021, for example, one particularly popular pessimistic prognosticator said we still faced a “category 5 hurricane.”

But the point isn’t that the collapse was 100% certain. Even if the collapse looked mathematically likely.

Rather, the point is smart executives and savvy entrepreneurs included that “pandemic ends soon” scenario in their planning.

At this point, those foresighted managers and leaders have already responded. And you and I don’t want to get left behind.

Tip #2: Stay on Top of Local Guidance

A first concrete step you can take? And starting right now? Get disciplined about staying on top of state and local guidance.

Public health policies will change as things get better. Restrictions will end in your markets if they haven’t already. You want to be ready to respond quickly.

Already in online social media networks, you can see people talking about businesses quickly adapting to and recognizing the newest guidelines.

Example: You can find people saying they will shop someplace like Costco or Wal-Mart (which nearly immediately updated in-store policies for new CDC guidance related to vaccinated customers). And those customers will in effect indirectly penalize Costco and Wal-Mart competitors who delay.

By the way? I think you might choose to lose vaccinated customers to quick moving competitors. Maybe you serve customers who often can’t get vaccinated, for example. But you’d want to consciously make this decision. Ideally for strategic reasons.

Tip #3: Watch Your Supply Chains

A quick caution: you want to stay alert to the possibility your supply chains break or get stuck as the economy restarts.

CPA firms, for example, buy lots of technology products. So tons of hardware and software.

And one of the things we’ve noticed? You can’t quickly buy computers right now. (The order wait time runs months.)

And then the bigger point: Other stuff you and we need? We may experience the same supply chain problems.

Even things like retailers changing hours or consolidating outlets can really change the way we all need to operate going forward.

Tip #4: An Awkward Comment About Quality

So something internal to be aware of… and gosh this is awkward…

Quality problems with both services and products seems to be growing. That’s based on largely anecdotal evidence. (Which, yes, you should suspect…)

But working from home, burdened by restrictions, struggling through supply chain glitches? Yeah, this sort of stuff seems to push down product and service quality.

Probably customers and clients will just need to accept this. At least for a little while.

But you and I need to work diligently to prepare customers or clients for quality reductions. And then work diligently to return to earlier quality standards.

Example: An area where professional service firms have unfortunately reduced quality? Turn-around times. Many of us have struggled mightily to deliver in our usual timeframes. We need to get better, soon as we can. And we need to keep customers and clients informed in meantime.

Tip #5: Plan for Possible Labor Shortages

You would think workers are widely available. Nearly a third of small businesses appear to have closed according to Opportunity Insights’ Track the Recovery website.

The ten million small businesses who possibly closed presumably employed workers who should now need employment.

But one reads news reports that suggest regional labor shortages are stalling small businesses reopening or are pausing growth.

Example: Prior to the pandemic, we were often able to advertise a job opening online and get dozens of applicants within a few hours. The last time we did this, however? Four applications.

Tip #6: Keep Eye Out for Inflation

Former Treasury Secretary and Harvard Economist Lawrence Summers warns significant inflation is underway.

Whether Secretary Summers is right or wrong? Who knows. (I would bet he is, in case you’re interested.) But maybe the actionable point is, we want to consider the possibility that inflation unlike anything we’ve recently seen may become a “thing” over the next few years.

You and I therefore don’t want to be in a situation where we lock in flat or even just stable prices for customers but then need to buy production inputs that continually increase due to inflation.

Tip #7: Consider Sustainable Growth

A final caution: In many business categories (for example, food, accommodation, some brick and mortar retailing) firms got really beat up by the pandemic.

Overall, small business revenues declined by about 30 percent according to Opportunity Insights.

If you’re in the group that got beat up, you need to assess if you have enough working capital on your balance sheet to resume normal operations.

You may need to secure new funding. Or start slow and re-build your working capital by reinvesting profits.

Tip: If you were right-sized in terms of working capital before the pandemic, in the post-pandemic economy, you’ll probably need to have that same working capital to operate comfortably.

Two Final Comments about Post-pandemic Economy

The pandemic is over many places in the U.S. That’s really good news!

But that means for many small businesses, a big new challenge appears. Restarting operations and returning to a normal.