Over most of the last year, we’ve talked a lot at this blog about economic uncertainty and the Covid-19 pandemic.

Over most of the last year, we’ve talked a lot at this blog about economic uncertainty and the Covid-19 pandemic.

As you maybe know, the popular Paycheck Protection Program requires borrowers to certify they face uneconomic uncertainty due to the Covid-19 pandemic in order to get a PPP loan.

But as a new round of PPP lending ramps up, small business owners ought to reexamine the issue of economic uncertainty. The landscape looks much different today than it did back when all this started. And that change may play into whether a firm qualifies for a PPP loan. Maybe even a second draw PPP loan. Further, the changing landscape should factor into every firm’s business planning.

In particular, six issues stand out. Especially for folks who maybe haven’t had the chance to keep up with the Covid-19 research and the steady drip-drip-drip of pandemic-related data.

Widespread Infection in the United States

For example, a first important point for most small business owners to consider. The number of infections, according to reliable sources, greatly exceeds the number of confirmed cases.

Usually, you and I see or hear reports about confirmed cases. But the CDC estimates the actual number of infections runs four to five times the number of confirmed cases.

The CDC estimates that roughly 83 million Americans had been infected with Covid-19, for example, by December 31, 2020. (This information appears here, Estimated Covid-19 Burden. And I’ve copied and pasted a picture below.)

At the time I’m writing this in late January, confirmed cases run about 25,000,000 in the United States. Applying that same ratio of four or five infections for every confirmed case, then, we’re talking 100,000,000 to 125,000,000 infections.

The population of the United States equals about 330,000,000. So roughly a third of us have already been infected.

And the actionable insight here? Surely small business owners, in thinking about Covid-19 economic uncertainty, want to consider the strong possibility that a giant chunk of the population (including customers and employees) has already been infected. And also consider that that chunk grows larger every day…

Note: In the first version of this blog post, I referenced another document, CDC planning scenarios, which uses a higher ratio of infections to cases. The Estimated Covid-19 Burden document, however, appears to be the more up-to-date source.

Herd Immunity Closer Than Many Guess

A related point to mention, again in the context of economic uncertainty and your small business.

The herd immunity threshold we’ve all heard so much about? We may be closer to that than people guess. Especially when you consider both the immunity we receive from infections and from vaccinations, which I’ll talk about in a minute.

The CDC planning scenarios document just mentioned, for example, provides the R factors, or R values, that allow public health officials to estimate how many people someone infected with Covid-19 infects. The best guess scenario gives an R factor of 2.5. Which is the same thing as saying on average someone infected with Covid-19 infects 2.5 other people.

The other planning scenarios use R factors of 2 and 4.

And what’s interesting—at least to a small business owner thinking about economic uncertainty—is these R factors let you and I estimate roughly the herd immunity threshold using this simple formula:

1-1/R

You can use this formula, for example, to estimate herd immunity thresholds for the CDC planning scenarios’ R factors, as shown in the table below:

| R factor | Herd Immunity Threshold |

| 2 | 50% (or roughly 165 million in U.S.) |

| 2.5 | 60% (or roughly 198 million in U.S.) |

| 4 | 75% (or roughly 248 million in U.S.) |

But scientists argue about the actual herd immunity threshold. The real world shows more complexity and fluidity than this simple formula reflects.

As noted in earlier blog posts, one peer-reviewed study says Covid-19 herd immunity may run around 43%. (Article here: The disease-induced herd immunity level for Covid-19 is substantially lower than the classical herd immunity level.)

Another study (not yet peer-reviewed but widely discussed) estimates that herd immunity thresholds might run more like 10 to 20 percent (Article here: Individual variation in susceptibility or exposure to SARS-CoV-2 lowers the herd immunity threshold.)

Scientists seem to agree you can use the simple herd immunity formula to determine herd immunity thresholds from vaccinations. They don’t agree that same simple formula works for infections-based herd immunity.

In any case, the point you and I can take away, in terms of economic uncertainty. The end of this pandemic may not yet be visible… but it may be just over the horizon. Certainly well within the time frame we “business plan” for.

A Sidebar about Natural Herd Immunity

One tangential note about natural herd immunity: Depending on how closely you’ve followed the Covid-19 news, you may recall policy makers, scientists and physicians arguing that herd immunity from infection wouldn’t work. (See here, for example: Herd Immunity is a Dangerous Strategy.)

If you reread or revisit those commentaries now, however, you see that those folks were often really saying herd immunity wouldn’t work except with catastrophically high fatalities.

The terrible reality here? We’ve had catastrophically high fatalities.

About 400,000 family members, friends and neighbors—often those most vulnerable in our communities—have died.

Over the next few weeks, predictions say, we tragically will lose another mind-numbingly large number of people.

Understand I’m not suggesting we rely on natural herd immunity going forward as a strategy. (I don’t know that anyone suggested that.)

Rather, the high community spread of the last few months has plausibly resulted in, tragically, the very scenario people worried about. Further, when one combines natural immunity with vaccinations, yeah, we’re close enough to herd immunity to incorporate its effect into our business plans.

Infection Fatality Rates and Age-related Risk Gradient

In the beginning, the first reports of infection fatality rates appeared apocalyptic.

People who closely follow such things may remember that early World Health Organization reports implicitly suggested a 3 percent to 4 percent infection fatality rate.

You can still read media accounts that seem to suggest this. (The error the writer usually makes when reporting this? He or she compares deaths to confirmed cases, thereby ignoring the infections that aren’t ever laboratory confirmed.)

But here’s what the CDC estimates for infection fatality rates. This table comes from that CDC planning scenarios document I’ve referenced a couple of times already.

Make sure you understand how those decimal values work.

If you look at the current-best-estimate scenario, for example, you’ll see that the infection fatality rate equals 0.00003 for people in the age group 0 to 19. That 0.003 percent infection fatality rate means Covid-19 fatalities for that age group run roughly 1 out of every 33,333 people who catch the virus.

In comparison, if you look again at that scenario, you’ll also see that the infection fatality rate equals 0.054 for people in the age group 70 and older. That 5.4 percent infection fatality rate means Covid-19 fatalities for that age group run roughly 1 out of every 19 people who catch the virus.

You can make calculations for other age groups, too. But I think an actionable insight falls out of the variability in infection fatality rates.

That insight? The steep increase in risk related to age may be a factor in how much economic uncertainty a small business faces.

The case for closing schools and childcare facilities, for example, surely weakens as policy makers and parents grow to understand the extremely low risk for children. And that may be good news and lessen uncertainty for some business owners.

And then obviously, small businesses serving older customers or employing older workers face extremely high risk—which small business owners want to recognize and plan for. Surely that higher risk creates higher economic uncertainty.

Vaccination Counts Snowballing

As I write this, Covid-19 vaccinations in the U.S. probably total about 22 million Americans. And the daily vaccinations run about 800,000 to 900,000 a day.

The incoming Biden administration plans to bump the rate to 1,000,000 a day for its first 100 days.

This volume of vaccinations should dramatically reduce economic uncertainty over the next few months.

The vaccinations appear to provide remarkable protection. Better than 90 percent, for example, in the cases of the first two vaccines available, Pfizer and Moderna. And as a planning matter, that protection exists a few days after the second dose.

By the way? Be sure to combine the effectiveness of vaccines with the age-related risk. When you do that, you can see that as communities vaccinate those most vulnerable, fatalities and hospitalizations should shrink massively. And those positive changes should help communities restart and economies rebound. (As I write this, the CDC reports that nearly 2.6 million vaccination doses have been administrated in long-term nursing homes–a feat that may save one or two hundred thousand lives.)

Finally, when you think about herd immuity thresholds, remember to combine the 100 million plus people who’ve been infected with the 100 million people who will soon get vaccinated. Both infection and vaccination can produce immunity.

Supply Chain Risks

Two final comments about Covid-19’s impact on small businesses.

First, note that the pandemic’s lockdowns, restrictions and reductions in consumer demand have destroyed millions of small businesses.

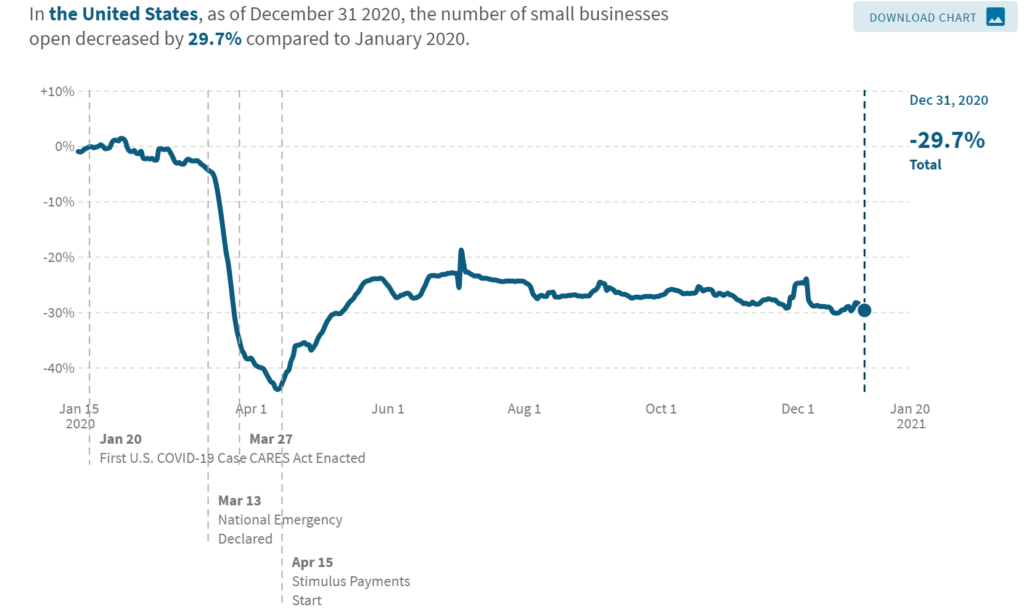

The tracktherecovery.org website estimates that nearly one in three small businesses has closed (see chart below). That’s six, seven, maybe even eight million small businesses.

If your firm relies on small businesses as suppliers or customers, therefore, think through how these small business closures affect your operations.

You may have lost, or may soon lose, customers or vendors. Or your supply chain partners may have lost them.

You may need to identify these broken links and work to repair or replace them.

A related thought, too. Even if your supply chain miraculously emerged unscathed, probably you want to think about either shortages in services and goods or price increases.

A crazy example here to show you how I think we ought to think: If your firm or organization usually sponsors a fall holiday party? I think you not only make plans now to have the party. I think you make a reservation and pay a nonrefundable deposit to lock in your event.

Re-inflating Balance Sheets

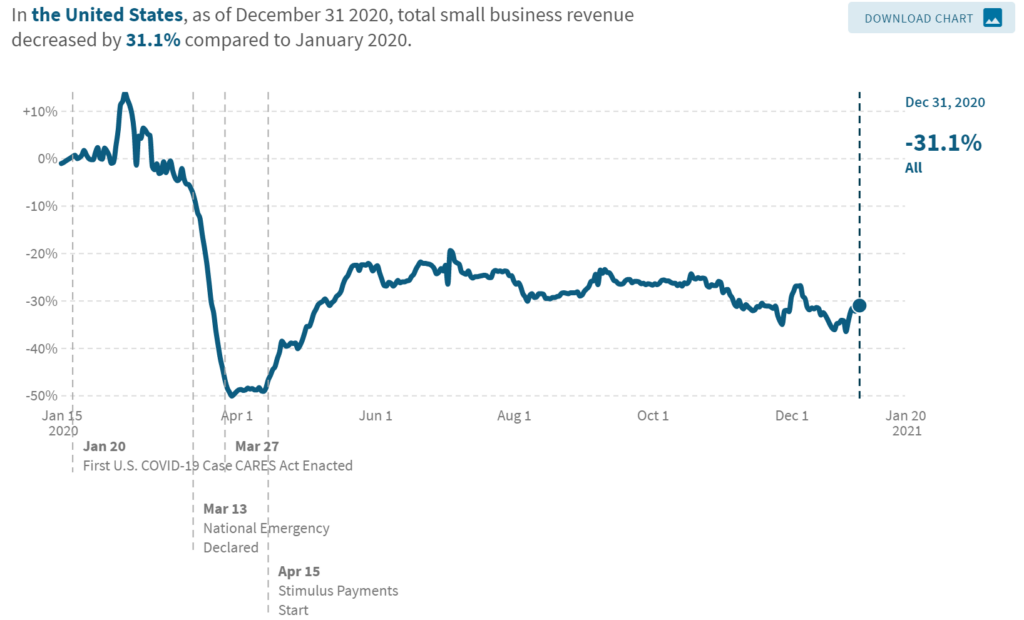

And then another related comment—also sparked by the data available from the Track the Recovery website. On average small businesses saw their revenues shrink by nearly a third over the months of the pandemic (see chart below). And I think you need to consider this angle when you think about economic uncertainty.

Those revenue shortfalls probably mean you made less money. Maybe even lost money. You know that. But the other more hidden damage here: The revenue reductions probably shrunk your balance sheet.

If you started the pandemic with, say, $100,000 of working capital, your shrinking balance sheet may now show only, say, $25,000 of working capital.

And the challenge is, your now smaller balance sheet won’t support you ramping up your sales to your old levels until you re-inflate your balance sheet. Which creates uncertainty of course. And also amounts to a financial puzzle many small firms will have to solve.

Final Words on Covid-19 Economic Uncertainty

The upshot of all this? At least in terms of thinking about economic uncertainty and your small business plan and PPP loans?

The economic environment your firm faces might look very different in the coming weeks and months.

Much, maybe even most, of the news counts as good. Which is weird to point out given the destruction and distress of the last year. And that good news reduces the economic uncertainty.

But some of the news is still pretty terrible. And lots of folks need our support and help.

All of the above creates a requirement to carefully plan for the changes that surely arrive in the coming months.

Other Resources

As an example of how sentiment has changed over the last few months, see the blog post we published late last spring about the economic uncertainty safe harbor: PPP Certification and the New Safe Harbor.

We’ve got blog posts that supply more information on second draw PPP loans, PPP loan increase amounts, and calculating whether a firm qualifies for a PPP loan.

For more detail about Covid-19’s impact on small businesses—and sorry it’s a long gritty post—you can check this out: Post-Pandemic Covid-19 Small Business Planning.

Very thoughtful and insightful article. Thanks!

Thank you for feedback. It’s a tricky subject to write about. And to read about.

Re PPP. If you have a C Corp. The company grossed 120,000. Expenses were $37,000 plus $20,000 paid to owner. The profit of $63,000 was also paid to the owner for

a previous years loan from the owners personal account. Am I using $20,000 or $83,000 as my income?

The wages paid to the owner count as payroll that plugs into the PPP formula. Not a loan repayment.

Some more comments on herd immunity… not from me (I’m a CPA) but from an epidemiologist to whom I forwarded your very interesting article.

I would say that “natural herd immunity” is a bad strategy for more reasons than you mentioned.

People can and have gotten Covid twice.

Immunity from a infection seems significantly worse than that from the mRNA vaccines.

More spread means more opportunity for novel variants that may be worse and even evade the vaccines.

“Natural herd immunity” isn’t even a thing really. I can’t think of a single infection that has died out because it infected too many people. We will never reach natural herd immunity for measles for example (which you actually do only get once), let alone the flu. It’ll just become endemic and just kill and hurt people more slowly.

I’m not sure we disagree here. But FWIW, I’m using the textbook definition of herd immunity. E.g., a definition like that shown below from Oxford dictionary:

So, it’s not a “strategy” at all. I tried to be really careful and not say that. Because I know it’s easy to think when someone uses the phrase “herd immunity” that they mean something else.

I wonder if your friend was thinking I’m suggesting herd immunity is a way to avoid vaccinations? Or to painlessly “power through the pandemic”… because as I tried to make clear above, I absolutely do not think either of those things! Yikes!

And the planning point is, the Oxford dictionary definition may change the way communities deal with the infection. And that change in turn impacts things like economic uncertainty and the timing of communities and local economies “restarting.”

E.g., maybe kids go back to school. Or churches can reopen. Or people can spend holidays with families and friends. Or my real concern small businesses reopen and people get their jobs back.

BTW thank you for your comment. It’s really good to have an opportunity to discuss this.

All good comments. Thanks for your thoughtful insight.

🙂

Incredible post.

If I were a small business owner, my firm would be Nelson CPA, even if my business wasn’t in the Seattle area.

Eldon Holl

CPA (Ret)

🙂

P.S. Eldon, remind me again whether you prefer your check sent to your home or directly to your bank?

I’m in one of the areas that is still severely restricted (portland, or) so it’s an easy proof for me that my small business is heavily affected. My client hrs are down more than 50% at this point and there is no sign of small business recovery here, which is what I would need to increase billable hours. I’d worry more about it if I lived in an area that is ‘open’ for business though. It would be an awfully hard thing to try to prove under audit, one way or the other. 😛

Having said that, I have several clients that are technically able to apply, (invoices bunched in alternate quarters rather than spread evenly through the year provide an exaggerated drop over quarters) and are doing so but it worries me. If you apply for a second PPP… but have record breaking profits in both 2020 and 2021 it seems like something would flag that for audit, at least on the second draws.

I don’t know. Right now it just feels like a free for all. Or a buy-now-pay-later for all.

I agree with you Morgan that just because you make the 25 percent reduction formula work, the economic uncertainty requirement should still apply.

I also assume folks will be able to see who applies and the details. As for first draw loans. And you wonder if there isn’t some downside to advertising you’ve been beat up. I mean, I guess people will know that’s happening to some folks. Restaurants, for one. But I’m not sure you want your competitors to know you’re down.

I guess the question is: If someone is eventually audited, how do they prove you were NOT uncertain? And even if they do, is there actually an established penalty? SIGH.

Good question. And I’ve suggested people collect documentation from sources dated around the time they apply that support the uncertainty position.

Also remember that if borrower’s loan small-ish, there’s sort of an automatic presumption of economic uncertainty. We’ve talked about that before. It applied to first first draw loans. And maybe to the newest wave of PPP loans too.

I can’t comment since I haven’t heard or seen it yet.

I think you hit on some really good points about the impacts of Covid on economic certainty (or lack thereof). It’s hard to make plans as a small business when you’re not sure what the future holds, but there’s always some hope to hold onto.