I got some sad news last week. A friend, actually another small business owner, had finally reached the breaking point. He had found he was working harder and harder but making less and less. His business, as he told me, was broken. He was giving up.

I listened and nodded with sympathy. And then I started thinking about the pickle he finds himself in. And what I realized was his situation is not unique for a small service business.

His (terrible) situation often becomes the final resting place for small service businesses that make a couple of easy mistakes and then experience a bad break or two.

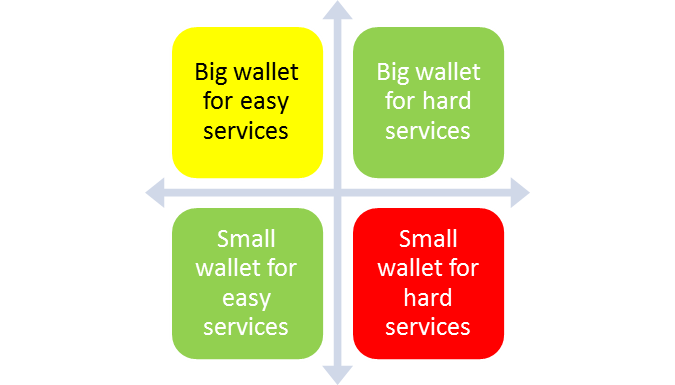

In fact, a simple infographic probably explains why this small business owner is burning out in his small service business using two axes (see below). A vertical axis plotting your clients’ and customers’ ability or willingness to pay for services. And a horizontal axis plots the ease or difficulty of providing those services.

Note: I’m calling clients and customers with a willingness and ability to pay “big wallet” clients and those who lack such willingness and ability “small wallet” clients. I’m using the label “easy services” to refer to those services that you can provide at low cost or with easy effort and the label “hard services” to refer to those services that require lots of effort or that make you deal with lots of complexity.

Here’s the interesting thing about creating an infographic like the one shown to size up my friend’s operation (or my operation, too). When one thinks about the services a business provides or the clients and customers it serves using a simple graphic like that shown, one can see how a service business (especially a small one) becomes a terrible grind–and a role you wouldn’t wish on anybody you care about.

The big takeaway? You can only make decent coin and work in a balanced way when your pricing matches your services.

For example, do you (or do I) want to be a high-end service provider? Great. That’s a great strategy. But we need to be able to provide that service to clients willing to pay for high-end services. Restated in using the labels of the earlier graphic, we can provide hard services… but only to big wallet clients.

And yet what happens to many service business, or at least many small service businesses is that you or I end up providing these “hard” services to small wallet clients. These people, afterall, often aren’t being served by your competitors… And especially when you’re starting or growing your business, these people do keep staff busy and contribute revenue.

But here’s the problem (hopefully): Eventually we want to make a fair living and want to work in a balanced way. And there’s probably no way to do that by serving hard services to small wallet clients.

Only Two Quadrants Provide Long-term Profit Potential

In fact, only two quadrants or spaces offer you or me long-term profit potential and reasonable work-life balance.

You or I can provide easy services to small wallet customers. Or we can provide hard services to big wallet customers. (These are the green quadrants shown in the graphic.) But that’s it. Only two quadrants offer the promise of stable long-term profits and work-life balance.

Red Quadrant Businesses Easy (and Dangerous) to Grow

Accordingly, you and I need to avoid the red quadrant–the “hard services for small wallet prices” space.

This niche represents the heart attack quadrant. The only way to make a decent living in the red quadrant (if you want to call it a living) is by working tons of overtime.

Targeting the red quadrant truly becomes a killer business strategy for the small business owner. And I don’t mean that in a positive way.

Yellow Quadrant Signals Caution

And let me also make a quick tangential aside. No immediate problem exits with working in the yellow quadrant where you or I sell easy services to big wallet clients or customers.

I have a hunch that there aren’t that many prospects in this space. But even if you or I can build a business in the yellow zone, I sense we need to proceed with caution. It seems unlikely to me that we can experience a long term success in any business that’s built on providing easy services to big wallet clients and customers.

We’re in a strategically weak position if the client or customer can buy the same service someplace else for a better price. Or if the client or customer can buy a better (or hard) service for the same high price.

Two Reasons for Optimism

If you are already working in a death march service business, the realities hinted at in the simple graphic above can discourage you. But I don’t think that’s the point one should take away from this sort of analysis. No way.

First of all, nobody with a small service business has a totally green, yellow or red quadrant business. We’ve all got services and clients in each of the quadrants. In fact, some of my favorite clients and most fulfilling services have been solidly red-quadrant. (One does need to limit how much of this work one does…)

Second, and this is so obvious as to almost not merit saying out loud, but what should make a big difference in profitability and satisfaction is reducing the number of red quadrant services and customers and adding more green quadrant services and customers.

Fortunately you and I have the ability to do this. We do control both our pricing and the services we provide. This should mean that we can choose not to provide hard services to small wallet clients… And maybe even easier, we can focus on adding green quadrant clients and customers and green quadrant services.

A Final Comment of Clarification

I want to close by sharing a final hopefully useful comment.

Though the earlier graphic shows two quadrants as profitably green, some pretty good research indicates that working in that upper right quadrant (hard services to big wallet clients or customers) more naturally leads to business success than working in the lower left quadrant. Perhaps the most recent objective discussion of this trade-off appears in Michael E. Raynor’s and Mumtaz Ahmed’s book, “The Three Rules: How Exceptional Companies Think” (Portfolio 2013).

But earlier business researchers have also pointed to the power of prospecting in what the earlier graphic shows as the “hard services for big wallet customers” quadrant. The former Purdue business school professor Arnold C. Cooper, for example, pointed this out in 1990 in an NFIB publication, “New Business in America.”