In recent blog posts, I’ve pointed out some flaws I see in the Mr. Money Mustache and Bogleheads philosophies for preparing for … [Read more...] about Small Business Entrepreneurship Better than Bogleheads or Mr Money Mustache?

management

Why File Out of State Tax Returns

Can we talk about something that’s a little bit awkward for small business owners? Specifically, can we discuss the “why file out of state tax … [Read more...] about Why File Out of State Tax Returns

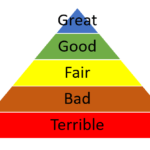

Small Business Profitability: From Terrible to Great?

I've been binge-watching David Rubenstein's excellent TV show where he interviews news makers. And let me say that if you haven't seen the show, check … [Read more...] about Small Business Profitability: From Terrible to Great?

Portfolio Leverage Modeling with cFIREsim and FIRECalc

I’m slightly hesitant to talk about modeling portfolio leverage. The topic, in terms of personal safety, sort of resembles a discussion about how to … [Read more...] about Portfolio Leverage Modeling with cFIREsim and FIRECalc

Quick and Easy Small Business Fringe Benefits

Need a small business fringe benefits package to attract and retain good employees? Hey, me too. But it’s tough, right? We small business owners … [Read more...] about Quick and Easy Small Business Fringe Benefits

Business Education Deductions

A couple of times recently, I’ve talked with taxpayers about their business education deductions. And they have questions. Some small business … [Read more...] about Business Education Deductions

Asset Allocation for Small Business Owners and Entrepreneurs

In an online forum the other day, a long-time member advised someone to ignore their small business when considering their asset allocation. No one … [Read more...] about Asset Allocation for Small Business Owners and Entrepreneurs

Buying a Small Business: Tips and Tactics

I don't want to be negative about you buying a small business. Buying a small business can be a great option. But you need to be careful. Getting … [Read more...] about Buying a Small Business: Tips and Tactics

Small Business Net Present Value Analysis

Last week's blog post talked about how to calculate an internal rate of return for your small business investment returns. But you probably also want … [Read more...] about Small Business Net Present Value Analysis

Small Business Investment Returns Astronomical?

In this week's blog post, we're going to talk about small business investment returns. But if you read no further, please please take away this … [Read more...] about Small Business Investment Returns Astronomical?