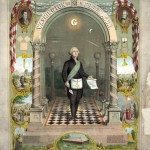

We probably all expect to get the truly great business insights from some Harvard or Stanford business school professor who has just completed … [Read more...] about George Washington’s Business Secrets

management

Paying Zero S Corporation Shareholder-Employee Wages

I stumbled onto an online forum discussion recently where participants were berating some new S corporation owner about paying zero S corporation … [Read more...] about Paying Zero S Corporation Shareholder-Employee Wages

How Taxes Kill Successful Businesses

A handful of times this summer, I’ve helped successful business owners with a surprisingly common problem: That problem being a tax burden that seems … [Read more...] about How Taxes Kill Successful Businesses

Accounting System Recommendations for Novice Bookkeepers

Small-business owners ask us all the time about how they should set up their accounting system. Accordingly, in our office, the accountants have … [Read more...] about Accounting System Recommendations for Novice Bookkeepers

Ben Bernanke, Scenario Planning, & Your Small Business

So this blog post is a bit schizophrenic. I want to do a quick book review of Ben Bernanke’s book The Courage to Act. Then I want to delve into the … [Read more...] about Ben Bernanke, Scenario Planning, & Your Small Business

Lessons from Liberty Tax Service, Part 1

A few weeks back, I attended a presentation for people interested in becoming Liberty Tax franchisees. A friend was thinking about the franchise, … [Read more...] about Lessons from Liberty Tax Service, Part 1

Inside Tips for WA Small-Business Owners Using the SHOP Exchange

This is the time of year when small business owners often need to work with the Washington State SHOP Exchange. For this reason, I thought it'd make … [Read more...] about Inside Tips for WA Small-Business Owners Using the SHOP Exchange

Why Small Businesses Should Outsource Payroll

Winston Churchill, apparently quoting some unknown earlier writer, once said, “Democracy is the worst form of Government except for all those other … [Read more...] about Why Small Businesses Should Outsource Payroll

The Rich Get Poorer: the Myth of Dynastic Wealth

In the recent paper, “The Rich Get Poorer: the Myth of Dynastic Wealth,” Robert D Arnott, William J. Bernstein, and Lillian J Wu analyze the arguments … [Read more...] about The Rich Get Poorer: the Myth of Dynastic Wealth

Form 3115 for a Cash to Accrual Method Accounting Change

Most small businesses use cash-basis accounting for their operations. And that makes sense. First of all, cash-basis accounting makes a firm’s … [Read more...] about Form 3115 for a Cash to Accrual Method Accounting Change