This week at the Evergreen Small Business blog we’re talking about the issue of a “retirement plan b.”

This week at the Evergreen Small Business blog we’re talking about the issue of a “retirement plan b.”

The week started, for example, with a post that explains why you may need a plan “b” even if you’ve got a great plan “a.”

Yesterday, today and tomorrow, the blog provides short instructions for using three popular online tools to come up with the scenario you need to create a “plan b” for.

Today’s post, for example, talks about how to use the cFIREsim tool.

Describing Your Retirement Savings Program with cFIREsim

The cFIREsim tool does a great job simulating the draw down a retiree may experience in different circumstances. But the tool, for all its glorious power and flexibility, struggles a bit with retirement plan b calculations.

Nevertheless, you can make good robust retirement plan b calculations with cFIREsim. Further, cFIREsim is unusual as compared to FIRECalc and Portfolio Visualizer in that it gives you precise numbers for all the different retirement plan outcomes you may encounter.

To use cFIREsim for retirement plan b calculations, follow these steps:

-

- Open the cFIREsim home page using this link cfiresim.com

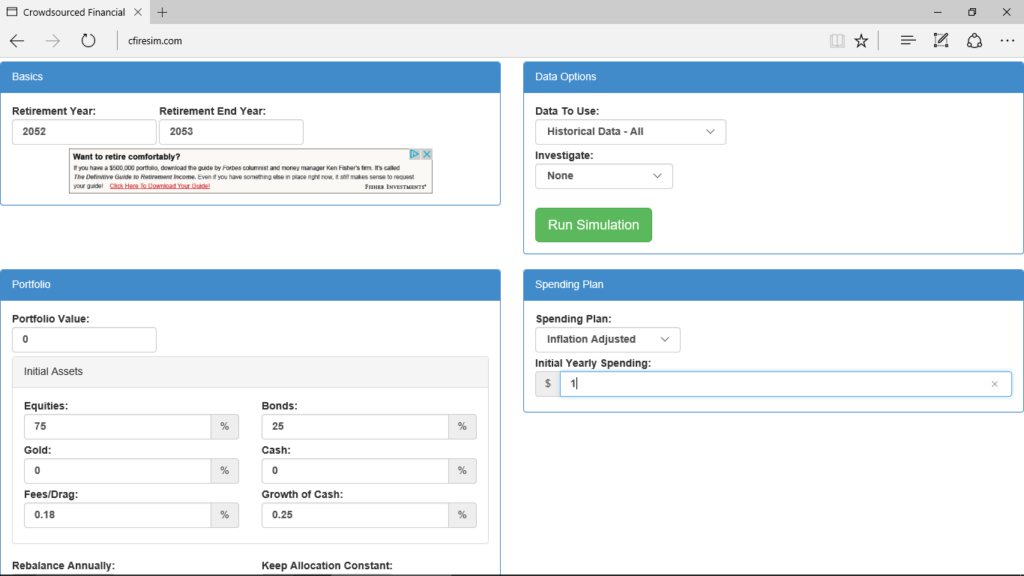

- Enter the future year at which point you stop saving into the Retirement Year text box (See Figure 1 which follows and click the image if you can’t read it).

- Add 1 to the value you entered in the Retirement Year text box and then enter this value into the Retirement End Year text box. (For example, if you plan to retire in 2052, enter 2052 into the Retirement Year text box and enter 2053 into the Retirement End Year text box. cFIREsim requires at least a year of retirement in order to work.)

- Enter your current savings into the Portfolio Value text box. (This amount might be zero.)

- (Optional) Adjust the values shown in the Equities, Bonds, Gold and Cash text boxes to match as closely as possible your asset allocation formula.

- Enter the value 0 into the Spending Plan – Initial Yearly Spending text box.

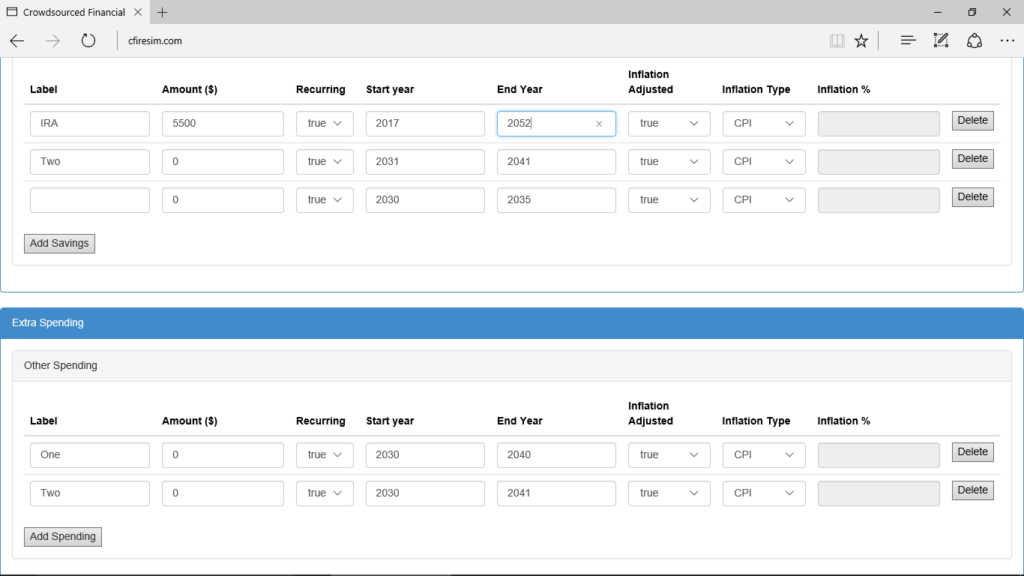

- Scroll down the cFIREsim web page until you get to the Other Income area. You need to use this area to describe your annual retirement savings (see Figure 2 which follows and be sure to click the image if you can’t read the inputs).

- Use the Amount text box in first row in the Other Income area to give the annual amount you’ll save. If you plan to save $5,500, enter the value 5500 into the text box.

- Use the Start Year and End Year text boxes to describe the first year and the last year you’ll save. For example, if you’ll save from 2018 until 2052 when you retire, enter the value 2018 into the Start Year text box and the value 2052 into the End Year text box.

- Click Run Simulation to have cFIREsim model your retirement savings plan.

Reviewing Expected Retirement Plan Outcomes

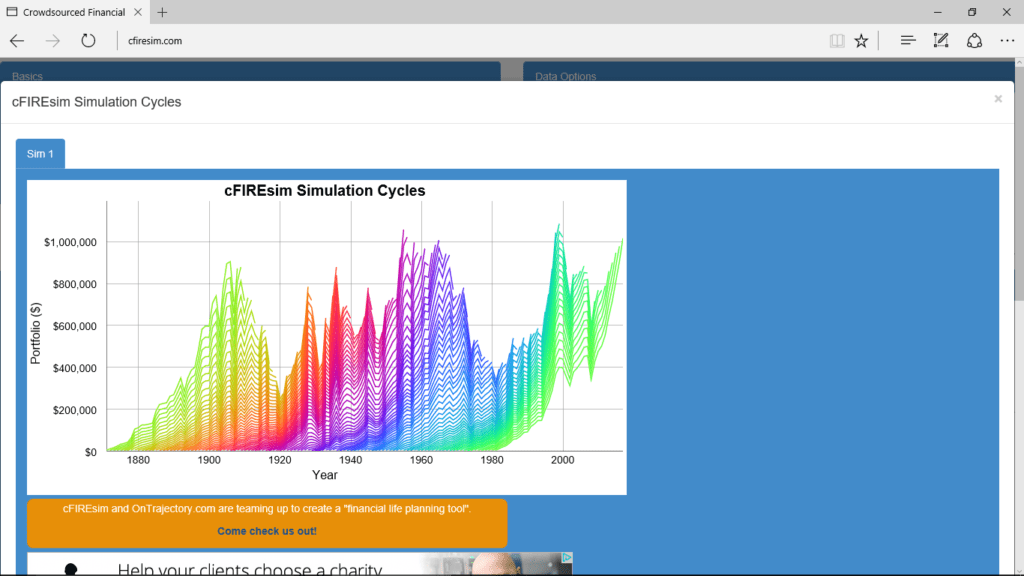

After you click Run Simulation, cFIREsim draws a line chart that summarizes the way your retirement savings grow if history repeats itself (see Figure 3 which follows… again click the screen shot to open a copy of a larger, more legible image).

Figure 3 This graph isn’t super helpful but if you look carefully at the lines drawn, you can see how your retirement plan would have worked at various points in time starting in 1872.

Tip: You can point to a value on the line chart and see the plotted value’s precise value. This does give you a way to see where your retirement plan would have ended up at various points in history.

To see precise retirement plan outcomes, and assuming you’ve installed a spreadsheet program like Microsoft Excel on your computer, click the Download Year-by-year Spreadsheet button which appears beneath the line chart area. (You can’t see this image in the screen shot just shown, but you can easily find it when you work with the cFIREsim tool for real.)

When you do this, cFIREsim creates a spreadsheet which provides all the numbers for every possible scenario including the final value for each of the scenarios. The spreadsheet labels this value as the portfolio.infAdjEnd, a cryptic field name which appears to mean “the Portfolio inflation adjusted ending value.”

Note: For the first blog post in this series, Retirement Plan B: Why You Need One, I used the cFIREsim spreadsheet to do the math.

Be forewarned, you’ll need to scroll around the spreadsheet a lot. The cFIREsim spreadsheet includes thousands of rows to show all the retirement plan outcomes. But the detail gives you a really rich picture of likely outcomes assuming the future looks something like the past.

And then critical final point: What those data points will prove is that you and I are very likely to find our retirement savings at the point we start retirement different from what the calculators calculate as the (apparently) expected value. Yikes.

Other Resources about Retirement Plan B

That’s all you need to know to use the cFIREsim tool to quantify what your retirement plan b needs to be able to handle. If you’re researching this whole topic, however, you also may be interested in these other recent blog posts:

$10,000,000 Individual Retirement Accounts and 401(k)s Really Possible?

Absurdly Good Retirement Outcomes: What Small Business Owners Can Learn From Public Employee Plans

Why You Don’t Need to Worry About Income Taxes During Retirement

By the way, if you don’t your retirement plan “a”, download a free copy of my “Thirteen Word Retirement Plan” available here.

By the way, if you don’t your retirement plan “a”, download a free copy of my “Thirteen Word Retirement Plan” available here.