Yesterday, the Small Business Administration provided a simpler forgiveness application for PPP loans of $50,000 or less.

The key simplification? A borrower ignores changes in employee headcounts as well as changes in salaries or wages.

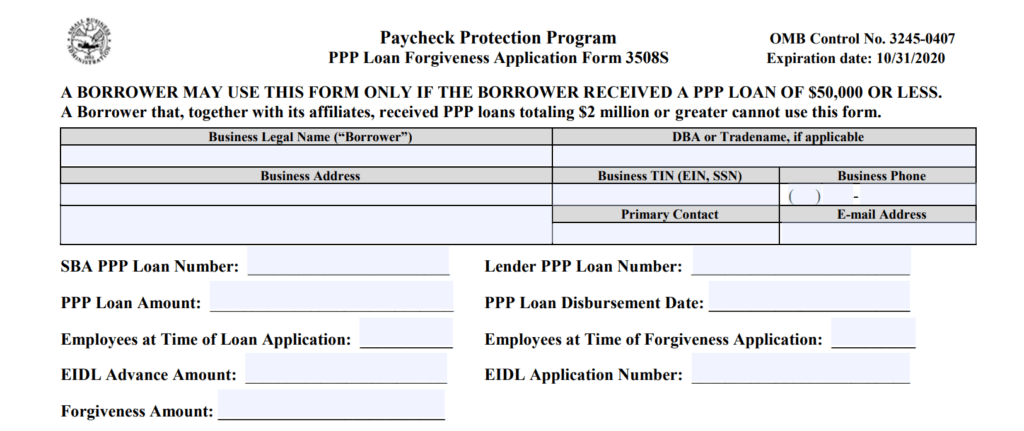

If you’re eligible to use the simpler PPP loan forgiveness form, you probably want to do so. The new 3508S application form makes things really easy.

Using Simple PPP Forgiveness Form

How easy, you ask?

Well, the form first asks for identifying information including your business name, contact information, tax identification number, and then the loan number and amount (see below.)

Then, the 3508S form asks the borrower to initial seven representations and certifications, including that the borrower:

- Isn’t asking for more forgiveness than the actual loan amount

- Used the PPP money for payroll costs to retain employees; business mortgage interest payments; business rent or lease payments; or business utility payments

- Spent at least 60% of the forgiveness amount on payroll

- Capped the owner payroll to the appropriate limit–probably the lower of either 2.5 months’ of 2019 compensation or $20,833.

Tip: You can grab a pdf copy of a filled-out form here: PPP-Loan-Forgiveness-Application-Form-3508S.

Only Hard Part of 3508S Application

The only hard part of the 3508S application? You still must collect and submit documentation of your spending.

For example, you’ll need to submit payroll documentation, such as reports from your payroll service, that shows you spent at least 60 percent of your PPP money on salary, wages, health insurance, state and local taxes and retirement benefits.

But if you have an outside service do your payroll processing? Yeah, that’ll be easy.

Let me note, too, that you’ll need to submit good documentation for the non-payroll costs you spent PPP money on.

For forgivable nonpayroll costs—mortgage interest, rent, and utilities—you’ll need receipts or cancelled checks. And you’ll need evidence—like a contract or agreement—showing your mortgage, rental agreement or utility services were in effect before February 15, 2020.

For a mortgage, you’ll also need a loan amortization schedule (to show the forgivable interest component of the loan payments).

Nitty Gritty Details on Nonpayroll Costs

Hopefully you won’t need to worry about nonpayroll costs. (I’ll explain why I say that in a minute.) But just because the documentation for nonpayroll spending is a little confusing, and some readers may need to include those costs, let me quote the actual instructions here for nonpayroll cost.

The 3508S instructions say that in order to include nonpayroll costs in the forgivable amount, borrowers need to supply “Documentation verifying existence of the obligations/services prior to February 15, 2020 and eligible payments from the Covered Period.”

Specifically, for mortgage and loans, a borrower submits a copy of the:

lender amortization schedule and receipts or cancelled checks verifying eligible payments from the Covered Period; or lender account statements from February 2020 and the months of the Covered Period through one month after the end of the Covered Period verifying interest amounts and eligible payments.

For rental or lease payments, a borrower submits a copy of the:

current lease agreement and receipts or cancelled checks verifying eligible payments from the Covered Period; or lessor account statements from February 2020 and from the Covered Period through one month after the end of the Covered Period verifying eligible payments.

Finally, for business utility costs, a borrower submits copies of:

invoices from February 2020 and those paid during the Covered Period and receipts, cancelled checks, or account statements verifying those eligible payments

Understanding the Covered Period Complication

One potential complication you can probably ignore: Borrowers who received their PPP loans before June 5, 2020 can look at spending over the eight weeks that follow funding of the PPP loan. (This is called an 8-week “covered period.”)

But most borrowers will want to use the standard 24 week spending window, or “covered period.”

A larger spending window makes accumulating enough spending to get full forgiveness easier.

The 24-week spending window probably means a borrower only needs to submit records from the payroll service. (The PPP loan provided roughly 10 weeks of payroll, which means businesses should have more than enough payroll spending within a 24 week window.)

Finally, if a borrower uses the 8 week spending window, the forgivable owner payroll drops to the lesser of 8 weeks’ worth of 2019 compensation for any owner-employee or self-employed individual/general partner or $15,385 per individual. (Compare this to the larger $20,833 limit for owners when a 24-week covered period.)

Final Thought on PPP Forgiveness Application

So here’s what I think you do if you borrowed $50,000 or less.

As soon as it’s been 24 weeks since you received your PPP money, apply for forgiveness. Probably you only need to submit the payroll reports from payroll service to show enough forgivable costs.

And that’ll let you get back to business.

Other Resources You May Find Useful

The 3508 PPP Loan Forgiveness Application Form and form instructions

Detailed information about what costs count toward forgiveness: The Paycheck Protection Formula Explained and Illustrated.

Also let me mention that we’ve blogged a couple of times about how to manage through the Covid-19 pandemic: Post-pandemic Covid-19 Small Business Planning (which also explains how to grab a free copy of our business planning workbook and e-book) and then a long discussion of how Covid-19 closures are hurting and in some cases killing small businesses–and then how business owners can try to manage through this crisis.

My bank would disagree with you that if your Payroll Costs fully cover the loan amount, you would get forgiveness for the full amount. I am a sole proprietor and received a PPP loan for less than $50,000. I decided to file for forgiveness rather than wait for a simplified form. Just wanted to get it over with. My loan was based on 2.5 times the monthly net income from my 2019 Schedule C plus medical insurance premiums. When I filled out the application, I listed as Payroll Costs only the amount I withdrew from the business during the 24-month period, because it exceeded the total amount of the loan. I did not list the medical premiums that I had spent. To my surprise, the bank only approved the amount of the Schedule C net income from my application, saying that that was the cap for that category. Now I am stuck for the medical insurance portion of the loan!

Your bank and I don’t agree. And the accounting really works pretty simply, though it sounds like there’s some confusion in your situation.

The accounting for a small proprietor works like this. If your sole proprietorship made, say, $48,000 (as per the Schedule C) in 2019, that equates to a $4K monthly payroll cost and gives you a $10,000 loan. As long as you pay $10,000 out to owner during the spending window, you get $10,000 of forgiveness.

BTW note the sole proprietor’s health insurance doesn’t appear in the preceding paragraph. That’s not a mistake. SE health insurance comes “out of” the $48,000.

Sounds like errors were made in either the PPP loan amount (perhaps you borrowed more than you should have?). Or that errors were made in spending PPP funds or calculating the forgiveness amount.

SIR

NEED FUND

PLEASE HELP

You want to wait for the PPP program to restart… and then act quickly if it does.

More info here: https://evergreensmallbusiness.com/sole-proprietorship-ppp-loan-applications/

BTW, when I wrote the above referenced blog post, I thought it VERY likely Congress would renew the PPP. Now, with the election so close and Mr. Trump’s illness, I think renewal less likely. Sorry.

Here is further explanation sent to me by my bank.

“The SBA has given the following calculation for Self-employed Schedule C filers:

The compensation of self-employed Schedule C individuals, including sole proprietors, self-employed individuals, and independent contractors, that is eligible for loan forgiveness is limited to 2.5/12 of 2019 net profit as reported on IRS Form 1040 Schedule C line 31. Separate payments for health insurance, retirement, or state or local taxes are not eligible for additional loan forgiveness; health insurance and retirement expenses are paid out of their net self-employment income.

Here is your calculation for forgiveness: 2019 Sch. C Net Profit $27524.00 / 12 x 2.5 = $5734.

At the time you got your loan, you added in your health insurance of $10,228, the SBA has removed that portion as eligible forgiveness and the reason you are net getting full forgiveness.”

So even though they originally approved my PPP loan application with the health insurance paid out of the Schedule C net income (clearly shown on the documents submitted to them), now they are saying that the SBA is not allowing that portion for forgiveness because it was paid out of the Schedule C net income.

Such a simple, small loan like this and I still get jerked around by the process! Defeats the whole purpose behind these loans, which is to get help to the small business owners.

You double counted. E.g., if you earned $48K in 2019 (as per the earlier example) and you used $12K of the $48K for health insurance, that doesn’t mean you made $60K. You still only made $48K.

What happens if you received a PPP loan and were on shutdown due to state mandate? When you reopen can the 24 week rule apply?

You want to use the PPP money to pay employee payroll, owner payroll, and then interest on business loans, rent, utilities, even if you’re shut down.

In other words, the whole point of the program was to provide a lot of funding so you can get through shutdowns and this weak patch in economy.

I have a SBA loan but it is not Consideref a PPP loan. It is for my business and has a 3 percent payment each month after 1 year. I’m wondering how the two differ and if there is any forgiveness for this loan versus the PPP loan forgiveness discussed in this article .

The PPP loans are the loans that provide forgiveness. Sorry.

If they are doing this for PPP loans, then they should do the same for EIDL loans also. Both loans are fairly the same, both are for small businesses. To help them during this pandemic, only thing that separates the two. Is that the PPP, is geared towards paying employees and business expenses. EIDL can be used for the same thing, paying employees and business expenses. So why not include EIDL loan also for forgiveness, like they are doing for the PPP loans!

As an independent contractor..how would I prove that I used the money provided for my payroll. I cannot afford a company to process my payroll to myself.

This is the question of the morning… Which means I should have covered this in the blog post! Ugh.

But here’s answer: A sole proprietor doesn’t do “payroll” for the owner. Rather, he or she pays draws. The total of those draws, evidenced by checks, equals the owner compensation you’ll get forgiveness for.

I did an electronic transfer and wrote a memo stating what the transfer was for. Will that work?

Dee

I think so.

The IRS and the SBA won’t buy that excuse that you can’t afford a way to keep track of your records. There is quickbooks desktop for around 300.00. And quickbooks online for about 40.00 per month. Both connect to your online banking. If you had either of these you simply run the payroll or. 10 99 report unfortunately you didn’t have this in place but you can fix it with a ton of work but it’s doable. You would have to manually put in all your bank statements from the time of the loan until the 24 week period was up. Thats how you would get the needed documentation

How does a self employed business person ( such as a Realtor) who received the $20,800 loan verify the “payroll”? There are no payroll records.

You need to show payments to the owner equal to $20,833. See this discussion: https://evergreensmallbusiness.com/sole-proprietor-and-partnership-ppp-tax-rules/

Also see tip #4 here: https://evergreensmallbusiness.com/ppp-loan-accounting/

What if you didn’t actually take the draws out of the business? You left the money in the business bank account for use?

Read the application for forgiveness, but I think you need to make the payments. To the owner, I mean.

How does this apply when you work from home and apply a percentage of mortgage or rent as business expense.

How do you apply payroll when you are the the ceo and have no employees and thus no payroll. But you pay yourself? Thx

If you’re a sole proprietor, your owner draws count. And BTW if you are the only employee, the max PPP loan you could get equals $20,833. And if you pay that out to yourself as a draw, that’ll be all you need for full forgiveness.

Great job sir. You are very helpful.

Thx for being awsome and very informative😄

As a Lyft driver, I recvd a $14k PPP, to prove payroll & expenses can’t I use my bank statements as proof? Much appreciated.

I think you want to show payments to Bashir the proprietor.

How I apply for ppp

You need to wait until the program reopens (if it does). More info here: https://evergreensmallbusiness.com/sole-proprietorship-ppp-loan-applications/

I have a sole-prop with employees, and I take draws. I am doing the 24 week period. 2019 income was about $20k. Can I direct 2.5/12 (approx $4k) of that to myself or 24/52 (approx $9k).

Thanks!

The sole prop share is 2.5/12ths… Sorry. (For non-owner employees, you could go 24/52nds…)

Great article and I will be completing it soon. One problem. We received our loan funds electronically. They were directly deposited into the checking account. Not much identifying info other than a description of “PPP Loan Disbursement” in the checking account!

Well in the application form they want the PPP Loan number but I don’t have one! And there is nobody to call and no email. Any suggestions would be appreciated.

You can document the payments in any reasonable way, I’m sure. Cancelled checks, remittance receipts, maybe bank transfers showing on statements. I would think especially for sole props.

You e-signed loan document. Log into your lenders account and retrieve your documents.

This should apply to eidl too, because it’s the same

Not sure what you mean by “it’s the same.” Sorry.

I’m a uber driver. How can I get my 7k PPP loan forgiven?

Yes. And probably you get full forgiveness if you just pay $7K of draws to Felix during the covered period.

If we received both the EIDL advance as well as the PPP loan does the EIDL advance still come off the forgivable portion of the PPP? I read the instructions but I may have missed that portion. Thank you!

I think the answer to your question is “yes.”

I am a sole prop but also have 1 employee, but I do not use the payroll service to pay myelf. How do I submit proof that this was for my “payroll?”

For your employee, payroll equals whatever shows on your payroll reports as gross wages PLUS any state and local taxes, health insurance, retirement benefits.

For you, the total draws you’ve paid but not more than 2.5/12ths of what your 2019 Schedule C shows.

Please use the above statements as general descriptions…

i have dry cleaning business. Can i get now ppp grant. I got before small bank about 6,400. In Aug.

Right now, the PPP program isn’t lending. But it may restart: https://evergreensmallbusiness.com/sole-proprietorship-ppp-loan-applications/

My accountant initially did my payroll numbers for an eight week period . I only borrowed a little over $10,000 total for my PPP. I wrote one other small check to myself after the eight week period. Am I suppose to go with the initial period since the majority of the money was paid out then. Or 24 weeks. I am confused.

You want to use the 24 weeks “covered period”.

Due to being hospitalized and then a long recovery, I just applied for PPP.

I am a sole proprietorship and I am the only one in my verifiable company.

I’ve been in business for 5 years. As a personal chef due to Covid-19, I have one client.

I’ve taken $40,000 out of retirement investments and I am close to living in a box on lower Wacker here in Chicago. Seriously!

What do you suggest?

Here’s the blog post I wrote for your situation: https://evergreensmallbusiness.com/sole-proprietorship-ppp-loan-applications/

I own a trucking company with one truck I have a lease on my truck and Elise on my trailer it is a lease purchase is that considered a proper expense that will be forgiven

The lease payments should count as rent, which should lead to forgiveness. You do need payroll costs (or owner draws) too…

I am a small business owner .Zi follow a few people on u/tube religiously. I know my PPP will be forgiven What are your thoughts on the EIDL loan? I got $99,000… I have started to pay $500 a month. people have told me that I should not pay this so soon, because it may be forgiven. Any thoughts? What about PPP2? Will that be available to me? Many thanks

Your EIDL loan isn’t part of PPP. Regarding a new PPP, a month ago I thought we’d see that. Now? Hmmm. Not so sure…

I have three restaurants I used the ppp money for lots of things. But my payroll so far exceeded the loan amount, can I just used 24 weeks payroll without rent or utility bills?

Yes. And I think think that’s the “easy” way to get full forgiveness. Because the documentation requirement means you just need payroll records.

I was wondering what the interest rates were for the two different types of loans. We had to close the business due to the owners closing the building. They will not be reopening. I received $12,000 3000 was the EIDL 9000 with the PPP. Should I just make monthly payments or return the whole thing. The money is sitting in my commercial checking account.

You can use the money for payroll, interest, utilities, and rent. Even if the business is closed.

What you should probably do, btw, is use as much of the $9K as you can for owner payroll (so draws paid out to Phil the proprietor). Then any leftover amounts for rent, interest on business loans and utilities that you’ll need to pay one way or another no matter what.

Your EIDL loan… not sure what you should do about that. Sorry.

Sole prop got ppp loan. In health care. Have my office in my home when I see patients. Mortgage & utilities for tax purposes are filed as a percentage for business expense with the rest being household. How can I document for loan forgiveness?

If you are the only employer, you probably only need to show payments to the proprietor.

E.g., say you got the max loan available for a sole, proprietor, which is $20,833. If you pay that out to John the proprietorship over the 24 weeks that follows you getting the loan, that’s good enough. That creates $20,833 of forgiveness. That approach also based on what we know now creates tax-free income. More info here: https://evergreensmallbusiness.com/sole-proprietor-and-partnership-ppp-tax-rules/

What is the deadline to submit for forgiveness?

I received my PPP loan via Chase Bank. Am I required to submit the forgiveness documentation and form back via Chase, or can I submit directly to the SBA on their site?

Thanks!

You submit forgiveness application to the bank you received the PPP loan from. You want to submit as soon as you can easily qualify for full forgiveness.

I m the owner of small business

I have completed the PPP forgiveness application loan

I tried to send it to my bank capital one and they told me they’re not ready to accept the forgiveness loans application

But they have sent me the PPP loan bill and it’s due on October 20th, 2020

My question is 1. I get confused about the whole process and I don’t know where to send my completed application

2. Do I have to start paying this money which is due on October 20th? If not what should I do?

I think you’re bank is wrong. You should be able to turn in forgiveness application. You shouldn’t have to pay.

BTW, if you can use the 3508S form because you borrowed $50K or less, you want to do that.

Where do you submit the form once completed

To your bank. The one who provided the PPP loan in first place.

I received PPP loan in April. Could not start back up payroll until Sept 1st. Bank originally told me that as long as I submit app by end of year its okay. Now I am not sure they gave me correct information.

I will have paid the amount of my loan (it was $14,000) in about 10 weeks. But, 24 weeks since I received the funds will be up before I paid out the full amount. Can I tell them I had to delay due to Covid and still get forgiveness?

You want to accumulate enough forgivable costs within the 24 week spending window to get full forgiveness. That’s how you’ll avoid needing to repay.

Accumulating costs is easy. The payroll does that. But, I opened my “spending window” in September from funds received in April. If you count 24 weeks from receipt of funds, I will go past 24 weeks from the funding date to pay out the entire amount in payroll. Bank said it was okay but rules seem different.

The accumulation of costs is easy. It is all payroll. But I started payroll on Sept 1st and if I measure 24 weeks from fund disbursement (April), It will be more than 24 weeks since I received the money. Is it 24 weeks from when I started using money or 24 weeks from when I received the money?

With the new 3508S form, assuming I am eligible because the loan was for less than $50,000, am I understanding it correctly that I would still get full forgiveness now even if there was reduction in the number of paid hours an employee received for a payroll during the 24 week covered period?

Yes. That’s correct. So if you can use 3508S, you may as well go for it now. Not much reason to wait…

Any news or prospects for regarding if, how and when the tax impact of the forgiveness will work? Latest I heard the forgiveness will not be taxable but to the extent you use forgiven loan proceeds to pay for business expenses (which of course you will) these expenses will not be deductible.

Thought Congress was going to “fix” this as they had from the beginning promised this to be tax free but this seems to be another thing lost in the political stalemate. Just wondering from the standpoint of 4th quarter estimated tax payments. Thanks!

I think the IRS Notice 2020-32, published earlier, stands. Also, it’s worth reading the notice… My opinion is, IRS has this right.

Please I’m a Uber driver since 2016 and I’m active driver I once apply for the ppp loan but unfortunately I applied on late on July and my application was turned down I forwarded all my 1099 and necessary documents ID card…it comes out that I had an email from PPP loan it over…so please can you send me emails when it’s going to be done for the forgiveness fund…

We don’t really have a way to put you on a mailing list. But we email people whenever we have a particularly relevant blog post. And to get on that list, you just need to have downloaded one of our ebooks.

Note: Many of the ebooks are free! So grab one of the free ones. You’ll give your email address for that. And then you can be assured of getting a notice.

I thought they had opened up for the PPP loans again? Is this correct? If so this is my 1st time applying,is the 3508S the correct form? For a independent Contractor.. Thxs

No, not yet. And I think the longer Congress can’t decide, the less likely a restart becomes. Sorry.

Hi Stephen – any instructions or guidance for S Corporations? I have an S Corporation with two employees – me and a second employee. I take 120K compensation annually and the second employee takes 40K. I’m trying to do the math for the forgiveness, but getting confused as to which rules to follow. There are some stated about 2.5 times, others about $100,000 salary limit. Unsure which calculation method to use. Your guidance is much appreciated.

You only look at first $100K someone makes and owners only get 2.5 months, so for shareholder-employee, that’s $8333 a month for 2.5 months. Or $20,833.

For non-owner employees, $100K limit also applies (but isn’t relevant in your case) and you get 24/52nd per employee. With $40K employee, that’s probably $18,462.

Those are limits. Also, you need to pay these amounts to get forgiveness.