In earlier posts, I’ve described how to set up your own Washington corporation or limited liability company. And I’ve talked about the rules for and benefits of making a Subchapter S election.

In this post, I want to quickly describe the steps for making this election using the IRS Form 2553:

1. Download the election forms.

Download the IRS 2553 form from the Internet Revenue Service website. While you’re there, you may also want to grab the form instructions (though I’ll probably provide the step-by-step instructions you need in this post).

2. Provide the entity’s name, address, and EIN.

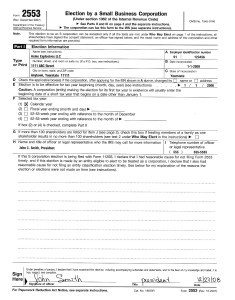

At the very top of the Form (see figure below), in the block labeled “Type Or Print,” you enter the name of the corporation or LLC, the street address, city and state, and the employer identification number. You also need to enter the date of incorporation, which is the actual incorporation date for a corporation and which should be the Subchapter S election date for an LLC.

And two quick notes: First, for an LLC, the 2553 election date is the “incorporation date” because prior to the S Election, the LLC is considered either a sole proprietorship (if it has one individual member) or a partnership (if it has multiple members) for tax purposes. Second, you do want to mark one of the applicable checkboxes in Box D if after receiving its EIN the LLC changed either its name or address.

3. Indicate the effective date.

Use Box E to indicate when you want the S election to become effective. Usually, you want to make the S election effective as of the start of the calendar year (if the entity has been in existence in previous years) or at the start of the entity’s existence (if the entity has just been created in the current year).

For example, if you’re turning an LLC that has existed for many years into an S corporation, you would probably want to make the S election effective as of January 1 of the current year. And if you’ve just created a new LLC as of, say, April 23 of the current year, you would probably want to make the S election effective as of that April 23 date.

4. Specify when the S corporation’s tax year ends.

S corporation fiscal years can end on December 31, or on the last day of September, October, or November. Having a non-calendar fiscal year—an accounting year that ends in September, October or November—only complicates your tax accounting and produces no real benefit for you, however. Accordingly, you almost certainly want to mark the Calendar Year option in box F.

Note: If you think you want a non-calendar fiscal year end, you shouldn’t make the S election yourself. You should confer with a knowledgeable tax practitioner.

5. Enter your name and telephone information into Box H.

This tells the IRS who to call if they have questions about the S election.

Note: In the area beneath box H, the IRS provides space for you to explain why you’re filing a late 2553 election. You shouldn’t need to use this space if you’re filing the election on time. People use this space when they miss the deadline and then need to file the 2553 form late with the actual S corporation return.

6. Sign the S election Form.

You’ll also need to sign and date the S election 2553 form at the bottom of page 1 (See earlier image) where the form asks for the signature and title of an officer. You may not have a “rea”” president or chief executive officer if you’re an LLC and not a corporation. However, you might as well identify yourself as the LLC “president,” “vice president,” or “treasurer.”

7. Name and get signatures from shareholders and spouses.

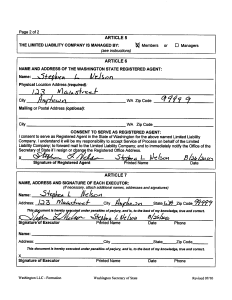

On page 2 of the 2553 form (see figure below), use columns J, K, L, M, and N to name each shareholder in the new S corporation. You need to provide each shareholder (or member) name and address in column J. You need to have each shareholder sign and date the S election in column K. You must use column L to identify the number of shares that each shareholder (or member) holds.

If members don’t hold shares but only percentage interests, you can enter those percentages into column L. You need to enter each shareholder’s social security number into column M. Finally, enter the month and day that each shareholder’s tax year years. (This should be December 31 in case of individuals.)

If any of your shareholders reside in a community property state (Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, Wisconsin, and sometimes Alaska and Puerto Rico), the spouse of a shareholder must also sign the S election even if the spouse doesn’t own shares or an interest in the S corporation. Note that in the case of non-shareholder spouse, no stock is owned so a “NA” for “not applicable” can go into the Number Of Shares column and you can just put something like “spouse” into the Date column.

Note: You won’t need to worry about the third page of the 2553 form (see figure that follows). However, you should include the blank third page in the envelope or in the fax you send the IRS simply to show them the page is blank.

8. Fax or Mail the 2553 Form to make the federal S election.

I used to suggest that people mail the 2553 form using certified mail with a delivery receipt. I made this routine suggestion because if you mail the Form 2553 using certified mail with a delivery receipt and the IRS service center loses the 2553, you can often use a copy of the 2553 and your certified mail delivery receipt to prove a timely election—even if the March 15th deadline has past.

Certified mail with a delivery receipt isn’t a bad idea, but nowadays, the IRS is so forgiving about late S elections that it’s probably just as easy to fax the completed 2553, cross your fingers, and then make a late election via mail if there’s a deadline problem. Washington corporations and LLCs can fax the completed form to (801)-620-7116 or mail the form to:

Department of Treasury

Internal Revenue Service Center

Ogden, UT 84201

Fax: (801)-620-7116

Note: If your principal place of operation is not in Washington state, you may need to send the 2553 form to another location so check the 2553 form instructions for that address.

If the LLC was created in the middle of the year, is the 2 months + 15 day time limit from the date you filed the Articles of Organization, or from the date the Statement of Information was filed, or some other date?

With an LLC, the “75 day” time clock can start on the day the LLC is created (see the LLC certificate for the filing date)… or on any date after this date.But the election can only go back 75 days… in theory.

I.e., if the LLC articles are filed (accepted) by the Secretary of State on Jan 1, you could have until March 15 (that’s the 75 day deadline)… Or, even though the LLC filing date is January 1, you could make the election effective on February 1 which would mean you could have until April 15…

Note, too, that late election relief procedures in effect at the time I write this mean that you can in practice go back farther than just 75 days.